China's economy is stumbling, but by how much?

- Published

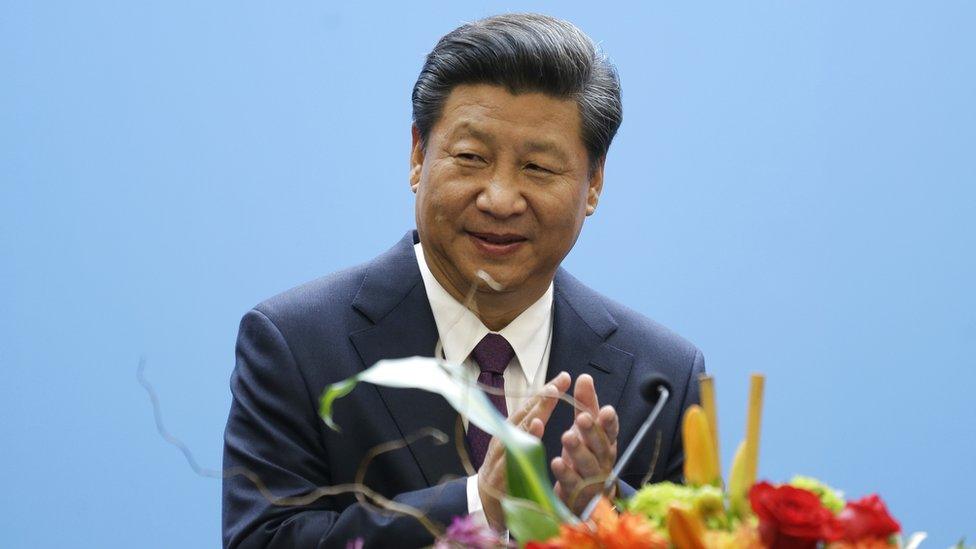

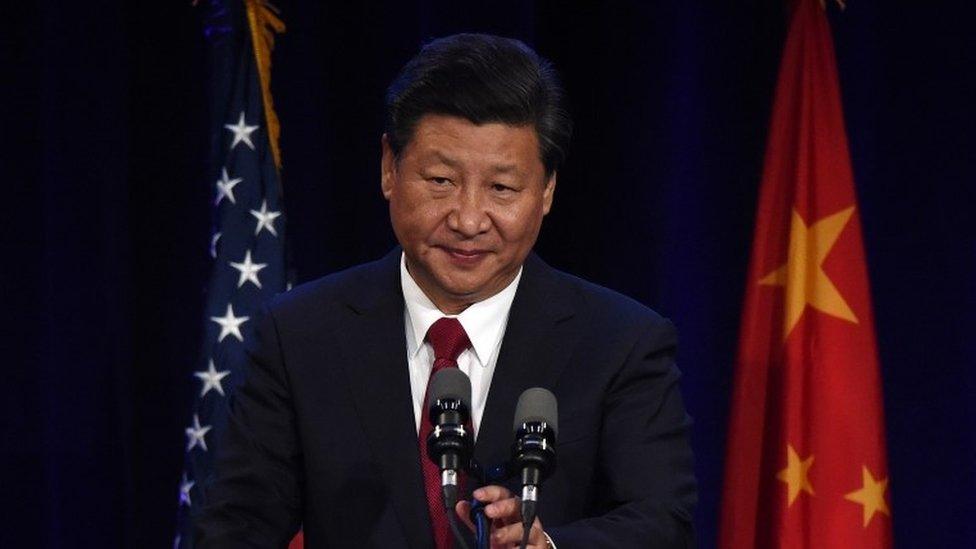

President Xi Jinping has said that the Chinese economy 'is still operating within the proper range'

China's economy is slowing down.

We know that. So, of course, does President Xi Jinping.

It is one of the major issues - shadows even - hanging over his visit to the United States.

After an average annual growth rate of 10% for three decades, that pace has cooled substantially. Last year it was 7.4%.

There are many economists who are profoundly sceptical about China's official data, who think the true figure is a good deal lower.

For next year the IMF forecasts 6.8%. And the slowdown was bound to happen.

'Excessive investment'

The IMF described the transition under way in China, external as "moving to a 'new normal', characterized by slower yet safer and more sustainable growth".

