Market turmoil: How does it affect me?

- Published

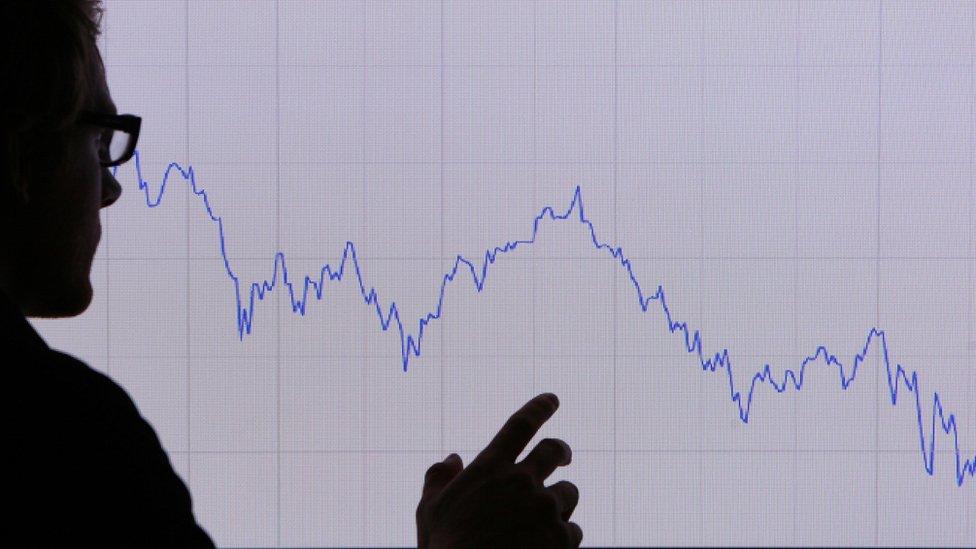

Experts tell us not to panic, but that's just what it looks like.

Slowing growth in China, collapsing oil prices, and now a bear market in shares all contribute to a scary scenario.

Despite the odd short-term respite, stock markets in the UK, France and Japan have now dipped by more than 20% since their peak in April last year.

The value of companies quoted on the FTSE 100 has fallen by no less than £396bn since then - that is, more than £6,000 per person in the UK.

"As markets globally enter bear territory, we have started to see panic creep into the market," says Adrian Lowcock, head of investing at AXA Wealth.

"This can cause investors to act irrationally and increase volatility in the short term."

So how much are ordinary people affected, and if you are affected, how much should you worry?

Pension funds

Even if you don't own shares directly, most workers in the UK now pay into an occupational pension scheme, thanks in part to the government's auto-enrolment programme.

Such schemes are mostly - but not totally - invested in shares.

The value of such schemes will have fallen significantly, and for those in defined contribution schemes, eventual pay-outs will look significantly smaller than they did nine months ago.

That will be a problem if you are about to retire and you need to use your pension fund to buy an income immediately.

If you can, experts advise holding off buying an annuity, for example, until share prices recover.

"You might be better served drawing an income from your fund in the short term, or looking to other savings," says Tom McPhail of Hargreaves Lansdown.

For example, Hargreaves Lansdown calculates that someone buying an annuity with a £50,000 fund would now get an annual income £433 lower than if they had bought it last April.

If you are some way off retirement, there may be no need to worry. Unless capitalism itself is under threat, markets will recover - eventually.

Those who still pay into a final-salary scheme will not be affected at all, as such schemes promise a particular annual income.

However, collapsing share prices could further threaten the viability of such schemes, should they persist. Members could be asked to increase their contributions as a result.

Star funds

In any case, many pension funds will not have been hit as badly as the FTSE 100, with its bias towards oil and mining companies.

The following areas have performed much better:

The US market: This has fallen about 10% since its peak - half the fall on the FTSE 100

The bond market: Funds investing in government or corporate bonds have only lost about 2% over the period

Individual funds: Neil Woodford's Equity Income Fund has fallen by just 3% since April; over the same time frame, Terry Smith's Fundsmith Equity, which invests heavily in US shares, has actually risen by 3%.

Cash: Many pension funds hold a proportion of your savings in cash, which will have held its value. Indeed, meagre returns of less than 1% on cash now look positively sparkling.

In other words, although most pension funds will have lost some of the value of your savings, many will not have lost as much as the headlines suggest.

Neil Woodford's fund has been among the best performers

China crisis?

Slowing growth in China, and fears that its currency has further to fall, constitute one reason for the current turmoil. There is good reason for that: China has been responsible for half the world's growth since the financial crisis.

Indeed, falling Chinese demand is one factor behind the collapsing oil price, which itself has hit the value of companies such as Shell and BP, in which so many pension funds are invested.

But some experts already think that the pessimism may have been overdone.

"For instance, the global economy is growing around 3%, and whilst China's economy - which is the focus of so much of the recent sell-offs - has slowed, there's still growth, strong consumption, and indeed the world's second-largest economy does look relatively stable," says Nigel Green, chief executive of the advisory De Vere Group.

As far as oil is concerned, Bob Dudley, the boss of BP, expects prices to rebound this year to as much as $50 a barrel. It takes a brave investor to buy oil shares now, but even if they don't go up in value, they are currently paying high dividends.

If Shell were to maintain its payout, for example, new investors could make a 9% return. BP's dividend is currently more than 7%.

'Don't panic sell'

In principle, investors are usually advised to buy - not sell - shares when they are cheap. But equally, experts say it is hard to call the bottom of the market.

Yet for those paying into pension funds on a regular basis, it is worth noting that you are currently buying shares cheaply anyway.

This is known as dollar/pound cost averaging. Losses you make on having bought shares expensively in the past should be matched by the better value you are getting now.

"Long-term stock ownership is, typically, the best way to create and grow wealth for investors," says Nigel Green.

"Stock markets can be fairly predictable over long periods of time."

If small investors do want to dip their toe in the water, Jason Hollands, of Tilney Bestinvest, thinks markets in Europe and Japan offer the best value, largely because their central banks are likely to introduce further stimulus for their economies.

"Both regions are already printing money, but are nowhere near their target rates of inflation, and therefore there is a real prospect of them stepping harder on the accelerator, which would support asset prices," he says.

Overall, Nigel Green offers four top tips:

Don't panic sell

Consider buying good-value shares

Diversify portfolios across asset classes and regions

Keep some cash spare.