How should you set executive pay?

- Published

Research suggesting the chief executives of Britain's largest companies will have earned more by the end of Tuesday, than most of us earn in a year, may boil down to something of an accounting gimmick from the High Pay Centre, external, but it has touched a nerve.

Many people have taken to social media to complain that executives are being overpaid.

And it's not that hard to see why. The High Pay Centre's research suggests the average FTSE 100 chief executive is paid £4.96m a year.

According to Tim Bush, from Pensions & Investment Research Consultants (Pirc),, external that's 180 times more than the average UK employee earns in a year.

But how do you decide how much a chief executive deserves or needs to be paid?

There is plenty of evidence that the public perception of executive pay is that it is still way above where it should be.

Just last month, the Chartered Institute of Personnel and Development (CIPD), external published research that suggested more than half of UK employees believed high levels of chief executive pay demotivated them at work and was bad for the reputation of UK firms.

Market rates

The most popular justification for high pay has always been the need to pay a competitive rate to get the best in the business.

So, most FTSE 100 companies will benchmark the basic salary of their chief executive against the basic pay of other executives within the same industry.

But it is not always obvious which companies are directly comparable, which means benchmarking is not a straightforward job.

Executives' basic salaries can range between £500,000 and £1.5m. But it is through the top-ups, or long-term incentives and bonuses that company bosses make their real money.

Executives in the oil industry tend to be the best paid even compared with bosses in the banking sector, according to Oliver Parry, senior corporate governance adviser at the Institute of Directors (IOD)., external

Tim Bush from Pirc says remuneration committees can be open to a certain amount of manipulation.

As long as there is only a handful of people perceived as qualified to do a job, he suggests, it is quite easy to keep salaries elevated.

The tendency of remuneration committees to rely heavily on headhunters also helps ensure that many listed companies hire senior executives from a small pool of individuals.

The only way to address the problem, according to Pirc, is "open advertising" of senior roles, something it is very keen to see more of at board level.

Shareholder alignment

Another trend is trying to align the interests of directors with the interest of shareholders, which Mr Bush says is "superficially compelling but, in detail, isn't".

The idea is that if you link pay and bonuses to the company's share price, the executive will put his or her shoulder to the wheel.

The problem, says Mr Bush, is that directors are taking little, or no, risk, as they aren't investing their own money.

More importantly, it often works as a one-way bet, he says. If the share price rises the boss benefits too.

But in bad times there is a trend to try to decouple pay and the share price, which Mr Bush suggests is "CEOs wanting to have it both ways".

He says the oil industry has been among the first to develop this "fair-weather element" to pay.

While the oil price was high, he says, executives tended to stay quiet, but now the market has turned and the oil price fallen by two thirds, Mr Bush says there is some evidence of directors wanting to move away from shareholder alignment.

Shareholder power

Chief executives of publicly-listed companies now face greater scrutiny than ever before.

Firms, for example, are now obliged by law to publish a single remuneration figure for their chief executive in their annual reports.

"What that means is that a shareholder should be able to go to a page in the company's annual report and see how much the CEO gets paid as a basic salary, cash bonus, pension and shares and how much in total that came to," says Mr Parry of the IOD.

And shareholders can now vote down the pay packages of chief executives, though this has, by Mr Parry's own admission, been a bit hit and miss up to now, there have been cases where it's had bite.

Christopher Bailey, the chief executive of fashion retailer Burberry, found his pay package of £1.1m plus £440,000 cash allowance and shares award worth £15m, became the subject of a shareholder revolt in 2014 - although the shareholder vote was non-binding and his pay package was voted through in the end - with 52% of shareholders voting against Burberry's remuneration policy that year.

And in December 2014, oil and gas giant BG Group revised a proposed pay package for its incoming chief executive, Helge Lund, after a shareholder revolt over his £12m upfront shares bonus.

Mr Parry thinks institutional shareholders will start to exercise these kinds of powers more on behalf of the people they represent, which is most of us who have a private pension.

And he argues the changes that have already been introduced, together with shareholders flexing a bit more muscle, should be sufficient to keep excessive pay in check.

Do more

For some, this doesn't go far enough. Prem Sikka, professor of accounting at the University of Essex, believes a wider group of people should have a say on pay, not just directors on "remuneration committees" or shareholders, but others who have a different kind of stake in the company.

"We know we live in a world where profit matters, but the weight to which we attach profit could be diluted.

"Get employees and customers to vote on executive remuneration. If they are treating people well, all well and good."

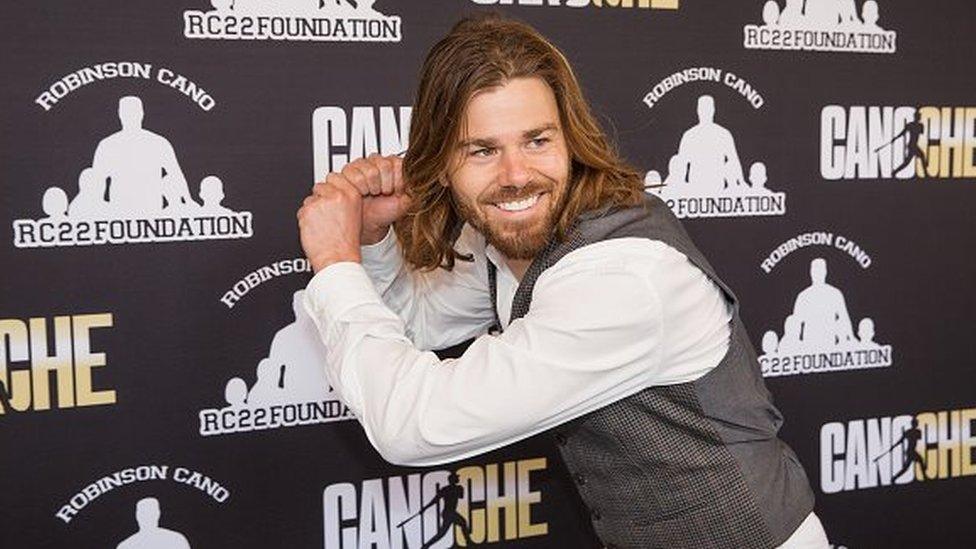

Take a pay cut: In 2015, technology boss Dan Price, took a 90% pay cut to boost the salaries of his own staff

Let the CEO decide?

Of course, there are alternatives.

For US technology entrepreneur Dan Price, it was a simply conversation with one of his employees that convinced him to announce in April 2015 that he was slashing his $1.1m annual salary by 90% to help pay for an increase to the average annual salary of his staff to $70,000. It made international headlines.

It won him a great deal of applause from his colleagues and morale is reportedly high.

The day a FTSE 100 chief executive follows his example, that will be big news.

- Published5 January 2016

- Published11 July 2014

- Published1 December 2014

- Published28 October 2015