'Bowie bonds' - the singer's financial innovation

- Published

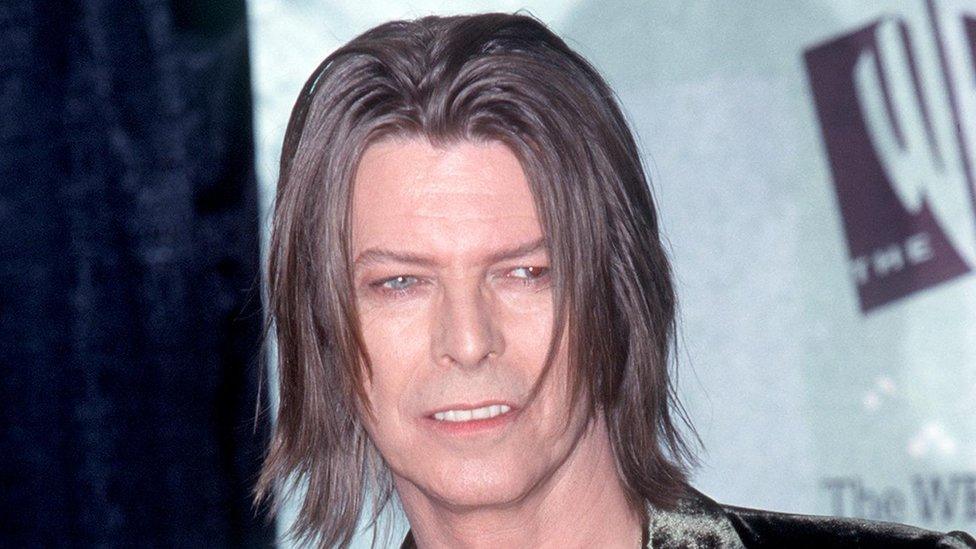

Bowie introduced the bonds in the late 1990s

David Bowie was a pop music icon to many, but how many people know he was also involved in innovation in the world of finance?

In the mid-1990s, David Bowie, his financial manager Bill Zysblat, and banker David Pullman came up with a new scheme to generate cash from Bowie's extensive back catalogue.

In 1997 Bowie sold asset-backed securities, dubbed "Bowie bonds", which awarded investors a share in his future royalties for 10 years.

The securities, which were bought by US insurance giant Prudential Financial for $55m (£38m), committed Mr Bowie to repay his new creditors out of future income, and gave a fixed annual return of 7.9%.

He struck a deal with record label EMI which allowed him to package up and sell bonds on royalties for 25 albums released between 1969 and 1990 - which included classics such as The Man Who Sold The World, Ziggy Stardust, and Heroes, according to the Financial Times, external.

Bowie used part of the $55m to buy out his former manager Tony DeFries, with whom he had split with in 1975, says music writer Paul Trynka.

Under pressure?

Mr Bowie's realisation in the 1970s that he didn't own all the rights to his catalogue - Mr DeFries reportedly owned up to 50%, on a sliding scale, in perpetuity, for music created up to a certain point - had caused Bowie to have a mental breakdown of sorts, Mr Trynka says.

"He had this psychological nose-dive - all this music he had suffered to create didn't [entirely] belong to him."

Mr Trynka says sources close to the deal suggested that the Bowie bonds allowed Mr Bowie to buy Mr DeFries out for more than $27m, but this amount has not been confirmed.

However the deal was split, it would have certainly helped Mr Bowie's finances.

The latest estimate of Bowie's net worth by the Sunday Times Rich List is £135m - putting him him joint 707th on the list, equal with pop star Robbie Williams, and Conservative Party co-treasurer Lord Lupton.

And that is before sales of Bowie's new album, Blackstar, which the Official Charts Company predicts will be number one on the album charts this week, external, and back catalogue sales following Bowie's death.

He sold around 150 million albums worldwide in his career, according to BPI stats.

Downgraded

The pioneering nature of Bowie bonds caught the imagination of all sorts of musicians.

Heavy metal monster Iron Maiden, funk and soul godfather James Brown, and Holland Dozier Holland, the song-writing team behind Motown records in the 1960s, were some of the artists to jump on the bandwagon, external.

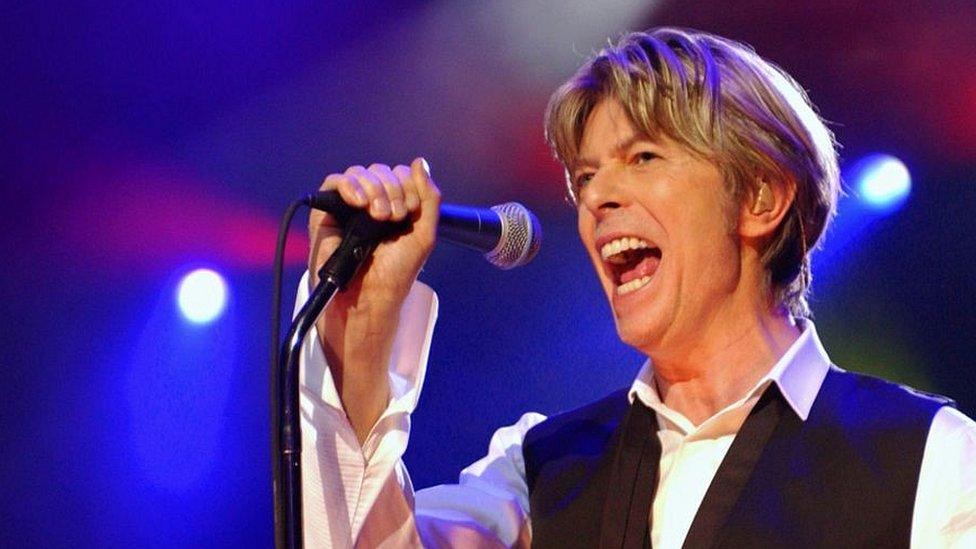

Other stars such as James Brown followed suit and sold their own bonds

But just as some albums are more successful than others, innovations in debt investment can also have mixed fortunes.

In 2004 rating agency Moody's Investors Services downgraded Bowie bonds, external to only one level above "junk", the lowest rating, after a downturn in the music industry.

Mr Bowie had himself predicted the decline in traditional music sales, telling the New York Times, external in 2002 that music would become "like running water or electricity".

However, the bonds "worked out well for everyone", according to music industry finance expert Cliff Dane.

"Due to the particular nature of the security - the quality of the relevant Bowie songs and recordings - and the time and the place, it made very good economic sense for the investors, and for the company organising it."

The model wasn't necessarily good for all asset-backed financing, Mr Dane says: "Think of the later bundling of sub-prime mortgages."

Bowie's innovation lay in using intellectual property to back securities, says financial writer Chris O'Leary, external.

He adds that banks were already starting to package up assets like mortgages into a new type of security in the 1970s.

But the innovation of using unorthodox assets to back securities is still going strong, according to Reuters writer Neil Unmack, who said Mr Bowie's financial legacy is "hunky dory".

"The wider field of esoteric asset-backed securities kick-started by the Thin White Duke has a genuine future," he says.

Sales of non-traditional asset-backed debt made up 11% of the total last year, he says.

"The risks are high: assets with little history are hard to model and vulnerable to sudden changes in regulation or government intervention.

"But enough of them will succeed for Bowie's financial oddity to stay in fashion," he adds.

- Published11 January 2016

- Published11 January 2016

- Published11 January 2016