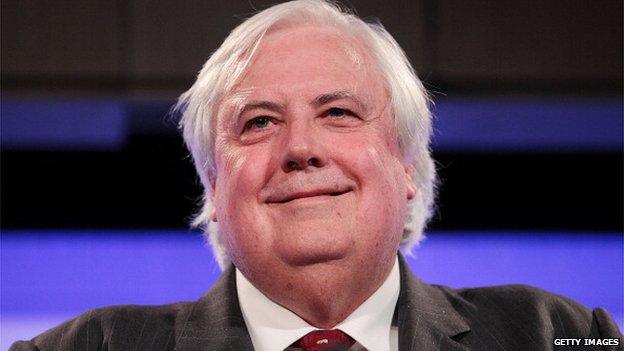

Australian tycoon Clive Palmer seeks support to save nickel plant

- Published

Australian billionaire Clive Palmer made headlines in 2012 when he announced that he was building a replica of the Titanic

Australian mining tycoon Clive Palmer is seeking government support after a bid for money from a Chinese conglomerate was rejected.

Mr Palmer, who is also a politician, lost a court bid on Monday for a $48m (£32m) advance on disputed royalties from subsidiaries of Citic Ltd over an iron ore project.

He wanted to use that money to save his unrelated and troubled nickel business.

Queensland Nickel is one of Australia's biggest nickel refineries.

"I call on the Premier and the Treasurer to clear their diaries for urgent talks on these matters, for the sake of more than 2,000 local jobs," Queensland Nickel managing director Clive Mensink, who is also Mr Palmer's nephew, said in a statement to Reuters.

But local media reported that up to 800 jobs could be at risk.

Battle with Citic

Concerns over the refinery plant surfaced in October when Mr Palmer met with the state government, but at the time, he denied he was looking for a loan.

A spokesman for the Queensland Treasurer Curtis Pitt told Reuters news agency that the government was already asking for a meeting with Mr Palmer over the future of the refinery and had created an independent commission to investigate the matter.

Gaining access to financial and other records would be part of the talks on Tuesday, he said.

Meanwhile, in Monday's supreme court decision in Western Australia, Judge Paul Allan Tottle said the financial state of Mr Palmer's nickel business was a factor in the rejection for money from Citic.

"I am not satisfied on the evidence ... that the stark alternatives, namely grant the injunction or let Queensland Nickel suffer dire consequences, reflect an assessment of all options that one would expect to be considered when a major business is experiencing financial difficulties," he wrote in his decision.

Mr Palmer's company Mineralogy wanted to use an advance on royalties from Citic to save his unrelated Queensland Nickel business.

Subsidiaries of Chinese state-owned conglomerate Citic bought the rights to its Sino Iron project from Mineralogy for $415m in 2006 and agreed to pay royalties after production had started.

However, the two firms have been in legal battles over the amount that is to be paid. The Chinese firm said it is paying royalties for one agreement, while a second one is in dispute.

During the court case, Citic's lawyers questioned how the company could request payment from a long-running legal dispute and use it for another business.

- Published4 March 2015

- Published19 December 2014

- Published25 November 2015

- Published16 September 2015