FCA introduces new rules to boost financial whistleblowing

- Published

Some banking scandals may have come to light earlier, if whistleblowers had been encouraged

New rules to encourage more whistleblowing in the City have been published by the Financial Conduct Authority (FCA).

It said the idea was to empower individuals to raise concerns about bad behaviour in banks and insurance firms.

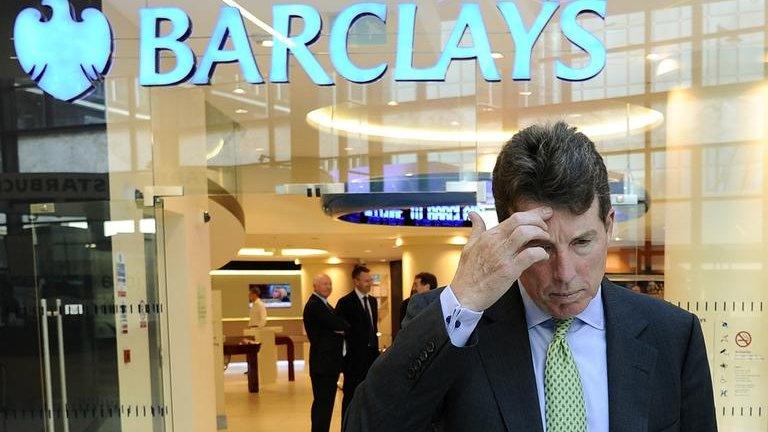

It follows banking scandals such as the attempted manipulation of the Libor rate by Barclays, for which the bank was fined £290m in 2012.

MPs later recommended that it should be easier for whistleblowers to complain.

In 2013 the Parliamentary Commission on Banking Standards (PCBS) suggested that such scandals might have come to light sooner, if employees had been prepared to raise the alarm.

Best practice

The new rules, external - which will come into force in September 2016 - will require big financial firms to

appoint a "whistleblower's champion"

make arrangements to handle disclosures from all employees

tell employees they have a legal right to blow the whistle

present a report on whistleblowing to the board every year

"Whistleblowers play an important role in exposing poor practice in firms, and they have in the past few years contributed intelligence crucial to action taken against firms and individuals," said Tracey McDermott, acting FCA chief executive.

In 2014-15, the FCA received 1,340 complaints from whistleblowers, a rise of 28% on the previous year.

The rules will apply to large banks, building societies and insurance firms, but they will represent best-practice guidance for smaller companies too.

- Published27 June 2012