HMRC still failing taxpayers, say MPs

- Published

HM Revenue and Customs (HMRC) is still failing UK taxpayers, a group of MPs has said.

It accused HMRC of only answering half the phone calls to its customer care centre, and not carrying out enough prosecutions.

Members of the Public Accounts Committee (PAC) said, external customer service was so bad that it could be affecting tax collection.

HMRC denied that, and said it had now recruited 3,000 more staff to help.

In 2011-12, HMRC answered 74% of calls from the public, but by the start of 2015, it only answered 50% of them, the MPs said.

Meg Hillier, chair of the PAC, said HMRC must "rapidly improve its customer service, previously described by the PAC as abysmal and now even worse".

'On hold'

The committee said HMRC was only answering 39% of phone calls within five minutes, against a target of 80%.

Adam Vooght, from Surrey, told the BBC that he was left hanging on the line for well over an hour.

"The automated message stated that the queue could be up to 30 minutes, but the reality was an incredible 1 hour 20 minutes before I could explain my problem to someone," he said.

"Unbelievably, the operator's response was to ask whether he could put me on hold."

Hidden in Switzerland

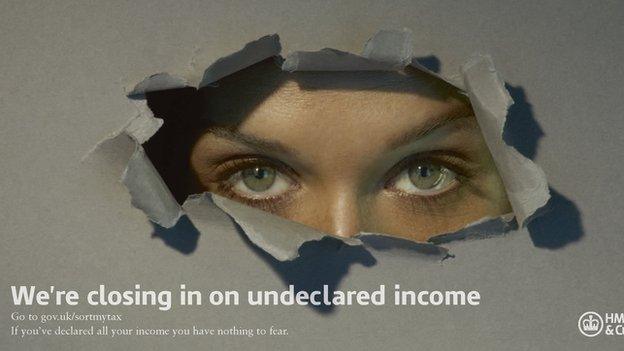

The PAC described HMRC's record of 11 prosecutions for offshore tax evasion in the past five years as "woefully inadequate".

Despite being handed a list of 3,600 British people who hid money in Switzerland, the tax collectors have prosecuted just one person involved.

Instead, the tax collectors have offered reduced penalties to people who come forward with information about money they have hidden overseas, something the committee said was no substitute for the "deterrent effect" of prosecution.

It said wealthy people who hide money offshore needed to be dealt with "robustly".

The MPs said HMRC had also ignored some of their previous recommendations.

Analysis: Jonty Bloom, BBC business reporter

The PAC believes that we have the worst of both worlds when it comes to our tax system.

Honest, hard working people who want to pay their taxes can't get through to HMRC because phone calls aren't answered, while tax evaders aren't even prosecuted when they are caught.

HMRC says that its customer services will improve as it recruits more people but the second point is more of an intellectual disagreement.

MPs want to see people prosecuted to deter future tax dodgers, but HMRC says that is an extremely expensive and an uncertain way of raising money as they might lose the case.

Instead the tax office says it collects more by encouraging people to admit their crimes and pay their taxes with fines on top.

Record revenues

In response, HMRC pointed to its record results and said the gap between tax due and tax collected had been reduced to one of the lowest in the world.

"We are disappointed that the Public Accounts Committee has overlooked HMRC's record results, which include collecting a record £517bn in tax revenues," an HMRC spokesperson said.

The PCS union blamed the problem on 11,000 full-time equivalent posts being cut since 2010.

"It has been abundantly clear for years that the department has cut too many staff and that services are suffering," said PCS general secretary Mark Serwotka.

"The department needs major investment backed by a real political commitment to tackle tax evasion and avoidance as an alternative to more damaging spending cuts."

- Published9 September 2015

- Published26 June 2015

- Published19 May 2015

- Published26 March 2015

- Published2 January 2015

- Published1 January 2015

- Published18 November 2014