Budget 2015: Why are we having another Budget?

- Published

Budget headline numbers

£730bn

Government's approx annual expenditure

-

£30bn The IFS says this would have to be cut from government depts to meet deficit targets by 2018-19

-

£12bn Planned cuts to welfare budget by 2017-18

-

£5bn Government plans to recover this in a clampdown on tax avoidance

George Osborne will deliver a Budget on Wednesday 8 July, less than four months after he delivered the last one.

Of course, a lot has happened since March and the chancellor no longer has coalition partners to keep happy.

Even so, he's also expected to have a Spending Review in the autumn and an Autumn Statement in the winter, which adds up to a lot of set pieces in one year.

He must have something interesting to say or he wouldn't bother and many journalists criticised the Conservatives for not giving more details about some of their plans during the election campaign.

Remember, he's planning to cut overall spending by 1% for the next two years and then freeze it in the third year to get rid of the deficit.

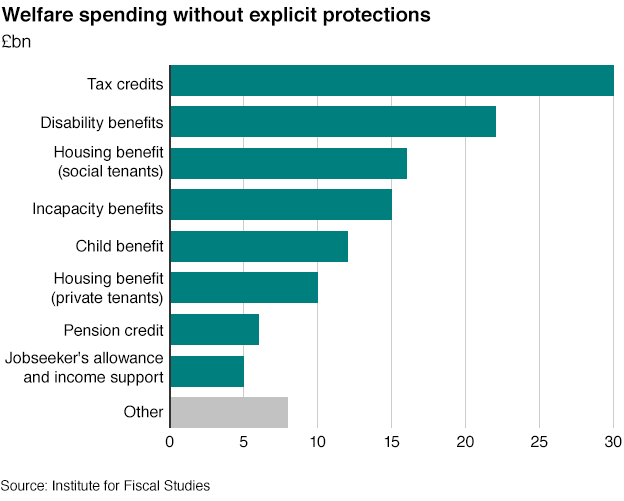

One of the biggest questions will be where he plans to find the promised £12bn of cuts in welfare spending by 2017-18.

It's not going to be easy because he and the prime minister have ruled out reductions to so many benefits.

With the prime minister having said that he will not cut pensioner benefits or child benefit, you can see from the chart above why he is expected to have to cut working tax credits and housing benefit.

He may still not give full details of where the cuts will come, but it would be surprising if we did not know any more about it by the end of the day.

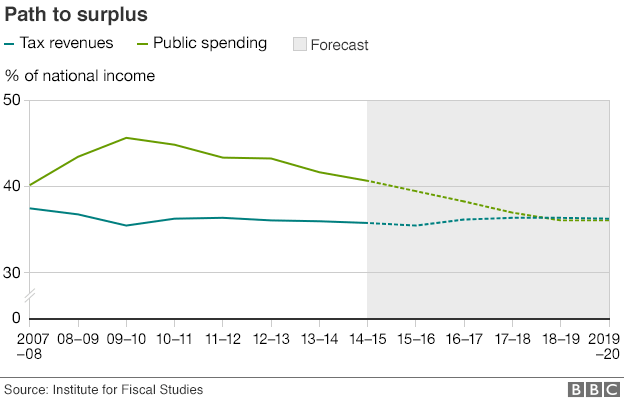

You can see from the chart below how Mr Osborne is hoping to bring tax revenues and spending closer to each other to get rid of the annual budget deficit during this parliament.

Clearly, almost all of the plans come from cuts to spending as opposed to a rise in taxes.

Among the measures designed to raise more money is £5bn in savings from anti-avoidance measures, which may or may not happen.

The government also has to fund £4bn in tax cuts that it promised before the election, which includes things like extra childcare provision and raising the stamp duty threshold.

This turns attention towards departmental spending. It is not clear how much detail we will get on departmental spending in this Budget and how much will be saved up for a Spending Review later in the year.

The Institute for Fiscal Studies says that taking account of areas of spending that have to rise, Mr Osborne has to find £30bn of departmental spending cuts by 2018-19. He has already announced that £3bn has been found in efficiency savings across departments this year.

In the last parliament, the government had a pretty good record of achieving the cuts it wanted in departmental spending, but it is likely to be more difficult this time round.

You would expect the government to make the easiest cuts first and it has quite a small majority in the House of Commons if any of the measures prove unpopular among its back-benchers.

In addition, the cost of public sector pensions keeps rising as more public sector workers retire and live longer. While the amount the government is borrowing each year is falling, the total amount it has borrowed is still increasing, which means interest must be paid on more money, albeit at a very low interest rate.

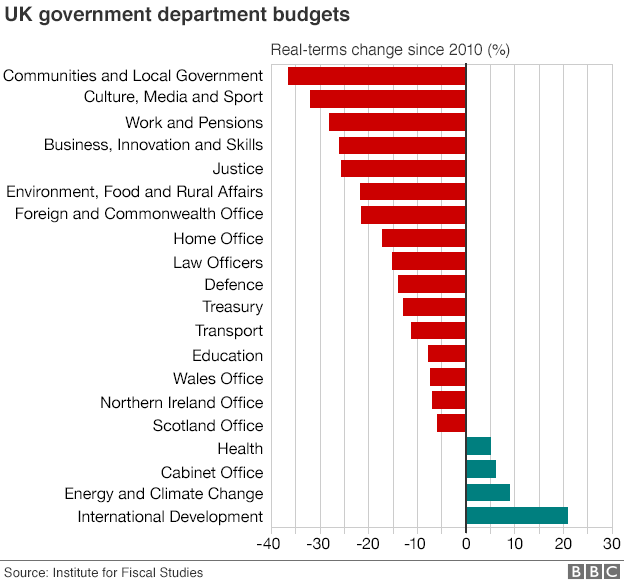

Spending on the National Health Service is not only protected - the government has promised to be spending an extra £8bn a year on it by 2020, which implies bigger cuts in other departments.

Education spending is protected for children aged five to 16 in terms of cash per pupil, so rising pupil numbers would also need to be made up for by cuts elsewhere. And international aid is also protected, and will grow in line with the economy.

As a result, the IFS reckons that the current plans to cut spending by 1% for the next two years and then freeze it for a third will actually mean cuts for unprotected departments averaging 5.4% a year for three years.

That will come on top of the cuts that have already been made since 2010, which are shown in the chart below.

The first budgets of new parliaments are notorious for raising taxes and cutting spending, but it's hard to imagine that Mr Osborne will not find anything to sweeten next week's statement.

We know from the Conservative manifesto that the income tax personal allowance will be growing again and that there will be measures that effectively increase the threshold for paying inheritance tax.

If he doesn't find anything new and eye-catching to sweeten the programme, expect Thursday's headlines to be all about welfare cuts.