Apple aims for bigger bite of music market

- Published

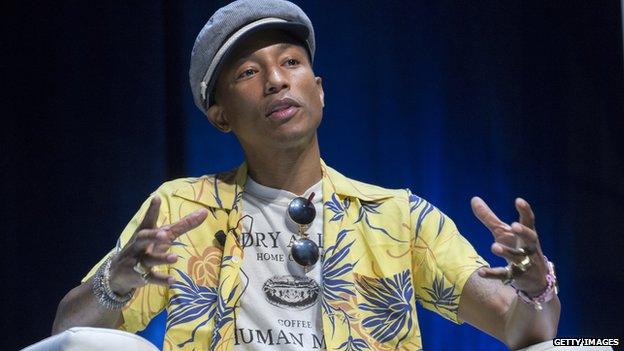

Taylor Swift will make her recordings available on Apple Music after pulling them from rival Spotify

If record companies had their way, the internet would never have been invented. For much of the second half of the 20th Century, music fans who wanted to listen to the latest release from their favourite artist had to make a trip to their local record store to buy an album or single on vinyl, cassette or CD.

However, the mass adoption of broadband in the developed world at the start of the last decade soon destroyed what was a very cosy - and highly profitable - business model.

A generation has grown up illegally downloading music - and many music fans are content to use advertising-funded websites such as YouTube to hear almost any track you can think of.

In 1999 the global recorded music industry raked in $26.6bn - buoyed mostly by sales of highly profitable CDs. But as pirating took off the total slipped to less than $20bn in 2007 and last year was down to just under $15bn, according to industry body IFPI.

The arrival of Apple's iTunes music download store in 2003 made it much easier to legally buy music online, but its growth has stalled as more music fans switch to streaming services such as Spotify.

The transition is similar to the way that many consumers now rent movies online or through subscription services such as Sky or Netflix rather than buying a DVD.

Spotify's jukebox-like service lets users play millions of songs for free with ads in between, or pay £4.99/$4.99 a month without those annoying interruptions.

Since starting in 2006, the Swedish company now has 20 million paying subscribers and another 55 million using its free service. Aware of which way the wind is blowing, Apple this week joins the streaming bandwagon with the launch of Apple Music.

Apple Music will offer streaming music and a radio station called Beats 1

It will offer users a three-month free trial, after which it will cost the same as market leader Spotify, but with no free tier.

Apple Music will have a crucial advantage over the likes of competitors such as Spotify: it will be pre-loaded on the hundreds of millions of iPhones and iPads being used globally via a software update.

That saves Apple from having to do much marketing to promote the service, says Andrew Sheehy, lead analyst at Generator Research.

Exclusives

Rather than aiming to make a profit from music, he says Apple's main aim is to give iPhone users another reason to keep buying its highly profitable devices.

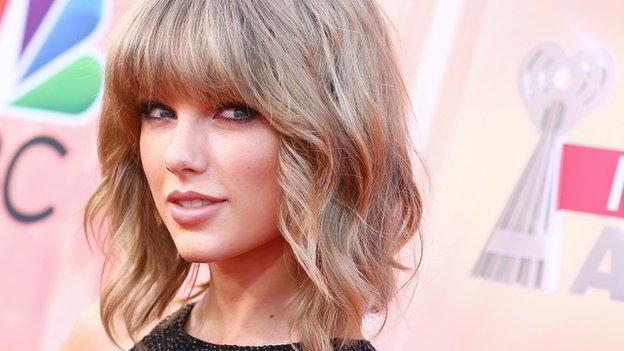

However, the company will use its might in the music business to persuade some big artists to offer some exclusive content - with Pharrell Williams being the first.

His latest song, Freedom, will only be available on Apple Music. Similarly, Taylor Swift will make her music available on the service after pulling it from Spotify last year.

Pharrell Williams' new song will be the first exclusive on Apple Music

There is no question that Apple's move into streaming will make life much harder for the likes of Spotify.

