The big Christmas giveaway: Are shops discounting too early?

- Published

- comments

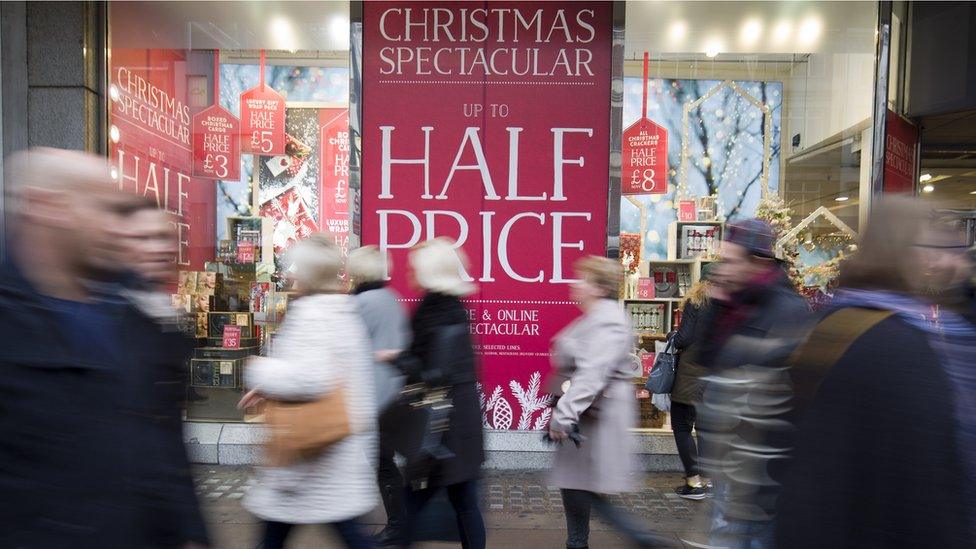

Some 70% of companies are already running a price promotion, according to veteran retail expert Richard Hyman

There are just a few days to go until Christmas Day and the festive shopping spree is in full swing. Many analysts are predicting the best ever sales for retailers this season.

In contrast, some are warning the fact that so many shops have started their sales - well ahead of the traditional Boxing Day sell-off - bodes ill for the sector's performance.

Could 2015 turn out to be the worst ever festive season for retailers?

We ask the experts.

Is the traditional Boxing Day sale becoming a thing of the past?

The pessimist

Richard Hyman, veteran retail industry expert:

The discounting this year is unprecedented. I've never seen anything like this and I've been working in the industry for 35 years.

Retailers across every sector of the industry have spent the last year teaching customers to only buy on sale. UK retail now has too many companies, with too many stores and too many websites, chasing too few customers.

An excess of supply over demand is forcing the majority of the industry to resort to price cutting in order to put money in the tills. And the message to shoppers is clear - if you see something you like, wait for the next promotion when it will be cheaper.

Right now, 70% of companies are running a price promotion. Clearly, the majority of retailers feel that they cannot entice shoppers to spend without offering the price drug as an incentive.

When most of the market is discounting, it tells you that they are doing it by default not by design. It suggests spending is so weak that sales are not coming through in the way retailers need and they have to turn stock into cash.

What we're seeing now is a structural change in retail indicating a growing excess of supply over demand.

Pre-Christmas sales have become the new normal. The problem is the new normal of having your margins cut and brand integrity damaged is neither healthy nor sustainable.

Next year we will see the beginnings of a serious shake out. It will take several years for an effective reset of supply and demand to get to a more viable status quo.

"It's all to do with the weather," says John Lewis boss Andy Street

The retailer

Andy Street, John Lewis managing director:

I understand where the comments about discounting come from, but it's very simple that it's all to do with the weather. It's been an extremely mild Autumn and that has led fashion retailers to reduce their price. But there's no surprise there, that's ever been thus.

I think it's actually a more stable position than the commentators are calling and, to be honest, we've got to wait to see the whole period through right to the end of clearance.

There's still a few days left before Christmas. We've always said this was about three peaks: Black Friday, Christmas and then clearance. John Lewis has not discounted any of its home products in the run up to clearance. It's still a big period for us and it's only when you've gone through all of that, that you can genuinely tell the profitability of Christmas.

If anything Black Friday was less of a spike than it's been in the past and it's spread out more evenly. But we will really need to see the full period even into January and clearance to really see how retail has done in total.

Consumers are feeling a little better than last year. The stats are clear they have definitely got a little more money than last year, but it is proving hard for retailers to continue to take the same share of that spending.

We are going to see a huge range of performances, and as online takes an ever greater share, those retailers who've worked out how the bricks and clicks come together will be the winners this Christmas.

"The majority of retailers feel that they cannot entice shoppers to spend without offering the price drug as an incentive," says Richard Hyman

The optimist

Richard Perks, director of retail research at market research firm Mintel:

So far in the run up to this Christmas, there has been less discounting than last year.

First of all, there was less in November - the lesson of 2014 was that Black Friday was damaging to the retail sector - it took cash away from full priced gift sales and put it into low margin special purchase merchandise.

So the strategy this year has been one of damage limitation. Asda pulled out altogether and it looks as if other retailers cut back on discounting where they could. People held off buying ahead of Black Friday, but were disappointed by the offers and ended up spending less on them than last year.

The result was lower sales in November than one would have expected. That means that there was pent up spending power heading into December.and much less need for discounting.

So what we have seen so far is the sort of things one might expect to see discounted now, products such as party wear, which need to be cleared now anyway, or coats which have sold badly because of the warm weather.

Retailers who have too much stock, probably because sales so far have been below expectations, are also doing promotions. Gap and FCUK are obvious examples, but M&S is clearly doing badly as well.

The aim in December should be to maximise sales at full price and the retailers with the best retail disciplines - such as Next and Zara - are doing just that.

Conlumino says shops hope Christmas will see the surge in demand that didn't happen on Black Friday

Greg Bromley, analyst at research firm Conlumino:

We expect total retail spending on Christmas to hit £16bn this year - up 1.3% on 2014 and up 2.6% on 2013.

We didn't see the sudden surge of Black Friday sales we expected, so retailers are hoping that pent-up demand from shoppers will now start to be released.

It might be more of a volume driven Christmas so rather than spending more, people are buying slightly more gifts for people and getting more for their money especially in food.

I don't think we've seen too much discounting yet, but we may see discounts start to increase in the days immediately before Christmas. The next few days will be crucial for retailers.