A new normal is needed because the forces behind China's previous dynamism are weakening. The ageing population means there's a limit to the contribution that a growing labour force can make to the economy.

Chinese factory output is fell in September, according to one report

All that previous strong growth means the technological gap compared with the rest of the world has narrowed. That in turn limits the scope for rapid gains from catching up.

Investment is another source of growth, which adds to the productive capacity of the economy. But China's investment level is already extremely high. Indeed IMF research suggested, external even in 2012 that it was excessive.

Why excessive? Because it diverts resources from other sectors of the economy including household spending, and if a country over invests an increasing number of projects are likely to be economically inefficient.

The question that has been worrying financial markets intermittently for the past few weeks has been - will the transition be a smooth one, or will China suffer what's called a hard landing, that's to say an abrupt slowdown or even a recession?

The answer really does matter for the rest of us.

Global recession?

China is by one measure the biggest economy on the planet. It accounts for 17% of global economic activity.

The US economy is almost as big but is not growing so rapidly. Things are likely to stay that way for years or even decades after China has settled to a more sustainable rate of growth.

That means that China's impact on global growth is larger, and so is the potential contribution it can make to increased demand for goods produced by other countries.

So hard or soft landing really is a big deal. Which can we expect?

Views among economists vary - when don't they? There is one very influential voice who has set out a pretty gloomy judgement, Willem Buiter, chief economist at the giant financial firm Citigroup, formerly of the Bank of England and the London School of Economics.

He says: "We believe that there is a high and rising likelihood of a Chinese, emerging market and global recession scenario playing out."

Now there's a debate to be had about what the word "recession" means,, external especially when applied to emerging economies and still more so for the global economy.

Mr Buiter's definition is based on an economy's potential to grow. He concludes that growth of less than 2% for at least a year is a global recession. The threshold for China is 2.5%.

China is having to deal with the impact of an ageing population

He is one of the sceptics about China's data, so his view is that the Chinese economy is already closer to that than the official figures suggest.

For the world economy he reckons there's a 40% chance of a moderate recession, with a 15% chance of a more severe downturn and a financial crisis.

If it does happen, he says, it's most likely the world be dragged into a recession by slow growth in a number of key emerging economies, especially China: "We consider China to be at high and rapidly rising risk of a cyclical hard landing."

Why? Many of the classical warning signs are present, he says - excess capacity in an increasing number of industries, too much borrowing and debt, and episodes of "irrational exuberance" in asset markets, recently property and the stock market.

He says: "This is the classical recipe for a recession in capitalist market economies."

If it does happen then it would surely affect many others. And there are other emerging economies already in recession including two large ones in the shape of Brazil and Russia.

China is among the most important export destinations for many countries - number one for South Korea (more than a quarter of exports), Saudi Arabia and Iran.

For the largest economies, China comes in as the second biggest export market for Japan, fourth for the US, and for Germany it's second among markets outside the European Union.

Falling commodities

Even countries with little direct trade with China could easily feel the effects of a hard landing, if they are suppliers to countries that do sell directly to China, or if they export commodities whose price in international markets is affected by weakened Chinese demand.

Take two key industrial commodities, crude oil and copper.

Weakened demand from China is widely seen as a factor that has caused global oil prices to fall

The price of crude oil has fallen by more than half since June last year. There are supply factors behind that - shale oil in the US and the unwillingness of Saudi Arabia and others to curtail production as they might have done in the past.

But weaker-than-expected growth in demand from China is another element in the price fall.

Copper is a key raw material for the construction industry. It's used extensively in electrical installations, and China's building boom has been hungry for copper.

Its price is also down by half, in this case from 2011. China's slowdown is the key factor.

So that's the case for being gloomy.

But there are some who are more upbeat about the outlook. In a recent note to clients, the London consultancy Capital Economics wrote: "In contrast to the widespread doom and gloom about China's immediate economic outlook, we think growth has already stabilised after a slowdown at the start of the year, and that there are good reasons to expect stronger growth in the months ahead."

Ahead of his visit to the US, President Xi told the Wall Street Journal:, external "The Chinese economy is still operating within the proper range."

His host, President Barack Obama, must be hoping he is right and that it stays that way. He's not the only one.

- Published24 September 2015

- Published23 September 2015

- Published23 September 2015

- Published1 September 2015