Shares sell-off by sovereign wealth funds hurting markets

- Published

When the price of crude was riding high at about $120 a barrel, oil-rich countries seemed to have plenty of cash to go around.

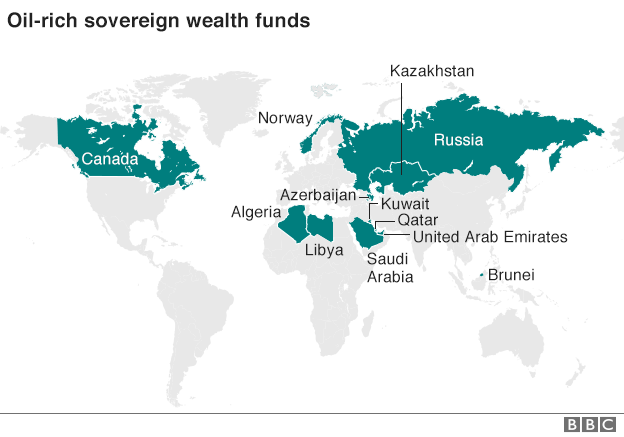

Money was invested in shares and other assets around the world, not just by individuals, but by the sovereign wealth funds (SWFs).

But with the oil price sinking to around a 12-year low, there are signs that SWFs are having to dump assets to raise money. And that is exacerbating the turmoil on world markets.

SWFs are a bit like a savings account for a country, with money put aside for a rainy day. The money was spent buying shares, currencies, property or other assets.

But with oil hovering around $28 a barrel, it seems that day has arrived. There appears to be a fire sale of assets going on quietly in the markets.

It hasn't been a good start to the year for the financial world. There has been lots of selling, and when you have too much of something, naturally the price gets cheaper.

At the same time, China's economy is not growing as much as it used to. But the other major factor has been discreet selling by those who need cash quickly.

In particular, this means oil-rich countries which are finding shortfalls in their national coffers because the sale of their oil is not bringing in as much cash as it used to.

It is difficult to put an exact value on the assets held by sovereign wealth funds of oil-producing countries. The vast majority of them don't publicly say what assets they hold.

However, the general estimate of the worth of the top 26 SWFs has been put at about $4.5 trillion (£3.2 trillion).

According to eVestment, the data provider, at least $19bn was withdrawn by state institutions (or SWFs) during the third quarter of 2015. And that trend is set to continue this year.

These countries, relatively rich because of their natural resources, still have bills to meet and services to deliver.

And for countries such as Russia, which are facing a double whammy of sanctions and a recession, the most important thing is to get their hands on any cash they can. So that means selling their investments.

A similar picture is emerging from the oil-rich Gulf states. Saudi Arabia has just had to adjust its spending. In its last budget, it raised the price of water and electricity for households.

Falling prices

The danger for the sovereign wealth funds is deciding when and how much of their investment to sell.

If prices continue to fall, they might be forced to liquidate, which, as any market trader will tell you, is much worse than selling when you want to. Forced sellers could flood the markets - and that may trigger a crisis.

Simon French, chief economist at stockbrokers Panmure Gordon, said: "The current weakness in equity markets is the second wave of the commodity rout. First, it was the valuations of the miners and oil and gas majors being marked down.

"This second wave is being led by the governments of countries dependent on commodity revenues. They built up equity portfolios in the good times and are raiding these 'rainy day funds' to balance their 2016 budgets."

It is believed that Blackrock, Aberdeen Asset Management and JP Morgan are among some of the financial institutions that have seen outflows from sovereign funds last year.

Bad investment

Some of the SWFs have made poor investment decisions and consequently, their worth has fallen.

Qatar was one of the biggest investors in Volkswagen, and since the emissions scandal, the German car company's share price has fallen substantially.

Ratings agency Moody's has carried out its own report, called Sovereign Wealth Funds: Sizeable Assets Provide Important Fiscal Buffers Against Lower Oil Revenues.

The agency says 73% of sovereign wealth fund assets globally are funded from oil and gas export revenues.

Elena Duggar, author of the report, said: "As oil prices remain lower for longer, fiscal and current account balances of oil exporters will be under increasing pressure. As a result, we expect increasing use of sovereign wealth fund assets to finance budget deficits and support domestic economies."

The sell-off has been relatively controlled for the time being. But if the price of oil remains low, the sell-off will intensify and start hitting sectors such as banking.

And that looks pretty grim for the rest of us, as it's our pensions and savings that are invested in those shares.

A crisis of sorts is brewing.

- Published20 January 2016

- Published19 January 2016