M&S fashion: Why does it miss the mark?

- Published

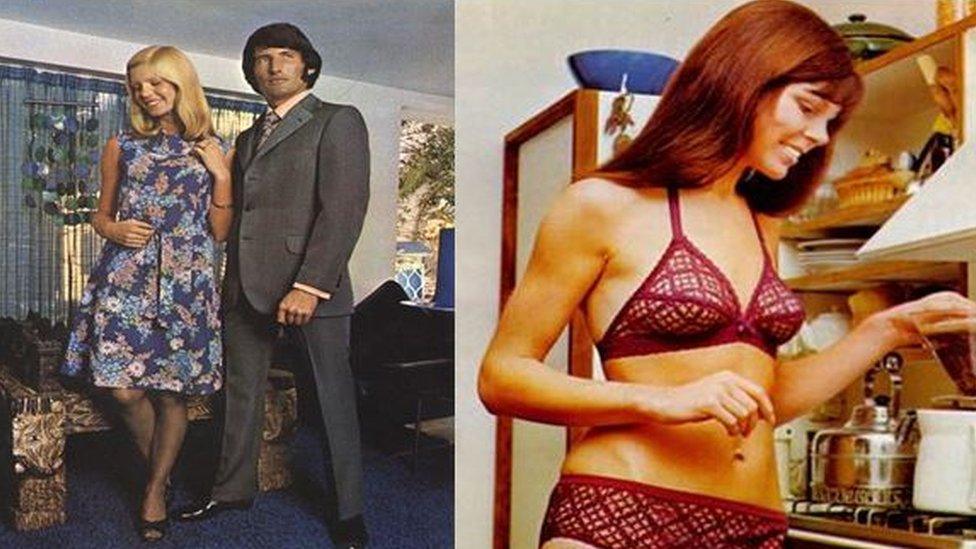

The 70s saw the introduction of the suit department at M&S menswear while the 'Scanlace' bra became a bestselling item

From the beginning, when Marks and Spencer sold its first bra in 1926, the brand became a byword for British-made quality goods.

Shoppers fell in love with 'easy-care' fabric dresses in the 1950s and 60s and with its tailoring and knitwear in the 70s and 80s.

The customer was always right, and they got what they wanted - quality everyday wear.

A renewed focus on design in the 1990s saw the retailer scale new heights. Its clothing even graced the front cover of Vogue magazine. Supermodel Amber Valetta was featured wearing a £21 M&S polyester shirt.

And with acclaim from the fashion press came bumper sales. Marks and Spencer's profits peaked in 1997 and 1998, topping £1bn.

But after the magic and sparkle, and despite the launch of a range of sub-brands like Per Una and Autograph - aimed at a more fashion-focused shopper - fortunes began to change for Britain's biggest clothing retailer, and the love affair began to chill.

The retailer used a host of celebrities to endorse its fashion ranges including actress Dame Helen Mirren and artist Tracey Emin

Sali Hughes, a beauty and fashion journalist, says the retailer lost its crown producing high quality pieces that are key to a woman's wardrobe.

"Marks and Spencer should be about beautiful basics. They used to be really brilliant for quality knitwear, tailoring and good hosiery and underwear. I could go there and know I could buy a white t-shirt that wasn't too short or a plain cashmere jumper that was well made.

"Now it seems the designs are terrible, the sizing is all strange and the styles are badly cut. There are also far more retailers on the high street and it's easier to go somewhere else."

In 2008, M&S splashed out £31m on advertising and profits peaked again, topping £1bn. They have steadily fallen since.

When Alexa Chung wore this Marks and Spencer skirt it caused a buying frenzy

Glimmers of fashion hope

Not even the slew of celebrity endorsements from the likes of model Twiggy and actress Dame Helen Mirren have been enough to raise womenswear sales.

But there have been some glimmers of hope. Fashionistas went mad for the mid-length suede skirt from M&S after it was worn by fashion celebrity Alexa Chung.

In 2015, the skirt was credited with helping to "jump start, external" the first profit rise for four years but not everyone was convinced.

The Guardian's Hadley Freeman, external claimed the skirt represented "a triumph of M&S PR over actual fashion for women".

For the past five years, clothing sales have been in an inexorable decline, but apart from the fashion what else is to blame?

Was it the weather? Marks and Spencer said its recent 5.8% drop in general merchandise sales - which include clothes - was due to "unseasonal conditions and availability".

It also claimed the weather was a factor in January 2015, when it said its 14th consecutive quarterly drop in clothing sales was down to unseasonal autumn weather.

Bitten from both ends

However, retail analyst Nick Bubb said: "You can't make excuses about the weather every year."

He says that one of the main problems has been that the retailer has been besieged, and bitten from both ends.

Discounters and budget chains have been taking market share from M&S at the lower end. Brands like Zara and H&M are taking a chunk out of the middle end of the market, while John Lewis has stolen a march on M&S at the higher end.

In 2013 top model Rosie Huntington-Whiteley launched a lingerie and nightwear range for M&S

"If you want to be all things to all men - and all women - it's going to be an impossible task," he said.

M&S also has problems competing with certain chains on price versus quality. Barclays Capital analyst Christodoulos Chaviaras said the quality of M&S clothes is good, but people can get better value for money elsewhere.

The firm's focus on full price items while other retailers have discounted, also played a part in M&S's negative sales, he said.

And Mr Bubb says that Marks and Spencer has failed to keep up with the Joneses online - which is now the key battleground for retailers.

John Lewis started investing in online sales more than ten years ago, he says, and Marks and Spencer has been playing catch-up.

"Marks and Spencer has too high a share of a declining market - offline retailing - and too low a share of the online market."

Senior management must also examine its conscience, he adds.

"They [the board] have taken the decisions on branding and marketing, and they've been very late to the party [with online]," he said.

Making a comeback?

Many yearn for the retailer to succeed again, so what can M&S do?

Kirsty McGregor from fashion industry publication Drapers says: "There has been a good response to the last few seasons from the fashion press... what we're not really seeing is these styles and sizing options in the regional stores and customers find that quite frustrating."

Retail analyst Tony Shiret adds: "They need to decide where the gaps in their coverage are, improve the quality of their classic staple lines and continue to make progress with the fashion."

But be warned M&S, there is a troubling rival also striving for the title of national treasure.

"Unfortunately for them [M&S] John Lewis has stolen the crown as the retailer that everyone loves and trusts," Sali Hughes said. "They have become the well loved and dependable aunty on the high street.

"I don't think this is the end for M&S, they can turn it around. They just have to get back to what they were really good at."

- Published7 January 2016

- Published4 November 2015

- Published20 May 2015