Lloyds: Government to sell £2bn stake to public

- Published

George Osborne: "This is the first time members of the public will be able to buy Lloyds shares"

Plans to sell shares worth at least £2bn in Lloyds to private investors have been announced by the government.

The Treasury said, external that the government would sell its remaining 12% stake in the bank in the coming months.

As part of this, a sale aimed at private investors will be launched next spring.

Members of the public will be offered a 5% discount to Lloyds' market price and small investors seeking shares worth less than £1,000 will get priority.

Those who keep their shares for at least 12 months will get one bonus share for every 10 they own.

The value of the bonus share incentive will be capped at £200 per investor.

PPI move

The share sale will be launched in spring next year, with applications available online, external and by post.

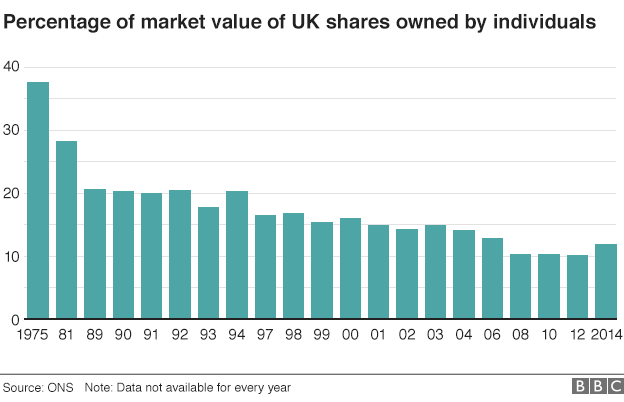

The move echoes government privatisations in the 1980s, when the Conservative government sold shares worth £3.9bn in British Telecom and a £5.6bn stake in British Gas.

Chancellor George Osborne described the sale as the biggest privatisation in the UK for more than 20 years.

"I don't want all those shares to go to City institutions - I want them to go to members of the public," he said.

The announcement comes just days after the financial regulator said it intended to set a 2018 deadline for people to claim compensation for mis-sold payment protection insurance (PPI).

The Financial Conduct Authority's decision was regarded as a boost for Lloyds, which has already set aside at least £13bn to compensate customers for PPI - more than any other bank.

The government saved Lloyds from collapsing at the height of the financial crisis in 2008 with a £20.5bn bailout, leaving it with a 43% stake.

The Treasury has recouped almost three-quarters of public funds used to rescue the bank by selling shares to institutional investors.

The proceeds from selling the shares are being used to reduce government debt.

Shares in Lloyds Banking Group rose 1.4% to 77.6p in morning trading in London on Monday, valuing it at £54.6bn.

It was the most actively traded stock on the FTSE 100, with 14 million shares changing hands.

'Well-regarded bank'

Richard Hunter, head of equities at Hargreaves Lansdown, said the £2bn sale equalled a 3.6% stake in the bank, with the 5% discount equivalent to 3.8p a share.

"Nonetheless, it does provide a welcome opportunity for smaller investors to at least participate in a fraction of the sell-off, in what is currently a well-regarded bank," he said.

"With a projected dividend yield which could nudge 4% and interest rates remaining in the doldrums, you can see this being of interest to income-seeking investors in the current environment."

- Published5 October 2015

- Published11 August 2015