George Osborne: Councils to keep £26bn in business rates

- Published

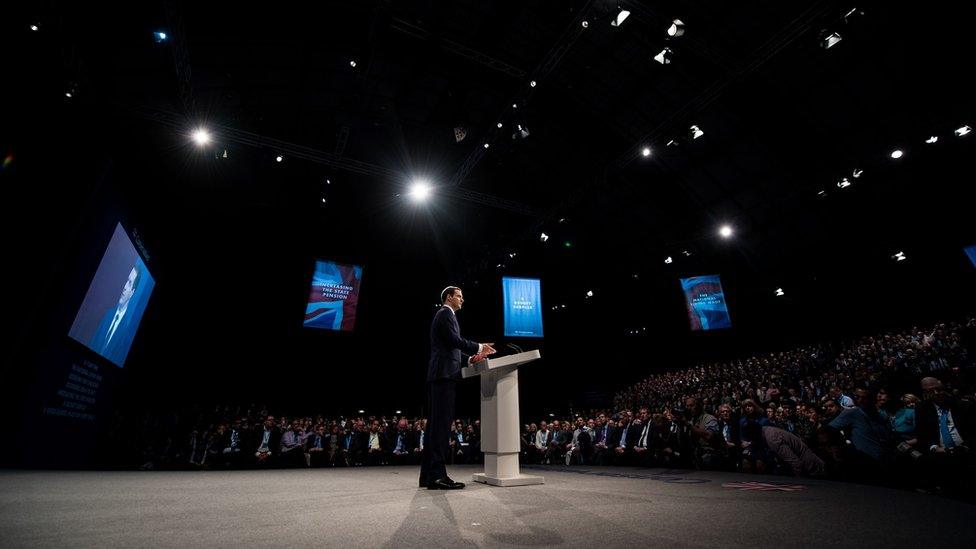

George Osborne announced the plan at the Conservative conference in Manchester

Councils in England will be able to keep the proceeds from business rates raised in their area under plans unveiled by Chancellor George Osborne.

Councils will also be able to cut the rate and some will be able to raise it. Mr Osborne said councils would hold on to £26bn, calling it the "biggest transfer of power" in recent history.

They currently keep up to 50% of the rates - the rest goes to Westminster.

The Local Government Association (LGA) said the move was "good news".

But Labour warned it could start a "race to the bottom" with councils competing to cut their rates the most.

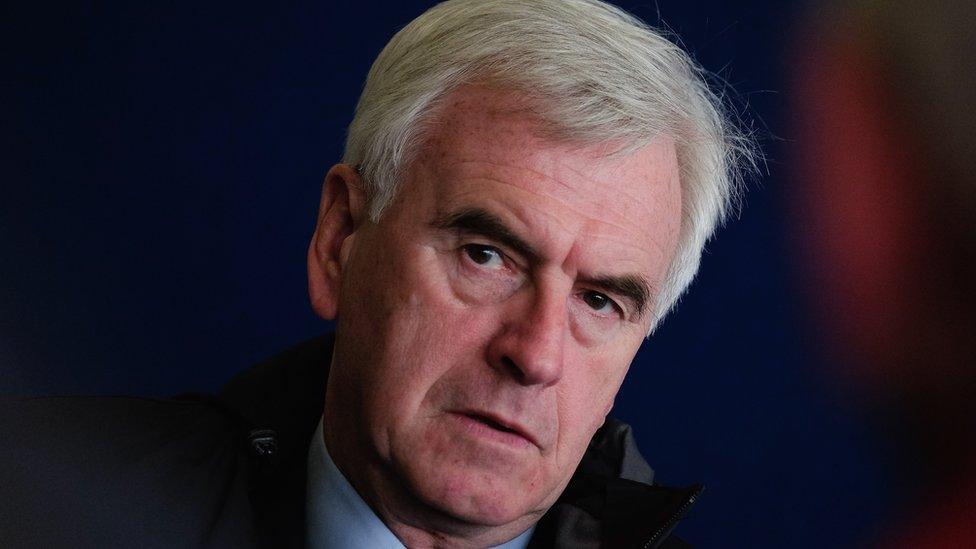

Shadow chancellor John McDonnell warned the poorest areas could be hit by the plan

Shops, offices, factories and businesses currently pay a uniform business rate set by central government.

Councils collect the tax and send the funds to the Treasury, which then redistributes them so that areas with fewer businesses do not lose out. Since 2013 local councils have been able to keep up to half.

Central government currently takes in about £11.5bn in business rates and redistributes £9.4bn in grants.

'Regional inequalities'

Mr Osborne said the change, due to be in place by 2020, would mean cities and communities no longer had to go to the government "with a begging bowl".

Under the new plan "attract a business, and you attract more money; regenerate a high street, and you'll reap the benefits; grow your area, and you'll grow your revenue too", he said.

The amount paid by businesses is calculated by multiplying the rental value of a property by either the standard rate (49.5p) or the lower rate (48p), before subtracting any rate relief.

Under the plans, councils will be able to cut these rates to attract new investment and jobs.

Elected mayors in big cities such as London, Manchester and Sheffield will be allowed to add a premium - expected to be capped at 2p - to pay for major infrastructure projects.

A system of tariffs and top-ups designed to support areas with lower levels of business activity will be maintained in its present state.

Analysis

By Robert Peston, BBC economics editor

This is not comprehensive decentralisation of tax-raising and spending powers.

That said, it does put local authorities in competition with each other to attract businesses - by easing planning restrictions for example - and thereby increase their revenues.

But although local authorities will be able to cut business rates, they won't be able to put them up, unless that is they are cities like London and Manchester with directly elected mayors - and even then they'll only be able to put the rates up by 2p in the pound, to finance infrastructure, and only if businesses vote in favour in local polls.

Or to put it another way, George Osborne does not believe that citizens - who for the sake of brevity I will call "us" - should be able to vote for a party that feels businesses pay too little.

Gary Porter of the LGA, which represents local authorities in England and Wales, said the change would be a "vital boost" to investment in infrastructure and public services.

He added: "While this is good news for councils and businesses, local authorities will face almost £10bn of cost pressures by 2020 so we will now seek to work with government about how this proposal can be introduced more quickly.

"We would expect measures to ensure local areas with less ability to generate business rates income do not suffer as a result of these changes and all councils are also given leeway to vary business rates up as well as down."

CBI director-general John Cridland said that if the change was a way to cut business rates, "then it will spur councils to take a pro-growth approach, and has the CBI's support".

"But this must not be a way to increase rates without the consent of the local business community."

'Safety net'

John McDonnell, the shadow chancellor, said: "Without the right safeguards in place it'll be the poorest areas that are hit hardest.

"We run the real risk of seeing the explosion of Tory tax haven councils, and it'll be consumers and taxpayers who are left to pick up the bill for it in our communities."

And TUC general secretary Frances O'Grady warned "regional inequalities will get wider", unless safeguards are introduced for councils in disadvantaged areas with low business growth.

A Treasury spokesman said it did not accept that the changes would mean a boom for London and the South East of England.

He said latest figures showed the biggest growth in revenue from business rates was in the East Midlands and Yorkshire.

The government also plans to introduce a "safety net" for any area where business rate receipts fall by 7.5%.

- Published5 October 2015

- Published5 October 2015

- Published5 October 2015

- Published3 December 2014