Who were the 2015 Christmas winners and losers on the High Street?

- Published

Unseasonably warm winter weather, the inexorable rise of online shopping and consumer reluctance to pay full price has added up to a fairly dismal festive season for some retailers.

We take a look at some of the winners and losers on the UK high street this Christmas.

WINNERS

Tesco

UK's largest supermarket, Tesco, reported a rise in sales over Christmas. UK like-for-like sales were up 1.3% from a year earlier in the six weeks to 9 January. The upbeat results were welcomed in the City and are being seen as part of the turnaround promised by chief executive Dave Lewis, who took over in September 2014. However, the grocer still faces tough competition from discount chains, and it reported a 1.5% fall in sales for the 13 weeks ending 28 November.

John Lewis

Britain's biggest department store chain posted an impressive 5.1% rise in like-for-like sales in the six weeks to 2 January, with products in its technology category leading the field with a rise of 9.6%. Online sales were up more than a fifth and accounted for 40% of total sales. (Like-for-like sales, which measures performance at stores open for more than 12 months, is the measure preferred by analysts as it is the most accurate picture of a retailer's performance.)

Waitrose, its food retailing business, falls into the other category, however - see the Losers below.

WH Smith

Newsagents and stationary retailer, WH Smith, reported a 2% increase in like-for-like for the 20 weeks to 16 January. Sales at its travel arm, which has shops at airports, railways stations, motorway services, and hospitals jumped by 12%..

High Street stores reported a 2% rise in like-for-like sales during the five weeks to 2 January.

The business, which has been going for 224 years, said profits were boosted by the recent trend in colouring books for adults.

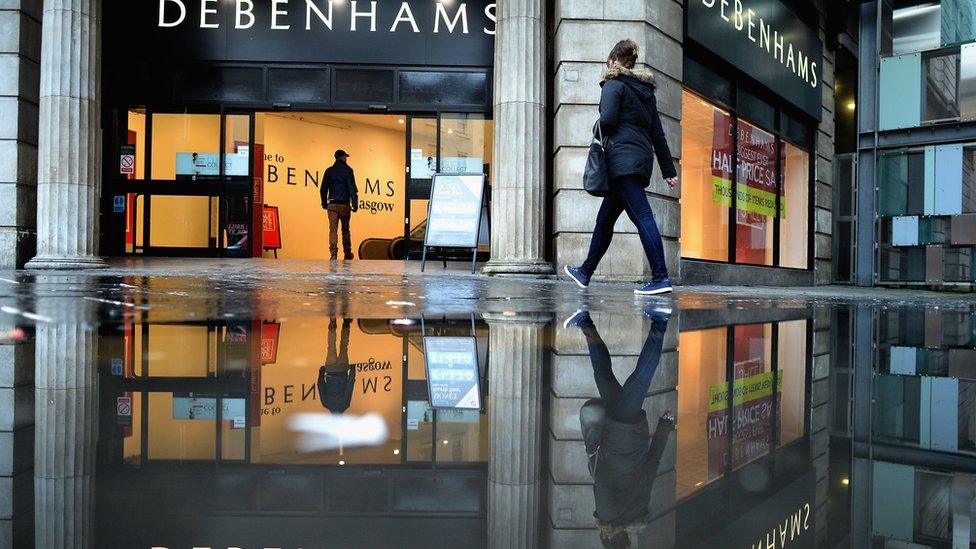

Debenhams

The department store had a reasonably good Christmas, with a 3.7% rise in like-for-like sales for the nine weeks to 9 January.

The retailer said it made fewer discounts and kept tight control of clothing stock, such as winter coats, to reflect the unseasonably warm winter.

House of Fraser

Like-for-like sales at the department store rose by 5.3% in the six weeks to 2 January, which chief executive Nigel Oddy said underlined its strategy of improving both stores and its online offering, and developing its in-house brands.

Morrisons

Britain's fourth-biggest supermarket reported better-than-expected sales, with like-for-like sales, excluding fuel, up 0.2% in the nine weeks to 3 January.

Analysts had expected a decline of as much as 3%, suggesting that its revival strategy is paying off.

JD Sports

The retailer said trading over the key Christmas period was "very positive", with like-for-like sales across all its sportswear brands up 10.6% in the five weeks to 2 January. As a result, it said underlying full-year profits could be up to 10% higher than current market expectations of £136m.

LOSERS

Marks & Spencer

Record food sales in the run-up to Christmas was not enough to save the high street stalwart, with like-for-likes falling 2.5% in the 13 weeks to 28 December.

