What does China own in the UK?

- Published

China may be the world's second-largest economy behind the US, but it has more money in the bank than any other country.

Indeed three of the world's 10 biggest sovereign wealth funds are Chinese, together holding more than $1.5tn (£988bn) in assets.

And despite the slowdown in the Chinese economy in the past five years, the government has been putting this money to good use, particularly so since it recovered from the global economic slowdown sparked by 2008's financial crisis.

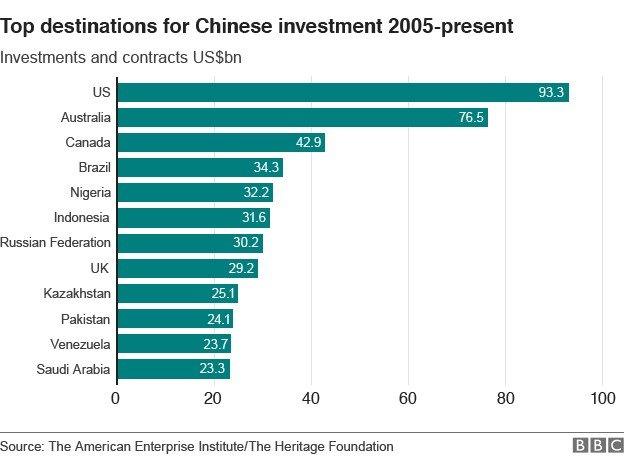

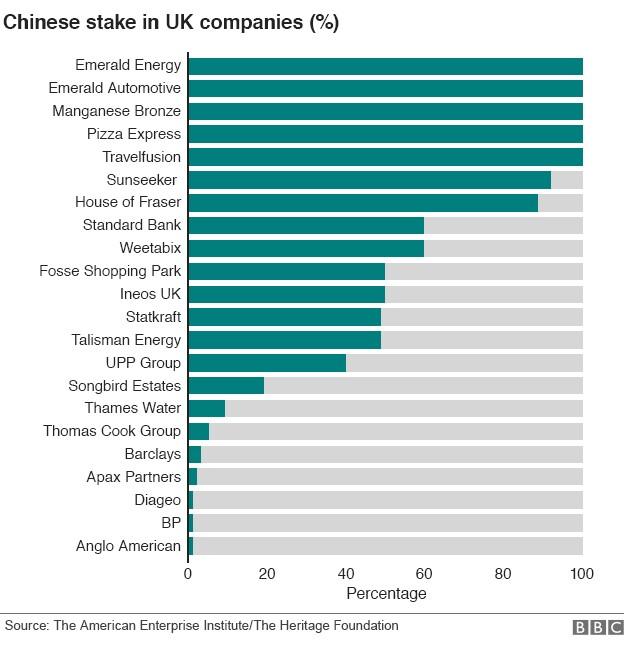

In fact, overseas investments have grown from $20bn in 2005 to $171bn last year. And, as the chart below shows, the UK is one of China's favourite places to invest.

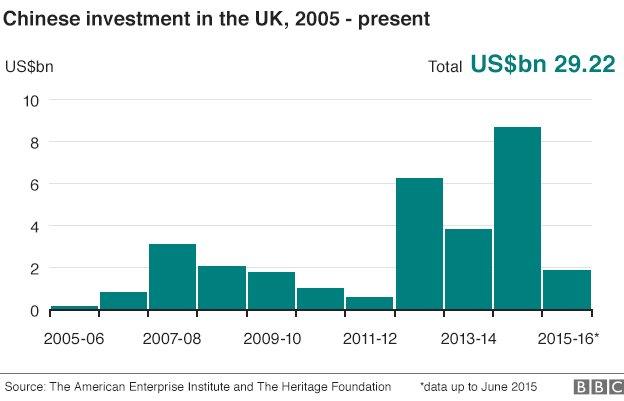

In the first half of this year, Chinese investment in the UK fell sharply - just $1.8bn compared with more than $8bn in the whole of 2014.

