Could euro survive temporary exit of Greece?

- Published

- comments

Unsurprisingly there is tremendous nervousness among politicians and bankers in Athens about the failure of the Eurogroup to make announceable progress on a rescue deal for Greece - and also among influential investors in London.

Here are just a few of their concerns - focused in particular on the idea, put forward by the German Finance Minister Wolfgang Schaeuble, that there perhaps could and should be a temporary exit of Greece from the euro.

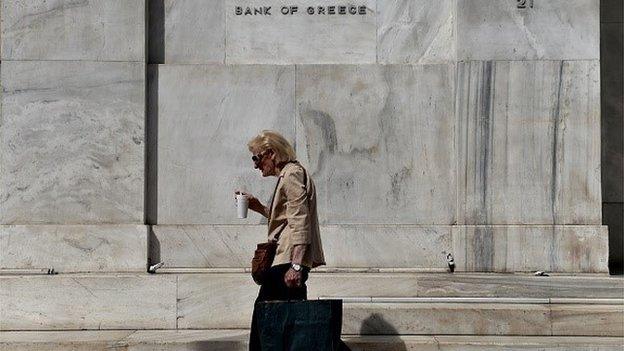

So the first rather chilling thing I've learned, from well-placed bankers, is there have been no conversations between the Bank of Greece, the government or regulators and Greece's commercial banks about the technicalities of leaving the euro and adopting a new currency.

This is astonishing - and some would say pretty close to criminal - given that on Wednesday night the president of the European Council, former Polish prime minister Donald Tusk, was explicit that this weekend's negotiations were all about whether Greece would stay in the eurozone.

"There have been absolutely no talks with the authorities on what we would do if we leave the euro - no technical preparations, nothing that we are aware of," said one senior banker.

He added, just in case I was in any doubt about the impact of leaving the euro on the Greek banks: "If it does happen, well I have no idea how and whether we would ever reopen".

So Greek exit from the euro would be hideous for banks.

It would also be nightmarish for the European Central Bank (ECB).

Here is one reason why.

It currently holds €50bn of Greek loans to companies and residential mortgages - as part of the collateral on the €120bn of Emergency Liquidity Assistance it and the Bank of Greece have provided.

'Colossal losses'

If Greece were to adopt a new drachma, Greek households and businesses would start to receive income in this new currency - which would collapse in value relative to the euro.

But the debts to the ECB of these households and businesses would almost certainly still be in euros.

So with their income collapsing in real terms, they would be unable to keep up the payments on the debts.

And the ECB would face colossal losses - perhaps €35bn of losses on the €50bn.

That is just one of the many headaches it would face.

Finally, an influential investor said that Mr Schaeuble's suggestion of temporary exit from the euro for Greece was a serious existential threat to the single currency - in the sense that there would demonstrably be a less painful and humiliating way out of the euro than permanent withdrawal.

At that point investors would start betting on which member nation would next run into difficulties paying debts or coping with a strong euro - and therefore which would be next to seek a temporary exit.

Investors would then withdraw capital from the nation perceived to be economically and financial vulnerable - reinforcing that vulnerability, in that the capital flight would increase the cost of money there, and undermine prosperity.

In other words, just as the European Exchange Rate Mechanism turned into an economic disaster because it was not seen as forever, the notion of temporary exit from the euro would almost certainly accelerate its breakup - or so some of those who control the world's trillions warn me.

Which is perhaps why, here at a few seconds before midnight, just perhaps Eurogroup finance ministers and government heads will find some kind of messy compromise to keep Greece in the euro (for a while at least).

But I am not betting large on it quite yet.