Mr Sheehy predicts that up to 25% of Apple users will pay for Apple Music after the trial ends. "The competitive dynamics are very lopsided - it's not a level playing field, but that's not to say that Spotify cannot be a success," he says.

Tim Ingham, editor of website Music Business Worldwide, says Apple is aiming to have at least 100 million subscribers after the three-month free trial ends.

He argues Apple Music should be welcomed because it will "help remind people how exciting and integral to their lives music is", adding: "Apple's potential is far, far greater than what Spotify has achieved so far. Hopefully it will bring the glory days back to music."

What is Apple's offer?

Mark Savage, Entertainment reporter, BBC News

The new Music app has that recognisable Apple sheen - bright, colourful and slick, with much less reliance on text than its predecessor.

If you've used iTunes before, it trawls your purchase history to suggest your favourite genres or artists, which swarm onto the screen in a cloud of "bubbles". You simply tap one to highlight a favourite, or hold it down to "burst" it.

Those decisions power the new "for you" tab - which suggests music and curated playlists from iTunes' vast library (the playlists we saw ranged from "chilling out" to "breaking up"). Subscribers can stream the songs and videos they like, or download them for offline use.

Elsewhere, you can browse new releases and top 10 charts, listen to Zane Lowe's new radio show, or even stream the BBC World Service.

What the service lacks is a coherent social element. At launch, there are no collaborative playlists - one of Spotify's most popular features - and the "connect" feature, which provides status updates from your favourite artists, is no match for Tumblr, Twitter or Facebook.

Apple users will enjoy the seamless integration with their current iTunes library - but with the UK pricing now confirmed to be the same as Spotify others will need more persuasion to switch than the availability of Taylor Swift's album 1989.

The end of Spotify?

Given the enormous marketing power Apple can deploy to promote the new service - perhaps using some of its near-$200bn cash pile to do so - will this be the end for Spotify? Not necessarily.

Mr Ingham believes Spotify can be a "very comfortable number two" after Apple.

Some investors appear to agree. Despite the imminent arrival of Apple Music, Spotify said in June that it had raised $526m (£334m) in new funding and was now valued at $8.5bn (£5.4bn). That's more than household names such as Sainsbury and Royal Mail are worth.

Unsurprisingly, Spotify also thinks it can survive the Apple onslaught. Mark Williamson, its head of artist services, says the company has only just "scratched the surface" after getting people to pay for music again. (To be fair, Apple probably deserves some of that credit for its iTunes store.)

Spotify co-founder Daniel Ek

While admitting that streaming "is not an easy business to be in", Mr Williamson adds: "We don't think it's going to be easy, but we're confident we can continue to innovate."

The big challenge for Spotify is continuing to grow if it has any hope of becoming profitable. The company reported a net loss of €162m (£117m) last year - largely because its agreement with record companies and publishers requires it to pay 70% of revenues to performers and writers.

Streaming is a pretty good deal for music fans - given that a monthly subscription costs little more than buying one album.

Sheeran for streaming

Many artists, such as Ms Swift, are less certain - mainly because they get paid far less for having a song played on a streaming service than for selling a CD or an album on iTunes.

Some, like her friend Ed Sheeran, are quite happy to be on Spotify because they believe the exposure helps increase sales of concert tickets. Live music is worth more, external than sales of recorded music in the UK.

Taylor Swift performs with Ed Sheeran

Streaming generated revenue of about $2.2bn last year, or 14.7% of the total, according to analysis of industry figures by MBW, external. That compares with a 46% share for physical music (that means CDs, with a tiny bit of vinyl on top) worth $6.9bn.

The rest of the pie is accounted for by sales on download sites such as iTunes and royalties generated by the use of music in advertising, films and television.

As Mr Ingham says, streaming is yet to capture the attention of most consumers, who might like music but will only buy a couple of CDs a year.

Given that many so people - especially millennials - seem quite happy to get their music fix from YouTube, Apple might face a bigger battle to get fans paying for music than it anticipates.

- Published8 June 2015

- Published22 June 2015

- Published24 June 2015

- Published24 June 2015