Governor: interest rate rise on agenda at turn of year

- Published

- comments

It has been more than six years coming, but the Bank of England's governor has today almost put a date on the first change in the interest rate it controls - a rise of perhaps 0.25% - since March 2009.

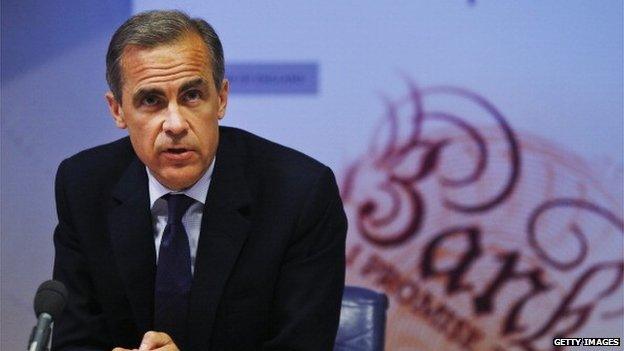

In the unlikely setting of Lincoln Cathedral, Mark Carney has indicated that, barring some dramatic change in the health of the British economy, an interest rate rise will be on the agenda at the end of the year, when recent falls in oil and commodity prices will have washed out of the headline inflation rate.

If rates were to rise early in the new year, from the current all-time record low of 0.5%, that would be three or four months after the expected equivalent move by the US Federal Reserve.

Now for those of you with big debts looking for reassurance that you are not going to be financially crippled by the increase, he has said two other things of note about the so-called Bank Rate.

First typical interest rate changes, increments, will be typically much smaller than the half of a percentage point that they used to be before the Crash of 2008 - so probably one quarter of a percentage point.

Also he has signalled that the new normal rate of interest over the medium term after a succession of rises over two or three years will be perhaps half the 4.5% over rate of the past 300 years. So nearer 2%.

The reason why interest rates, if all goes to plan at the Bank of England, would be much lower than in the past is that household indebtedness is still significantly above where it was before the madness of the boom borrowing years. So every little interest rate rise is much more expensive for many households than in the past.

And also households and businesses have become much more risk averse than prior to the banking meltdown of seven years ago. Which means that smaller interest rate rises should be more effective in slowing down economic activity and curbing inflation than hitherto.

All of which may reassure borrowers but will be toxic to savers.

What is particularly striking about the timing of the Governor's remarks is it comes the day after unemployment data which saw the first rise in unemployment for more than two years and earnings data which saw pay adjusted for inflation rising at its fastest rate since before the demise of Northern Rock in 2007.

That suggests the Bank's interpretation of those statistics is that unemployment falls are now being held back by skills shortages. And those skills shortages are also responsible for rising wage inflation.

If that analysis is accurate, a gentle increase in the cost of money would be shrewd, to prevent wage inflation forcing a significant pick up in price inflation.

All that said, some will argue the Governor is bonkers to be talking about increasing interest rates when the official inflation rate is precisely zero, two percentage points below target.