US shares close higher but Europe loses ground

- Published

US stocks have closed higher, but European markets have continued to suffer from worries over oil prices and economic growth.

The three main US indexes all gained between 1.4% and 2%, lifted in part by a 2% rise in the US oil price.

Earlier in London, the FTSE 100 closed 0.7% down, while the main Frankfurt and Paris indexes fell 1.7% and 1.8% respectively.

Those falls followed a heavy sell-off in some Asian markets.

The pound hovered close to five-and-half-year lows against the dollar.

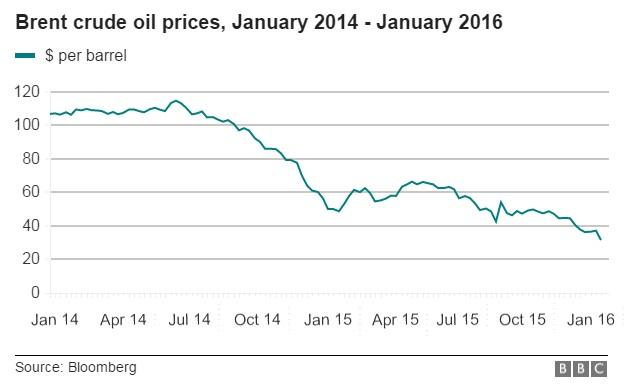

Alongside the rise in the price of US West Texas Intermediate crude, Brent oil also rose in afternoon trading. The price was up 2.5% to $31.03 a barrel, having briefly drifted below $30 on Wednesday.

The falls in European shares followed overnight losses in Asia. Japan's Nikkei index closed down 2.7%, having dropped more than 4% at one point.

Hong Kong's Hang Seng eased off two-and-a-half-year lows to finish down 0.6%. The Shanghai Composite, which has endured torrid trading in recent months, was one of the few bright spots, rebounding nearly 2%.

Oil slide

Investors were spooked by Wednesday sharp falls on Wall Street, when the Dow Jones and S&P 500 fell 2.2% and 2.5% respectively.

Joshua Mahony, market analyst at IG, said that fear may be masking some positive economic signs.

"The issue here is that before long people will forget why they are selling, but continue to sell simply due to the fear factor. Yesterday felt like the beginning of that.

"US crude inventories actually rose less than expected yesterday, which ordinarily would have been bullish for oil prices, yet once more the trend was the most important thing and everyone is looking for another reason to sell crude, which of course means the FTSE 100 in particular is dragged lower once more."

There are fears that the continuing low crude price reflects a slowdown in some economies and could weigh on growth in emerging markets, many of which rely on oil revenues.

On Wednesday, Russia's Prime Minister, Dmitry Medvedev, warned tumbling oil prices could force his country to revise its 2016 budget.

He said that the country must be prepared for a "worst-case" economic scenario if the price continued to fall.

Analysts at Cenkos Natural Resources said: "With no apparent signs of strengthening demand, and only further indicators of future global supply growth, the outlook for oil prices is leading most market watchers to ratchet down estimates for oil prices in 2016 and 2017."

Oil and gas projects worth $380bn have been postponed or cancelled since 2014 as companies slash costs to survive the oil price crash, including $170bn of projects planned between 2016 and 2020, according to a report from energy consultancy Wood Mackenzie.

- Published13 January 2016