Fed sticks, markets give small sigh of relief

- Published

- comments

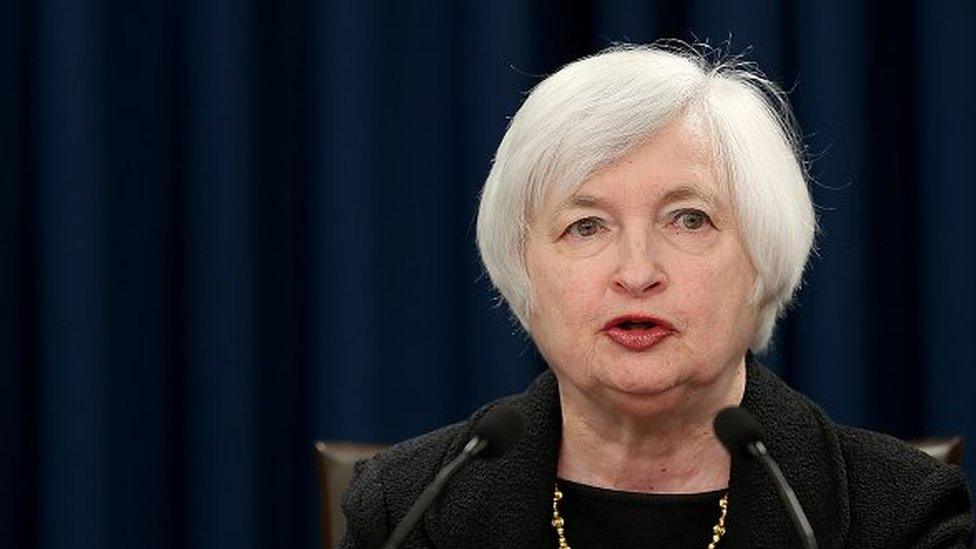

Federal Reserve chair Janet Yellen said global concerns affected the Fed's decision to leave interest rates unchanged

When America sneezes, the world can catch a cold.

So, the reaction to today's decision on the global stage will probably be relief - and initial reaction on the markets is upwards.

A rate rise would have left emerging market economies - which have suffered intense market volatility over the past few months as China's economy slows and commodity prices soften - with higher bills to pay for the money they have borrowed in dollars.

In the West, a rate rise in America would have increased pressure for central banks to follow suit.

And with, for example, the eurozone economies struggling, that pressure may have been unwelcome.

For the UK - where the economy is considered to be in relatively good repair - momentum towards a rate rise could well lessen.

The Governor of the Bank of England has regularly warned that an increase is on the cards, the first for nine years.

But with the Fed saying that the world's economic headwinds could "restrain" economic growth and with little sign of global inflation, Mark Carney's decision to announce an increase could be pushed back - many believe well into next year.

That's good news for mortgage holders. Not so good for savers.