Budget 2015: Permanent non-dom tax status to end

- Published

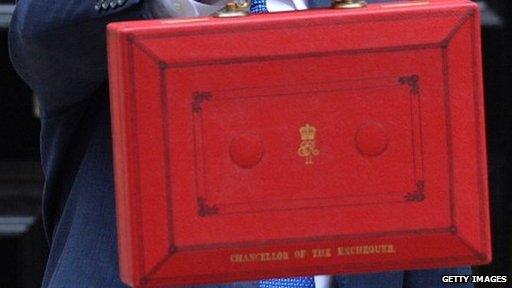

George Osborne: "British people should play British taxes in Britain and now they will"

Permanent non-dom tax status will be abolished from April 2017, Chancellor George Osborne has announced.

The reform does not eliminate the tax status, but individuals who have lived in the UK for 15 of the past 20 years will lose the right to claim it.

The non-domicile rule allows some wealthy UK residents to limit the tax paid on earnings outside the country.

The chancellor said changes to the non-dom rules would bring in an additional £1.5bn in annual tax revenue.

'Not fair'

The changes to the non-dom system would also mean that, from April 2017, somebody who is born in the UK to UK-domiciled parents would no longer be able to claim non-dom status if they moved away from the UK but then returned and took up residency in the UK.

The government also announced that from April 2017, new rules would be introduced so that everyone who owns UK residential property and would otherwise pay inheritance tax on the property cannot avoid the tax by holding it in an offshore company. It said this would limit "abuses" of the rule by some who have non-dom status.

"It is not fair that non-doms with residential property here in the UK can put it in an offshore company and avoid inheritance tax. From now on they will pay the same tax as everyone else," said Mr Osborne.

The chancellor said he had decided not to abolish the non-dom tax status completely because it "would cost the country money", adding many individuals that took advantage of the tax status "make a considerable contribution to public life".

But he added: "It is not fair that people live in this country for very long periods of their lives, benefit from our public services, and yet operate under different tax rules from everyone else."

Separately, the chancellor said HM Revenue & Customs would also receive an extra £750m to pursue tax evasion.

Mr Osborne said the additional funding would help HMRC officials raise £7.2bn in extra tax by 2020.

Budget in depth