How has austerity worked out for eurozone countries?

- Published

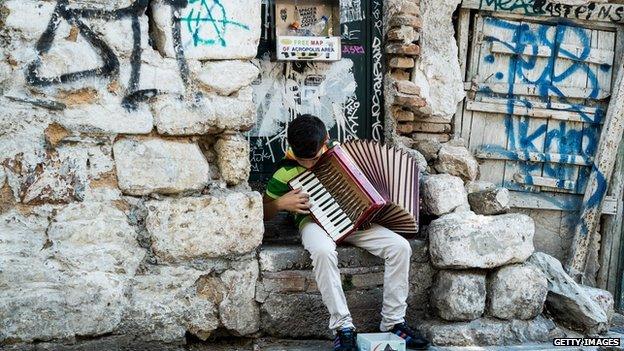

While Greece is in the news now because it desperately needs another bailout it is not the only country in the eurozone that has had to be rescued.

Ireland, Portugal, Spain and Cyprus have all been in the same boat. However Greece was the first and its problems have been the longest lasting. The Greek government gave misleading financial information to get into the euro in the first place and then manipulated the figures to mask the extent of its deficit right up to the time when the credit crunch exposed its deep-rooted problems.

Greece is also accused of having squandered the years since its bailout: it has failed to reform its bloated pensions system and failed to push through privatisations or reform the notoriously inefficient and complicated tax system.

In the other countries that have had to be bailed out it was far more a matter of an economic recession and a collapsing banking sector which had to be rescued by the state. The governments in turn needed to be bailed out because they ran out of money or could not borrow it in the financial markets at a reasonable price but they have, as a result, reformed their economies.

Spain

Youth unemployment passed 50% in Spain in 2012

Spain had very similar problems; a huge property bubble that burst and threw the economy into a prolonged downturn, that was far more important than Ireland's crisis because Spain is the fourth-largest economy in the eurozone.

Despite having relatively low borrowing levels before the crash, rescuing the banks increased government debt, just as the recession slashed tax revenues and ruined the country's credit rating, so Spain had to be bailed out,.

It introduced a series of stiff reforms and austerity measures, unemployment soared and is still over 20% making it the second highest level in the eurozone, after Greece, but the economy is now growing strongly and Spain has left the bailout scheme.

Portugal

Portugal had similar problems to Spain and Ireland but they were heightened by the fact that for decades it had failed to reform a bloated civil service and had also misspent much of the money it received from the EU over the years to develop its economy. As a result it was badly hit by the recession, as were its banks.

It was bailed out as well but has since left the scheme, although it still has huge debts which will take many years to repay.

Cyprus

Queues formed when capital controls were introduced in Cyprus in 2013

In Cyprus the economy was hit by the exposure of Cypriot banks to the Greek crisis and the spiralling cost of government borrowing. It let one of its banks go to the wall, cut civil service pay and reformed the economy in return for a bailout from the Troika.

Latvia

Latvia which was not in the eurozone in 2008 had very similar problems and has won praise for turning its economy around. It introduced huge tax rises and spending cuts and after a very sharp turn down returned to strong economic growth.

Iceland

Iceland's tourist industry has boosted its economy

Iceland, a member of the European Economic Area but not the EU or the eurozone, suffered perhaps the most spectacular crash having massively expanded into banking. The economy that traditionally depended on fishing and tourism was devastated when all three of its major banks went bust. Relative to the size of its economy it was the largest banking collapse in history.

Iceland accepted an IMF bailout and help from several other countries, capital controls were introduced in 2008 limiting how much money could be taken abroad and they are only now being removed.

The economy has, however, returned to growth, not least because the collapse of its banking sector led to high class graduates seeking jobs in other more productive industries. It is also boosted by its tourism and fishing sectors.

Ireland

In Ireland a huge property bubble and a booming economy led the government to believe that it was responsible for an economic miracle. It was even dubbed the Celtic Tiger, but it turned out to be little more than a massive property bubble. As a result when the credit crunch struck, the Irish property market rapidly collapsed, as did much of the tax revenue that it was bringing in.

Ireland's banks, which had lent billions to builders, property developers and home owners then collapsed and the government bailed them out, took on their debts and almost went bust itself as a result. It had to be rescued by the Troika (the IMF, ECB and EU) but it has slashed spending, increased taxes, reformed the economy and is now well on the road to recovery.

Ireland left the bailout scheme in 2013, although it is now holding a public enquiry into why it bailed out the banks in a way that almost brought the country to its knees.

Painful reforms

While there are plenty of countries both inside and outside the eurozone that have been in similar problems to Greece, the fact is that many of them used a period of tough austerity to force through painful reforms. This is not necessarily good news for Greece, because it is not just the Germans who are opposed to writing off Greek debt or bailing it out once again.

Far-right Golden Dawn protesters in Greece

Ireland, Spain, Portugal and even Cyprus which is traditionally very close to Athens might all feel, with considerable justification, that they are being asked to give more of their money to a country that has failed to introduce the reforms they did.

Certainly Latvia which not only reformed its economy but also joined the eurozone in 2014 is one of the harshest critics of Greece's performance and highly sceptical about why it should help pay to bail out Athens again.