BP boss: Oil price will rise

- Published

- comments

The boss of BP has predicted that the oil price will rise in the second half of the year as demand increases from America and China and supply begins to ease as the US shuts down production.

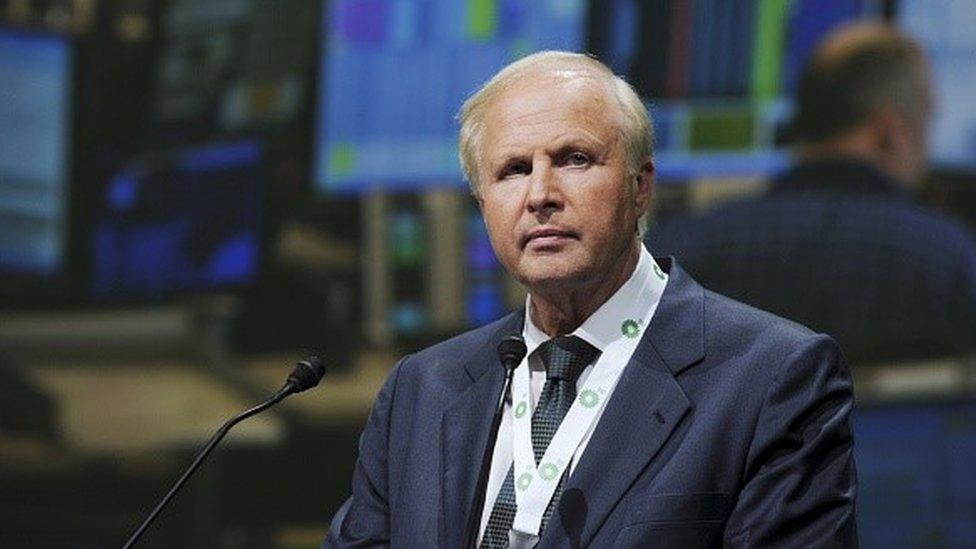

As the oil price fell to new 12-year-lows today, Bob Dudley said it would be a year of two halves, with lots of volatility in the first six months when the oil price could still spike downwards.

He said it was "not impossible" that the price could fall as low as $10 as some analysts are predicting but such a price would not be sustained.

"It has been low in the last year, I think it has been lower for longer but it is not lower forever," he told me.

"I think it's going to be a year of two halves.

"We could see some real volatility in the first quarter [and] second quarter.

"And then around April or May as the stock drawdowns [in preparation] for the summer driving season in the northern hemisphere, then I think that given the rise of demand in China and North America . . . in the second half of the year prices would start on an upward trajectory.

"We could see a price $30 to $40 by the middle of the year and I think towards the end of the year it could be into the $50s."

Mr Dudley's bullish assessment comes despite the International Energy Agency warning on Tuesday that the oil market "could drown in oversupply".

And oil prices have been falling again.

"This is a commodity cycle," Mr Dudley said. "Investment is being cut back across the world, that will have an effect down the road."

Mr Dudley said that oil could remain in "the low $20s" a barrel for a number of months and, despite rising towards the end of the year, would be unlikely to increase to $100 a barrel or more.

"The fundamentals of demand are definitely increasing, demand for gasoline in North America, Chinese demand, Indian demand, it's going up. And this [supply and demand] will get back into balance," he said.

'Hyper-competitive world'

Mr Dudley said that despite the lower oil price the North Sea was still viable economically and would be for decades to come.

"It's a particularly challenged area, it's a mature province in oil and gas globally, and the cost structure was challenged at $100 a barrel, and now we are at $28 - so you can imagine," Mr Dudley said.

"We are investing £8bn in the North Sea, large projects are underway today, they should come on stream 2016, 2017, 2018 to the West of Shetland.

"So we are deeply committed to the North Sea."

Bob Dudley said it is currently a "hyper competitive" world for oil and gas for investment

He said that although there might be further job losses, the majority had already been announced.

Turning to Iran, we touched on the fact that BP was once called the Anglo-Persian Oil Company and had major interests in Iran before being expelled in the 1950s.

I asked Mr Dudley if BP would be interested in investing in Iran again given the imminent lifting of some of the global sanctions on the country.

"We are watching carefully," he answered with a degree of caution given that US sanctions will remain in place.

"We have got to be very careful about that.

"The opportunities there have to be economic.

"It is a hyper-competitive world in oil and gas for investment right now - you have Iran, you have Mexico coming on stream.

"We'll have to choose very carefully.

"I don't think anyone will invest in Iran just because it is Iran. I think it has got to be an economic decision on the use of our very scarce capital."