China devalues yuan currency to three-year low

- Published

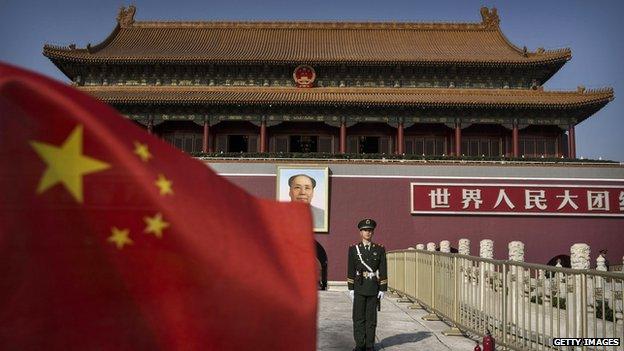

The yuan decision comes in the wake of weak economic data

China's central bank has devalued the yuan to its lowest rate against the US dollar in almost three years.

The lender said the move was a "one-off depreciation" of 1.9% in a move to make the exchange rate more market-oriented.

The move, which makes exports cheaper, comes after weak economic data from the world's second largest economy.

Washington has in the past complained that China uses its currency for competitive advantage, but the US Treasury's response was measured.

"While it is too early to judge the full implications of the change... China has indicated that the changes announced today are another step in its move to a more market-determined exchange rate,'' a department statement said.

However, the statement added: "We will continue to monitor how these changes are implemented and continue to press China on the pace of its reforms, including additional measures to transition to a market-oriented exchange rate and its stated desire to move towards an economy that is more dependent on domestic demand, which is in China and America's best interests. Any reversal in reforms would be a troubling development."

However, one US politician, Senator Chuck Schumer, was more forthright. "For years, China has rigged the rules and played games with its currency. Rather than changing their ways, the Chinese government seems to be doubling down.''

Weak exports

At the weekend, China reported a sharp fall in exports and a slide in producer prices to a near six-year low in July.

Exports fell by 8.3% in July, far worse than expected and the producer price index was down 5.4% from a year earlier.

The midpoint for the yuan is now set at 6.2298 to $1, up from 6.1162 yuan on Monday.

The People's Bank of China (PBOC) manages the rate through the official midpoint, from which trade can rise or fall 2% on any given day.

Until now, it had been determined solely by the central bank itself.

Making the rate more market-based will mean the midpoint will now be based on overnight global market developments and how the currency finished the previous trading day.

China wants to be included in the IMF's reserve currencies basket

The PBOC's move comes amid speculation that China is preparing to widen the trading band for the currency from the current two percent range.

China has long kept tight control of the yuan value on concerns over financial volatility and losing its policy control.

Yet it is also under pressure to reform its currency policy as it pushes to become one of the International Monetary Fund's "special drawing rights" (SDR) reserve currencies.

These are currencies which IMF members can use to make payments between themselves or to the Fund.

'A new currency war?'

Analysts ask, though, whether this really is a one-time move from China.

"The question on everyone's mind is whether this is the awakening of the dragon - ushering in a new global currency war?" Angus Nicholson, market analyst with trading firm IG wrote in a note.

"If this move ushers in a new era where the CNY [Chinese yuan] fixing is increasingly reflective of the spot market, it could be positive for its prospects being included in the IMF's special drawing rights basket of currencies this year."

Asian equities outside of China slipped on the news as investors weighed the implications of the surprise move.

Analysis: Robert Peston, BBC economics editor

The decision of the People's Bank of China to devalue the yuan by 1.9% will have global ramifications, in the short, medium and long-ish term.

Immediately it will increase the competitiveness of China's exports at a time when the country's economy is growing at its slowest rate for six years - and when many economists fear that the slowdown will become much more painful and acute.

And for all the spur to growth it may give, the devaluation will reawaken concerns that Beijing is still a million miles from having re-engineered the Chinese economy to deliver more balanced growth based on stronger domestic consumer demand.

- Published11 August 2015

- Published11 August 2015

- Published9 August 2015

- Published26 May 2015

- Published28 May 2015