Osborne doubles his China bet

- Published

- comments

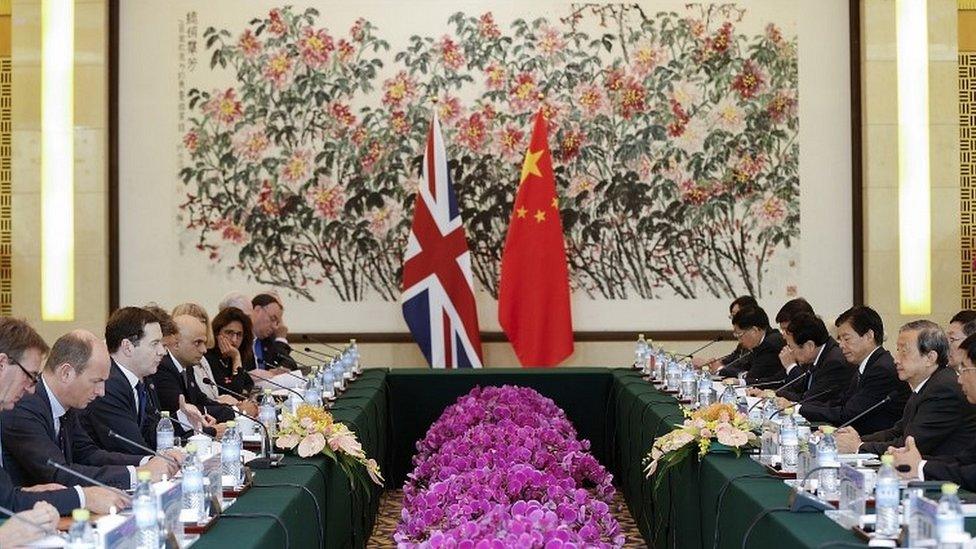

What is most striking about George Osborne's Chinese tour is he is doubling his political and economic bet on the world's number two economy at a time when that economy is looking its most fragile for 30 years.

His calculation is that China's economy will slow in a relatively contained way to a more sustainable rate - perhaps 4% or 5% a year compared with the official target of 7% - without a devastating crash that would damage a large number of client economies and engender social unrest in China itself (in employing the great Goldman bull of China Jim O'Neill as his commercial minister, Osborne could hardly wager otherwise).

Today's manifestation of the China bet is confirmation of a long-trailed loan guarantee - initially worth £2bn but likely to rise substantially - to bind in Chinese and French nuclear giants to their promised massive £24.5bn investment in the Hinkley Point C new nuclear plant.

This is certainly long-term strategic planning for more power security by Osborne and the government (well they would say). With oil fluctuating at between $40 and $50 a barrel, Hinkley's prospective electricity looks scarily expensive.

And there is a paradox about how pricey the nuclear megawatts look right now - because one of the big causes of the oil price collapse is the Chinese slowdown that has savaged demand for energy.

'Pure expression'

But Osborne views Hinkley as a bloated sprat to catch a ginormous mackerel: a Chinese-designed nuclear power plant in Essex is hoped to be in the offing (according to the energy secretary Amber Rudd in today's FT); a wagonload of construction investment in the chancellor's cherished "Northern Powerhouse" is chuntering down the track, according to leaders of north-of-England city council leaders out here with him.

China represents perhaps the purest expression of Osborne's realpolitik approach to promoting prosperity in Britain.

He is blowing a raspberry at human rights campaigners by going to Urumqi, where the indigenous Uighur population complain of economic and cultural discrimination by Han Chinese, to win business for British companies in President Xi's "One Belt, One Road" global transport-infrastructure "grand projet" (a Silk Road for a globalised age).

And Osborne is also politely ignoring Washington, which is increasingly uneasy about what it sees as the Treasury's disloyal Beijing tilt (the White House was unamused, Beijing smug, when the UK became the first western member of the Chinese-sponsored Asian Infrastructure Investment Bank).

The chancellor's calculation is that the Chinese will remember who stuck by them when the going got tougher.

And he is also presuming that as the returns from investing in China itself diminish, Chinese institutions - many of them still loaded - will increasingly think owning a bit of Britain isn't such a crazy idea after all.