UK inflation rate falls back to 0%

- Published

A smaller rise in clothing prices from a year ago contributed to the fall in the inflation rate

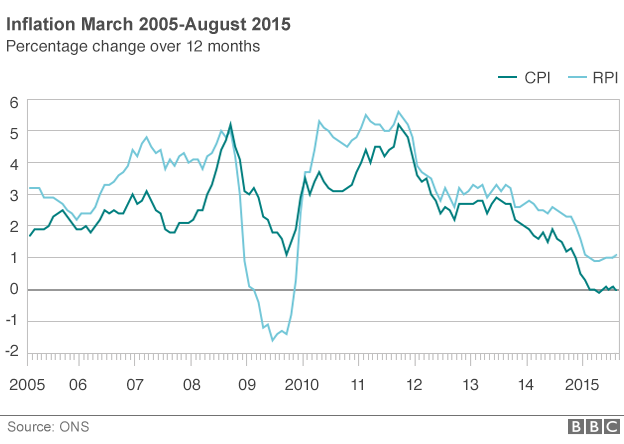

The UK's inflation rate fell to 0% in August, down from July's rate of 0.1%, the Office for National Statistics (ONS) has said.

Inflation, as measured by the Consumer Prices Index, fell due to a smaller rise in clothing prices from a year ago and cheaper fuel prices, the ONS said, external.

CPI inflation has been almost flat for the past seven months.

Inflation has failed to take off due to a sharp fall in oil prices and a continuing supermarket price war.

Oil prices hit a six-and-a-half year low of around $42.50 per barrel in late August.

The ONS figures also showed that the Retail Prices Index (RPI) measure of inflation rose to 1.1% from 1.0% in July.

Bank rate

The rate of core inflation - which strips out the impact of changes in the price of energy, food, alcohol and tobacco - fell to 1.0% in August from the previous rate of 1.2%.

"With consumer price inflation flat in August and core inflation easing back to 1.0%, there is little immediate pressure on the Bank of England to start raising interest rates," said Howard Archer, chief UK and European economist at IHS Global Insight.

"Further reason for Bank of England caution on interest rates is the recent evidence that the economy has hit a soft patch during the third quarter," he said.

The Bank of England's key interest rate has been at the record low of 0.5% since March 2009, and despite much speculation about when it might rise, inflation still remains well below the Bank's target of 2%.

Many analysts expect the Bank of England to start to raise interest rates in the first quarter of 2016.

Last week, Bank policymakers voted 8-1 to hold rates again, and said the risks from the slowing Chinese economy had increased since August.

'Fragile recovery'

British Chambers of Commerce economist David Kern said that low inflation reinforced the case for keeping low interest rates.

"Low inflation supports living standards by boosting disposable income and will help to sustain the economic recovery.

"However, last week's poor trade and manufacturing figures show that the recovery is still fragile, particularly in the face of major global uncertainties," he said.

But some economists said the UK economy was strong enough to override concerns about economic uncertainty, the economic slowdown in China, and a shaky eurozone performance.

Michael Martins of the Institute of Directors said that "given the strength of the UK economy, pickup in output, tightening labour market, and tentative signs of productivity increases," the Bank of England should be prepared to follow the US Federal Reserve should it raise interest rates this week.

Pay rise

Other analysts pointed out that despite low headline inflation, price pressures remained in the economy.

Richard Jeffrey of Cazenove told the BBC that low inflation would be temporary. "It's coming through energy prices, petrol prices, diesel... [and] food prices. If you strip those things out, and you begin to look at domestically generated inflation, actually that seems to be rising at the moment."

Andrew Sentance, a senior economic adviser for PwC and former Bank of England policymaker, said the effect of falling energy and food prices pulling inflation down "will wear off in the months ahead, with CPI inflation likely to rise back to 1% to 2% in the UK by the first half of next year".

"It could go higher still if wage increases continue to pick up in response to a tightening labour market," he added.

- Published15 September 2015

- Published10 September 2015

- Published9 September 2015