Housing affordability gap grows, says ONS

- Published

Home ownership statistics have been compiled by the ONS

The gap between the most affordable and least affordable homes in England and Wales has widened, figures show.

The average home in Westminster, London cost 24 times more than a typical gross annual salary in England and Wales, the Office for National Statistics said, external.

At the other end of the scale, the average property price in Blaenau Gwent in Wales was only four times greater than the average salary.

This gap has widened since 2007, the figures show.

Double dip

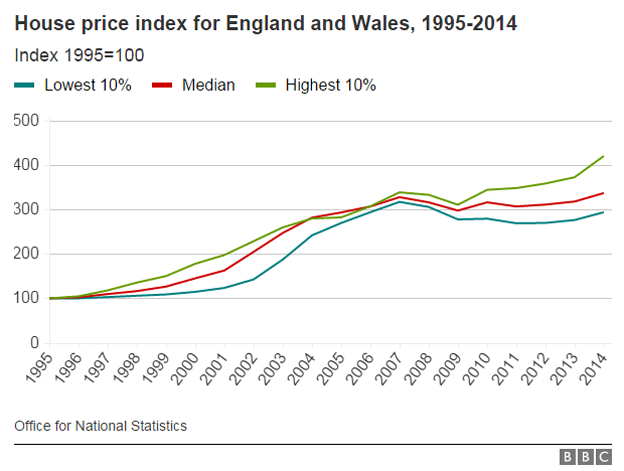

House price rises in the most expensive 10% of areas of England and Wales have outstripped growth for the least expensive 10% of areas.

"Westminster and other exclusive central areas of the capital have long been unaffordable for the majority of us," said Peter Rollings, chief executive of Marsh & Parsons estate agents.

"Investors have always been the highest stake players in these areas of London, and our latest research shows they have only strengthened their hand recently.

"Taxation at the top-end of the property market deters some domestic buyers from sitting at the table. London as a city thrives on foreign investment and being open to global business."

The ONS said that in 2014 - the latest figures available - the value of the least expensive homes had not returned to pre-recession levels. This left some owners at risk of being left in negative equity.

These areas suffered a "double dip" in 2011, when average house prices decreased again whilst prices in the most expensive 10% of areas continued to recover.

The typical home in England and Wales, based on a median average, was valued at £194,955 last year.

Rental sector

Property in Westminster was recorded as the least affordable

The gap between the property ownership "haves and have nots" was most clearly shown in Westminster.

While prices rose, and homes became less affordable to buy, the amount of rent paid to private landlords in Westminster typically took up 78% of an average salary in England and Wales in 2014.

This made it the least affordable area for private tenants as a result.

In contrast, tenants in Copeland, Cumbria, typically spent 22% of an average salary on rent, the lowest rate in England and Wales.

The figures show that rent for social housing took up a larger percentage of residents' earnings in England and Wales in 2014 than in 2002.

Many commentators have suggested that building more homes in certain areas will help to tackle the affordability issue.

The ONS said that house building had not recovered to the 150,000 or more completed new homes a year that were built before the recession. During the latter half of the 1960s more than 300,000 new homes were built every year.

Campbell Robb, chief executive of charity Shelter, said: "Millions of people who simply want a home of their own in a place where they can find work and take care of their families, are instead finding themselves priced out and stuck in a lifetime of unstable and expensive private renting.

"If the government does not refocus its plans and urgently start building homes ordinary people can actually afford to buy or rent, millions of young people and families will continue to pay the price."