UK inflation rate turns negative again

- Published

A fall in petrol prices contributed to the fall in the inflation rate

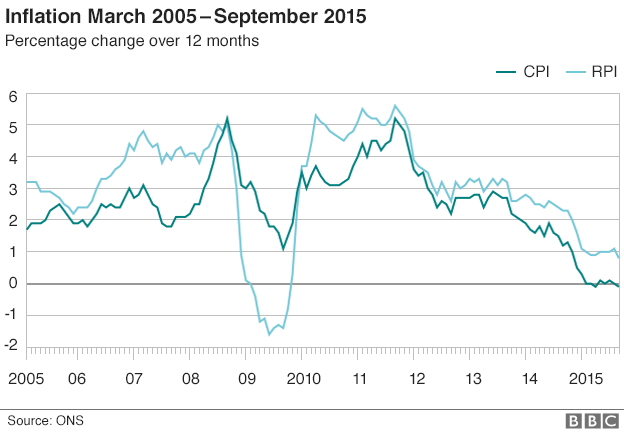

Inflation as measured by the Consumer Prices Index fell to -0.1% in September, official figures have shown.

The Office for National Statistics (ONS) said, external that a smaller than usual rise in clothing prices, and falling motor fuel prices, were the main contributors to the drop in the rate.

The CPI rate has been at or close to zero for most of this year. It was last in negative territory in April.

Most benefits will be frozen from April because of the latest data.

The annual uprating of some benefits, public sector pensions, and the state second pension, is linked to the September CPI rate.

So millions of people are unlikely to see any rise in these benefits, as is the case with most working age benefits, which are part of a freeze announced previously by the government. The state pension is protected and will rise by at least 2.5%.

Business correspondent Aaron Heslehurst explains what the fall in inflation means and why it matters

Price wars

Food prices fell by 2.5% in the year to September in the wake of continued supermarket price wars. This means that prices in the sector fell for the 15th month in a row.

Meanwhile, petrol prices fell by 3.7p per litre over the year, and diesel prices - at 110.2p per litre - are at their lowest in close to six years. There was also a fall in the price of household gas.

The Retail Prices Index (RPI) inflation measure fell to 0.8% in September, from 1.1% in August.

Analysis: Kevin Peachey, personal finance reporter

The official inflation figure from September has been significant over the years, as it is used as a guide when setting rises in various benefits, which take effect from the following April.

Chancellor George Osborne has already announced that a number of working age benefits, such as Jobseeker's Allowance, child benefit and some housing benefit, will be frozen from April anyway, as part of a four-year freeze.

But other entitlements - such as public service pensions, as well as disability and carers allowances - will be set using the latest CPI figure as a template.

The law does not allow for a downrating of benefits, so the practical effect is that these benefits are likely to be frozen from April too.

The exact change, or lack of it, will be approved by the government in the coming weeks.

The figures will be a blow for the millions of people who are on public sector pensions, and those receiving the state second pension.

On the flipside, the main state pension will continue to rise faster than the current inflation rate. From April, the state pension will go up by at least 2.5%, owing to what is known as the "triple-lock" protection.

Andrew Verity warns that pensioners could soon be facing a "squeeze on living standards"

'Benign outlook'

Ben Brettell, senior economist at Hargreaves Lansdown, said the latest CPI figure meant there was "no pressure on the Bank of England to lift interest rates".

Last week, the Bank said it did not expect inflation to reach 1% until spring 2016.

Mr Brettell added that CPI inflation was expected to climb in the coming months, as the big drop in fuel prices would fall out of the year-on-year calculation.

He added: "But core inflation, which strips out volatile components like food and energy, also remains weak at 1.0%. This offers little suggestion that underlying inflationary pressures are building in the UK economy, despite continuing strength in wage growth."

Inflation remains well below the government's target of 2%

David Kern, chief economist at the British Chambers of Commerce, said they expected inflation to remain at or below 0% for most of this year.

"Our forecast is that annual CPI inflation will start to creep upwards early in 2016, but will remain below the 2% target well into 2017," he added.

"The benign outlook for inflation is also reinforced by our quarterly economic survey, which shows that the proportion of manufacturers expecting to raise prices has fallen to a five-year-low."

- Published9 October 2015

- Published8 October 2015

- Published5 October 2015