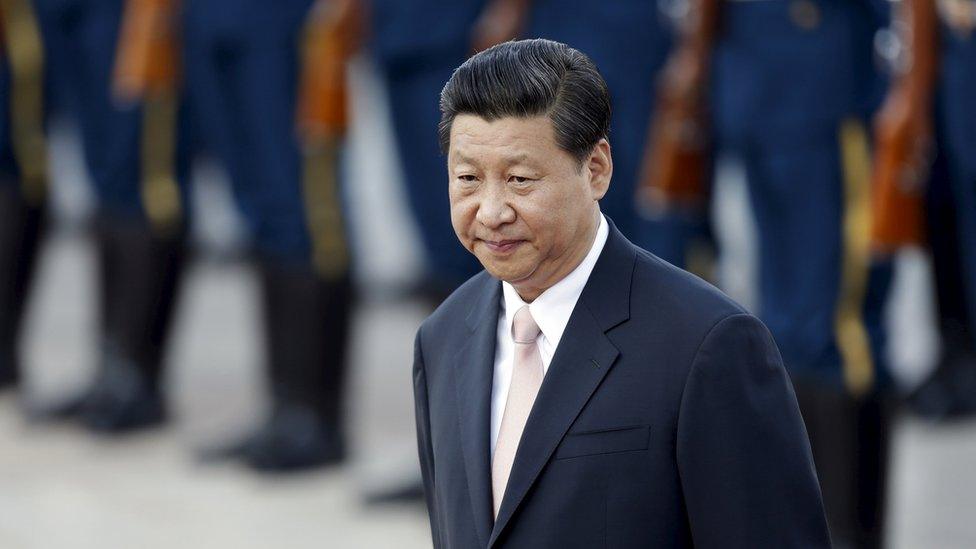

But this figure is likely to be boosted significantly this week with the announcement of a number of deals while President Xi Jinping and his delegation visit Britain. Backing for a new nuclear power plant at Hinkley Point in Somerset could well be announced, while a separate deal for another nuclear plant at Bradwell in Essex has also been mooted.

If these and other deals like them don't come off, then the UK could well slip behind Italy - which has seen huge inflows of Chinese cash in the past two years - as China's favoured European investment destination.

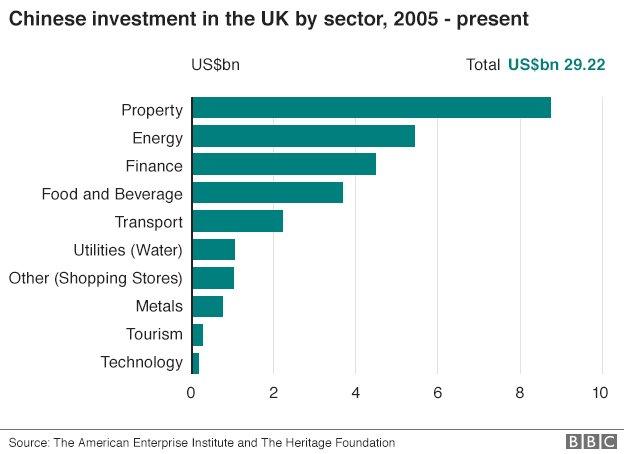

Almost half of all China's global investments have been in the energy sector, many of them designed specifically to provide power for the Chinese. While the country's overall population may not grow significantly beyond its current 1.4 billion, an explosion in the middle class as wealth increases will see demand for energy rocket.

And as China develops technologies to satisfy this demand, it will become increasingly keen to export them. This is precisely why China is so keen to showcase its nuclear technologies in the UK.

But energy has not been China's primary interest in the UK. In fact, property investments far outweigh those in energy. The motivation here is far more straightforward - profit. The Chinese simply see UK commercial property as a good bet. Unsurprisingly, this is also the main motivation behind the huge sums of money China has pumped into the UK's financial sector.

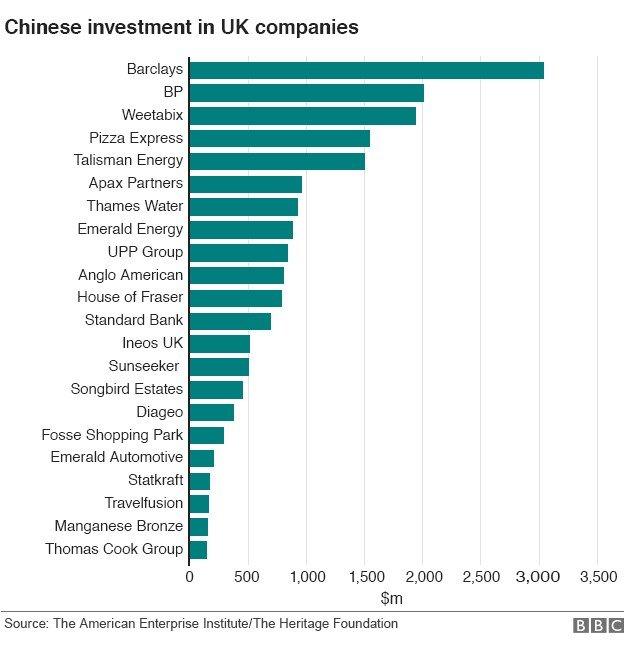

One such investment is in Barclays bank - all $3bn of it. This is by far the largest single investment in the UK by the Chinese government or a Chinese company, in this case China Development Bank.

As you will see from the charts below, when it comes to a massive global bank such as Barclays, not even $3bn gives you much of a stake.

The same is the case with oil giant BP, in which the SAFE sovereign wealth fund has invested more than $2bn.

But other investments in far smaller companies have given Chinese investors either outright ownership, in the case of Pizza Express, or a controlling interest, in the case of House of Fraser, Weetabix and Sunseeker yachts.

These charts are not exhaustive, and do not include some property investments. You can download the full data from the American Enterprise Institute, external.

- Published18 October 2015

- Published19 October 2015

- Published19 October 2015