Neil Woodford: The man who can't stop making money

- Published

This weekend, hundreds of thousands of small investors - many of them pensioners - will be saluting Britain's very own Warren Buffett.

Since he launched his own fund exactly a year ago, Neil Woodford has delighted investors with an 18% return on their cash.

By contrast, the average share on the London stock exchange - up to the end of last week - had risen by just 2%.

Mr Woodford, who judges success over decades rather than years, is doing everything he can to dampen down the euphoria.

"It's far too early to conclude that the fund's strategy has worked," he says.

On the personal qualities needed in a good fund manager, he is equally understated.

"I would suggest that a healthy balance between arrogance and humility is helpful," he says.

Colleagues are less equivocal.

"He's arguably the best fund manager of his generation," says Mark Dampier, research director at Hargreaves Lansdown.

His view is based on Mr Woodford's long-term record - 25 years of market-beating returns.

To many, he looks like the man who just can't stop making money.

'High single digits'

Neil Woodford is not the best fund manager in the country over the last year. In fact, he currently comes in at number 235 out of more than 1500 in a league table, external produced by Financial Express (FE).

But his performance is the best in the Equity Income sector - a part of the industry that aims to provide investors with a regular income.

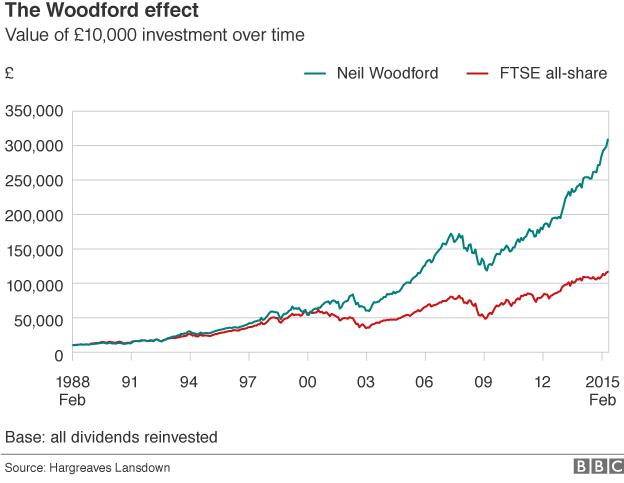

However, to get a true measure of the man, Woodford fans say you need to take into account his record at his previous employer, Invesco Perpetual. Anyone investing a pension fund of £10,000 with him 27 years ago - and then following him to his new fund - would now have £309,000. (Figures to end of May 2015).

Had they invested the money across the stock market as a whole, they would only have £117,000.

The danger of doing so well is that investors have high expectations - expectations which Woodford is trying to rein in.

He says his aim is to deliver "high single-digit" returns every year, averaged out over three to five years.

"We hope to deliver more than this, but this is the target against which we expect to be judged," he says.

Top five holdings in Woodford's Equity Income Fund

AstraZeneca 7.18% of fund

GlaxoSmithKline 7.05%

Imperial Tobacco 6.96%

British American Tobacco 5.74%

British Telecommunications 3.85%

Patience

Like Warren Buffett, Neil Woodford believes in long-term investment. Typically, he holds shares for more than 10 years. And he will only buy them when they look cheap.

He finds shares that are undervalued by the rest of the market; hence he is a big investor in the tobacco industry, for which he makes no apology.

"I'm not paid to exercise my moral judgements in my portfolio. The tobacco sector still looks structurally undervalued and is, therefore, an appealing investment."

Equally, he is a keen investor in the pharmaceutical and health industries. One company he has bought is 4D Pharma, based in Manchester, which is researching asthma and arthritis treatments. Its shares have quadrupled in value over the last year.

Drug development company Oxford Pharmascience is another. Its shares have quadrupled in the last six months.

But despite such spectacular short-term successes, if there is one word to describe Mr Woodford's approach, it is patience. Hence his new fund - launched in April - is called Woodford Patient Capital. It aims to provide long-term funding for start-up companies. And it is perfectly possible that he will never sell out.

Woodford's Oxford HQ - close to high tech start-ups

'A better crop'

With a wealth of start-up high tech companies in Oxford, it is no surprise that Woodford opened his corporate headquarters there. But there is another reason too.

Neil Woodford has never liked the City of London.

His 25 years at Invesco Perpetual, based in Henley on Thames, taught him to avoid the frantic atmosphere of trading desks.

"I have never had a yearning to work in the City, and in many ways I believe it is to my advantage that I don't."

He believes that not being in London keeps him immune from the noise - "the fashions and fads" - that can build up in the City.

Given his ambitions to nurture small companies, it is no surprise to learn that Woodford also has an interest in farming. Indeed he has a degree in agricultural economics.

If he farms like he invests, says Mr Dampier, he would be planting for the long term.

"He'd be thinking of enriching the soil, and getting a better crop next year and the year after."

Woodford country - perfect for farming and horse-riding.

Fast rides

In one respect only, Mr Woodford has met the conventions of a sometimes flashy profession - a penchant for fast cars.

Maybe that's vital for the streak of arrogance he says is necessary.

"You take the Porsches and the top cars, he's been through a few of them," says one colleague.

Yet according to another, he is very down to earth too.

Indeed, with an interest in ecology and the environment, he leads a peaceful existence in one of the prettiest valleys of the Chilterns.

It is there that he loves to ride horses - "very much a passion of mine," he says.

And are there any similarities between keeping in the saddle and running an investment fund?

"They are both very difficult to master," he replies. "And I am still learning on both counts."

Watch the Hardtalk interview with Neil Woodford here.

- Published9 March 2015

- Published20 May 2014

- Published28 April 2014