IMF calls on China to allow greater currency flexibility

- Published

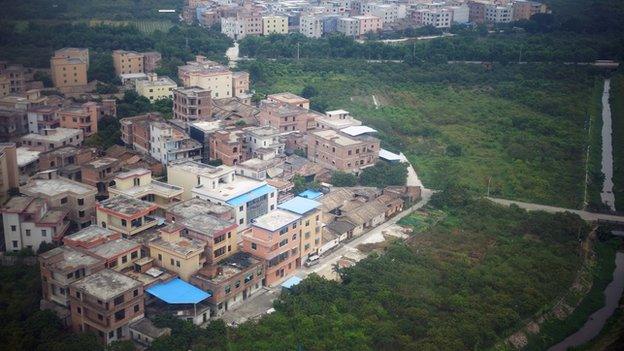

The IMF said China needs reforms that reorient the economy away from a reliance on real estate

The International Monetary Fund (IMF) has said China should continue to provide "greater flexibility" in its exchange rate policy as the country continues to see slower growth.

The IMF said, external the mainland should reduce foreign exchange intervention.

China's currency is widely seen as undervalued and the country was accused for years of suppressing the yuan in order to boost exports.

China says it is trying to manage the yuan's value against other currencies.

Analysts say that in reality it is still pegged to the dollar.

The IMF also said fiscal stimulus should be China's "first line of defence" in its economic slowdown.

It predicted China's growth would stabilise at around 6% by 2017.

The IMF also recommended there should be an emphasis on supporting private consumption.

China's economy grew by 7% in the first quarter of the year, a large figure by Western standards, but the lowest for the country since the financial crisis of 2009.

Last year its growth slowed to its weakest in 24 years, expanding by 7.4% in 2014 down from 7.7% in 2013.

Foreign exchange and reform

China's currency is widely regarded as undervalued

In April, the US Treasury Department said, external China's currency needed to appreciate further "to bring about the necessary internal rebalancing towards household consumption".

It did not label the country as a currency manipulator, however, and said China had made progress, with its "real effective exchange rate appreciating meaningfully over the past six months".

But the US said further appreciation was needed to prevent the yuan becoming more undervalued, particularly as the mainland continued to see productivity growth greater than its major trading partners.

In its latest economic outlook, external for the Asia Pacific the IMF said the mainland needed reforms that "reorient the economy away from excessive reliance on real estate, heavy industry, and external demand".

It said China should implement "without delay" a blueprint of reforms that was introduced in 2013 - including a clampdown on risky credit activity such as shadow banking.

It said the reforms were critical to sustainable growth.

In its Thursday report, the IMF forecast an expansion of 5.5% for the wider Asia Pacific region over the next two years.

Consumption was the main engine of growth across the region, it said, except in Japan where consumption was not as robust.

It said world growth would to pick up modestly to 3.5% in 2015 and to 3.7% in 2016.

- Published14 April 2015

- Published20 January 2015