Not for sale yet: Yahoo suspends Alibaba spin-off

- Published

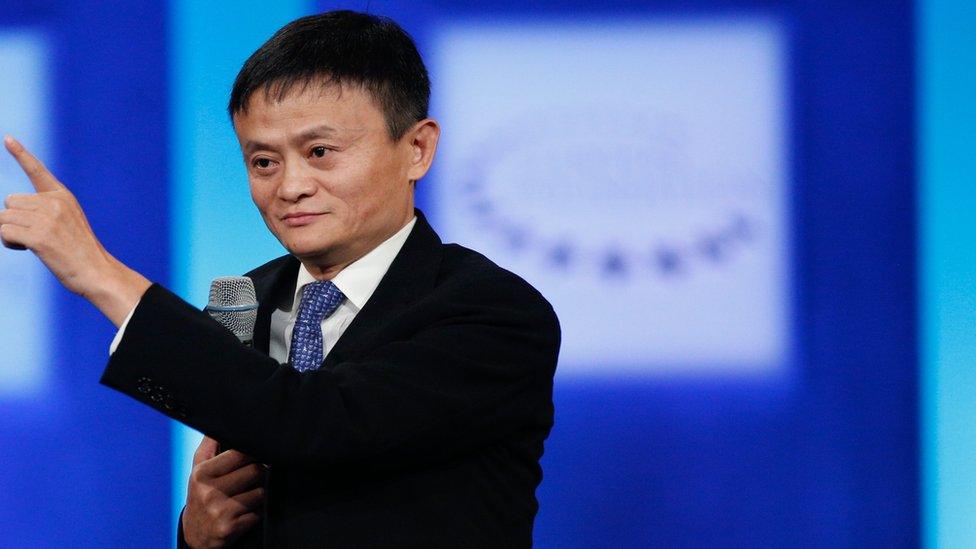

Yahoo had announced plans to spin-off its $30bn stake in Alibaba back in January

After days of humming and hawing over whether it would sell Alibaba, Yahoo came out with a decision that most people had been saying made sense from the start: hold on to the only really valuable part of its business.

The media world had been abuzz with rumours about what Yahoo will or won't sell ever since the board convened its annual general meeting last week.

And now it appears that its 15% stake in China's e-commerce firm, the Alibaba Group - which is worth some $30bn - is no longer on the block. Well, at least not for now.

Tax implications are deemed to be behind the about-face on the decision.

It seems that spinning Alibaba off would cost Yahoo more in tax - about $10-12bn - then selling another part of its business.

Think about what that means for a second.

It means the tax Yahoo would have to pay on an Alibaba sale is worth more than another part of its core business. It's clear the Chinese e-commerce firm is still the most valuable part of Yahoo.

So selling Alibaba - Ms Mayer's brainwave - doesn't make much sense, at least when you look at the figures. And that's what some of her most vocal and least supportive shareholders have been telling her.

Japanese stake

According to media reports, Yahoo has also been thinking about what to do with its stake in Yahoo Japan - of which it owns about 35%.

It is worth about $8.5bn at current exchange rates.

Now if you've done the maths, you'll have figured out that these numbers don't add up.

The reason this isn't reflected in Yahoo's final valuation is because of that mega tax bill we talked about earlier - from profits it's made in China and Japan - which would see around $10-13bn shaved off its value.

It's remarkable that a company that arguably defined the internet for people of a certain generation is today only able to stay afloat as a viable business by dodging a hefty tax bill.

Yahoo's trademark exclamation mark symbol was a sign of the enthusiasm in all things technology at the time.

But how the mighty fall.

Alibaba bought back 20% of its stake from Yahoo for $7.6bn in 2012

Yahoo is now seen as one of the laggards in the global tech industry, unable to keep up with nimbler and more modern entities such as Google and Facebook.

The company's new chief executive - the much criticised and scrutinised Marissa Mayer - was brought in primarily to bring her Google expertise to Yahoo and to revitalise the company three years ago.

But it's not been easy.

Ms Mayer has attempted to freshen up Yahoo - making acquisitions, adding services for mobile phones and smart devices, and also creating new tools for digital advertising - but so far, these measures don't appear to be working.

Although Yahoo sites are amongst the most visited in the world, it has lost advertising space on mobile, while its rivals have been forging ahead.

But don't write Yahoo off just yet. Even though revenues and profits have been falling, it still has a global audience of more than 600 million - behind only Google, Microsoft and Facebook.

Many of these users are in fast-growing emerging markets in Asia, such as Indonesia.

So one strategy could be to sell off the core internet arm of Yahoo - while keeping Alibaba, so as to avoid paying a huge tax bill.

But what would Yahoo be without its internet business? Just a shell company, and a far cry from the firm it first set out to be.

- Published28 January 2015

- Published21 April 2015

- Published23 November 2015