Food was up 0.4% for the period, but general merchandise - which includes its clothing - sank by 5.8%.

Neil Saunders from retail consultants Conlumino commented: "It is timid and it is wedded to this kind of 'we have to be cheap, we have to be premium, we have to be all things to all people. Of course the result is it ends up being not very much to anybody."

The dismal results coincided with the departure of chief executive Marc Bolland after six years of trying to turn around the troubled retailer.

Next

The clothing retailer blamed the warm autumn and winter weather for its "disappointing" performance, with sales at its retail stores falling 0.5% between 26 October and 24 December.

However, they were up 2% at the Directory arm, which includes online, meaning that overall sales rose by 0.4% for the period.

Argos

The owners of Argos, Home Retail Group (HRG), said like-for-like sales at the retail chain fell 2.2% in the 18 weeks to 2 January.

HRG - which is a bid target for Sainsbury's - warned that its full-year results would be at the bottom end of City expectations.

Homebase, which is also part of Home Retail Group, did better and saw sales rise by 5%. HRG has said that it is in talks to sell Homebase to Australia's Wesfarmers for £340m.

Sports Direct

The retailer, owned by Mike Ashley, also blamed the weather for a "deterioration of trading conditions on the high street" in the run-up to Christmas, which it did not expect to change in the next few months.

The company also issued a profit warning, which sent shares tumbling by almost 15% on 8 January.

An investigation by the Guardian newspaper into conditions at Sports Direct's warehouse in Derbyshire has generated considerable negative publicity in recent weeks.

Jonathan Pritchard, an analyst at Peel Hunt, said that "some mud from press articles/documentaries may have stuck to the brand".

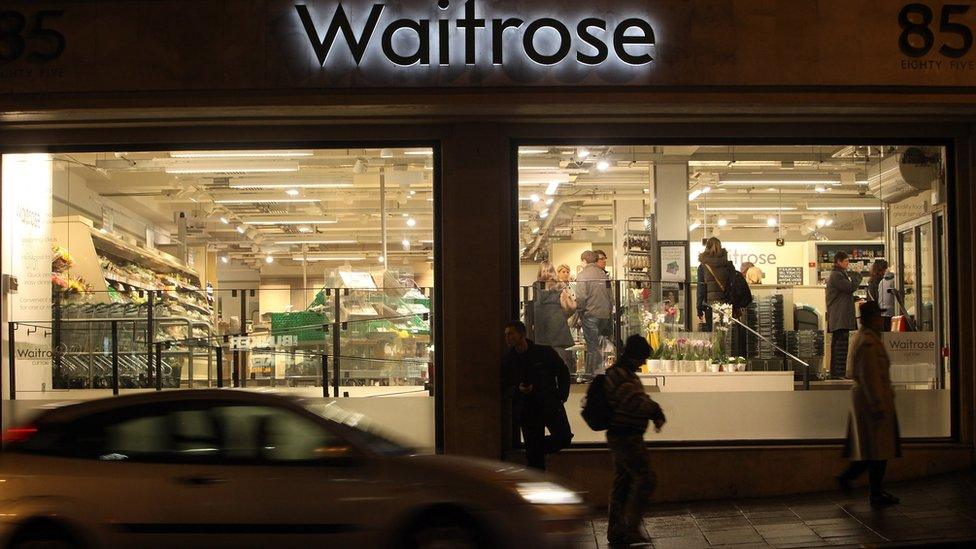

Waitrose

The supermarket that is part of the John Lewis Partnership had an unhappy festive season, with like-for-like sales falling by 1.4% in the six weeks to 2 January as intense competition in the grocery market hit hard.

Sainsbury's

Sainsbury's reported a 0.4% fall in like-for-like sales, excluding fuel, in the three months to 9 January compared with the same period last year.

However, the figure was better than some analysts had expected and was an improvement on the decline for the previous two quarters.

Himanshu Pal, a Kantar Worldpanel analyst, said the supermarket had done "quite well" over the Christmas period: "Sainsbury's is making the right moves in simplifying its pricing and strategy and reducing multi-buy offers."

Primark

Clothing retailer Primark's sales were hit by Europe's unusually warm weather over the Christmas period.

During the nine weeks to 2 January like-for-like sales were weaker, compared to the previous year, as it sold fewer coats, hats, scarves and thermal clothes.

However, parent company Associated British Foods said that in the 16 weeks to 2 January Primark's total sales rose by 3%.