Whither markets? Ask Carney

- Published

- comments

Most of us think financial markets will become ever bigger relative to our economy and really matter. But we have lost confidence that they work in our interest.

Such is the unsurprising result of a Bank of England survey, which forms the background to the Open Forum it is holding today in London, Birmingham and Edinburgh, and which also involves 300 schools.

In seeking the views of the public, us, on how to make financial markets sounder, the Bank of England is breaking its secretive, inward-looking habits of 300 years.

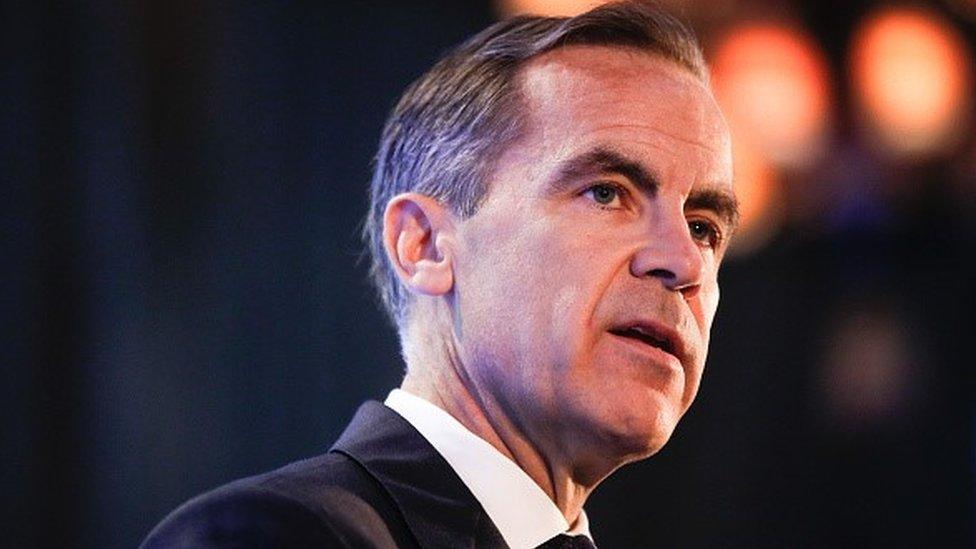

So I asked the governor of the Bank of England, in an interview you can watch here, external, whether this openness is a one-off or what he hopes will be a cultural revolution.

As for when and how markets will become our faithful, useful servants, rather than our wealth-destroying masters, Mark Carney conceded there is a troubling bubble in the UK's property market, which the Bank is monitoring lest it become worryingly pumped up.

And he did not demur when I pointed out that this bubble is partly the result of the Bank's and other central banks' evasive actions after the 2008 financial crisis, the slashing of interest rates to almost zero and the creation of billions of dollars and pounds of new money through quantitative easing.

So hope for our confidence in financial markets when official cure is as dangerous - well almost - as disease?