How video-on-demand tech is changing the TV landscape

- Published

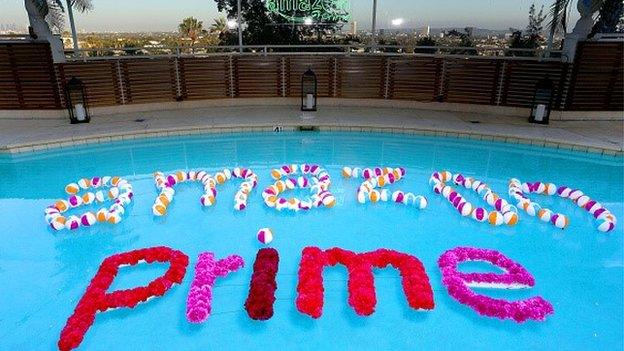

Amazon Prime's new car show fronted by former Top Gear presenters will have a £160m budget

When former Top Gear presenter Jeremy Clarkson revealed he would be making a new show on Amazon Prime after being dropped by the BBC, his successor, Chris Evans, must have felt a little nervous.

Subscription video-on-demand (SVOD) services such as Amazon's have sent shockwaves through the broadcast world, as they gain millions of new viewers each year and produce ever more of their own award-winning content.

Netflix, the market leader, is now in over 15% of British homes, while Amazon's market share is about 5%.

And new technologies that let us watch what we want on whatever device we want are transforming traditional television viewing habits.

'Big advantages'

According to UK regulator Ofcom, household subscriptions to the top SVOD services - Netflix, Amazon Prime and Sky Now - shot up from 4.2 million to six million in the 12 months to March.

Forecasts from Mintel suggest that UK streaming video subscription revenues will rocket from £437m to £1.17bn between 2014 and 2019 as users more than double.

Subscription video-on-demand

Global subscribers

199m

estimated households by 2020

-

65m Netflix

-

40m Amazon Prime

-

9m Hulu

-

750,000 Sky Now TV

For the broadcasters, this comes at a time when the number of people who own a TV set is falling in the UK and the long-term viability of the licence fee is in question.

Research from media consultancy SNL Kagan has also found that in the US, take-up of cable, satellite and other pay-TV services is falling fast as lower-cost SVODs undercut them.

Mark Mulligan, an analyst at media consultancy Midia, says that Netflix and Amazon have big advantages over broadcasters in their ability to target programmes at specific audiences and lavish budgets "measured in the billions" on their productions.

"A traditional cable company has to worry about filling entire programming schedules of a vast selection of channels - SVOD companies have no schedules at all," he says.

"So they can afford to be highly selective about what they want to commission and then pay over the odds to get it."

Amazon Prime has about 40 million subscribers worldwide

Last year, director of BBC television, Danny Cohen, admitted the corporation had been "blown out of the water, external" when bidding against Netflix in one deal.

And Mr Clarkson's new driving show on Amazon Prime - with its global subscriber base of 40 million - is reported to have a budget of about £160m for just three seasons.

No wonder Amazon founder Jeff Bezos recently admitted that the show will be "very, very, very expensive".

Connected home

The difficulty for SVOD services in the past was that you could only watch the programmes on a laptop or desktop, which meant they weren't ideal for collective family viewing.

Now internet-enabled smart TVs are bridging the gap, and new technologies, such as Amazon's Fire Stick and Google's Chromecast, are enabling viewers to beam content wirelessly from any connected device to their TV sets with relative ease.

Many cable TV services, such as Virgin's Tivo, also offer Netflix as part of their packages, again widening access.

Google's Chromecast dongle enables you to stream content from your mobile device to your TV

...but you need to have a very fast broadband connection for streaming to work flawlessly

But SVOD's Achilles heel is currently internet bandwidth - or lack of it.

Average download speeds in the UK are still around 23 megabits per second (Mbps), so viewing SVOD on more than one device at the same time can lead to jerky, stuttering pictures, says Michael Underhill, an analyst at media consultancy Enders.

When you think about all the connected devices in the average home fighting for a share of bandwidth, ultrafast wi-fi connections - 100Mbps and above - are likely to be needed for SVOD to continue its rapid growth.

'Impressive headlines'

And it's important to put SVOD growth numbers in context.

Such services accounted for about 3% of total UK viewing in 2014, while around 90% went to live, recorded and on-demand television - the domains of the traditional broadcasters and cable channels.

"For all the impressive headlines that companies like Netflix and Amazon generate, they are still only used by a minority of the population," says Enders' Mr Underhill.

"While Netflix dramas like House of Cards generate a lot of attention, the majority of viewing on these platforms goes to existing broadcast content," he adds.

"So the content that people like the BBC and ITV have funded and created has gone some way to making Netflix as popular as it is."

Netflix leads the SVOD pack with an estimated 65m subscribers

For now, SVOD platforms are mostly a "complementary" form of viewing, says Ofcom, used primarily to access films and US TV shows.

They also face fierce competition from mainstream and cable channels, which are themselves offering new digital services, not to mention from recorded TV and free video-on-demand services like YouTube.

"SVOD is just one reflection of an overall media landscape that's in the midst of fundamental change," says Phil Stokes, a media expert at PwC.

"In part, the traditional broadcasters are capitalising on changing viewing habits and the opportunities from technology by launching their own time-shifted catch-up channels, families of channels, mobile apps and video platforms."

Trump card

Another point Mr Underhill makes is that services like Netflix have largely produced dramas which, despite critical acclaim, do not attract the mega audiences of shows like Downton Abbey or Strictly Come Dancing.

"Platforms like Netflix have shown no interest in commissioning shows like the X-Factor or The Only Way is Essex or Springwatch, or indeed live sport or news," he says.

Video-on-demand dramas don't yet achieve the audience figures of shows like Strictly Come Dancing, says Enders analyst Mark Underhill

"In these areas TV broadcasting companies are producing the bulk of content and accounting for a large share of audiences."

"Whereas Top Gear will likely reinvent itself after a few years without Clarkson, it is much less likely that Clarkson's brand will be as robust after a few years hidden behind the online pay walls of an SVOD service," believes Midia's Mark Mulligan.

While Chris Evans may not need to be too worried just yet, PwC's Phil Stokes warns that broadcasters cannot afford to be complacent.

"They must innovate constantly," he says.