RBS government stake to be sold, chancellor announces

- Published

George Osborne insists the sale of RBS shares is the "right thing to do"

The government plans to sell its 80% stake in the Royal Bank of Scotland, Chancellor George Osborne has announced in his annual Mansion House speech.

Governor of the Bank of England Mark Carney said the phased sell-off "would promote financial stability" and benefit the wider economy.

The government provided RBS with a £45.5bn bailout in 2008.

But the Unite union, whose members include bank workers, said the deal would "short-change the public".

The government paid 500p a share for the bank, compared with the current price of about 361p - the shares were up nearly 2% on the news.

Mr Osborne also set out more details of the sell-off of the government's remaining stake in Royal Mail.

Royal Mail employees will share a further 1% tranche in the firm, while 15% will be placed with institutional investors.

'Best price'

The chancellor argued that the RBS sale must be seen as a whole and the share price will increase in subsequent offerings as confidence grows.

Mr Osborne said: "It's the right thing to do for British businesses and British taxpayers. Yes, we may get a lower price than that was paid for it - but we will get the best price possible. For the longer we wait, the higher the price the whole economy will pay."

Analysis: Kamal Ahmed, BBC business editor

Amid all the arguments about whether the taxpayers will "get their money back" on the sale of the government's stake in RBS, you could be forgiven for missing the bigger political issue.

George Osborne is philosophically opposed to the state owning major businesses like banks. He thinks RBS will do better in the private sector (and therefore eventually make higher profits, support the economy and pay more tax) than it will with the state owning 80%.

The chancellor knows that he needs to reassure the public that they are not being taken for mugs (and frankly, given the complexity of judging the costs of the bailout, you can make the numbers add up to almost anything), but beyond that, his politics are clear.

RBS is Britain's biggest privatisation ever, and even if the share price did not move up at all over the five years the government plans to sell its stake, the sale would still make £32bn for the Treasury.

Last night, the government received another £750m after selling a further chunk of its 30% stake in Royal Mail.

This is a privatisation rush in keeping with the fact Britain now has a Conservative majority government. If it can be sold, it will be.

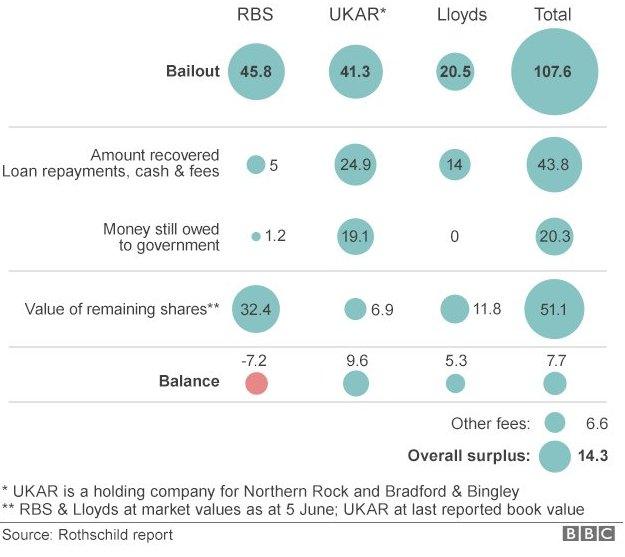

A review from Rothschild investment bank said that, despite this price gap, taxpayers can expect to make £14bn more than it paid out in bank bailouts if the sale of bank assets and fees already received are taken into account.

RBS has already paid back about £5bn in fees and repayments for insurance systems set up by the government as part of the bailout.

'Knock-down rate'

The sell-off plan was criticised by Unite, which questioned the timing given the current share price of RBS.

"By selling off the public stake in the Royal Bank of Scotland, George Osborne is short-changing the public and wasting a historic chance to bring needed change to Britain's banks," the union said, criticising the risk of selling the stake at a "knock-down rate to city investors."

Bank bailouts and amounts recovered, £bn

City sources have told BBC business editor Kamal Ahmed that Mr Osborne wants to take a two-stage approach to the sale.

Firstly, he wants an inquiry into the options for a sale and how it would be done. This could include a "Tell Sid" British Gas-style retail offer to the public or, as is perhaps more likely, a sale to institutions such as pension funds.

Secondly, he will look at a timetable for when the sale will start to take place.

RBS's chief executive, Ross McEwan, said: "I welcome this evening's announcement from the chancellor and we are pushing ahead with our strategy to build a simpler, stronger, fairer bank that is totally focused on the needs of its customers and centred here in the UK.

"When the government starts selling its shareholding, it will be selling a bank determined to be the best in the country."

- Published10 June 2015

- Published10 June 2015

- Published21 May 2015