Getting the most from your current account

- Published

The most affordable way of holding a bank current account, an academic has concluded, is to keep small sums in it but to never go overdrawn.

John Ashton, professor of banking at Bangor University, studied 17 years of bank account data to examine the costs faced by customers.

He told the BBC that it was well documented that overdrafts were an expensive form of borrowing.

What was overlooked was the "cost" of keeping large deposits in an account.

By doing so, customers were missing out on much higher levels of interest that would be paid in a better home for their savings.

"It is a surprise how large these amounts can be [in current accounts] - many thousands of pounds," he said.

Stick or switch?

How to leave your bank... in 60 secs

It might be possible to manage a current account to make the most of the system but, for many, the best way to get value for money is by switching to another current account altogether.

Bank customers could save £70 a year on average by switching their account to another provider, an investigation by the Competition and Markets Authority (CMA) concluded.

Why? The CMA explains: "We looked at the average charges for a customer who was £500 in credit and had a number of foreign exchange transactions in a year, and tried to work it out, if they switched to a different type of account, and we found that, if they switched to a reward account under which they received cashback rewards and interest on their credit balances, they would make the £70 saving."

For those who go into the red, the savings made by switching would be even greater, the CMA suggested. The average overdraft user could save £140 a year. Heavy overdraft users could save £260.

Switching is relatively simple. It is a seven-day process, external and all existing regular payments, incoming and outgoing, are automatically diverted to the new account.

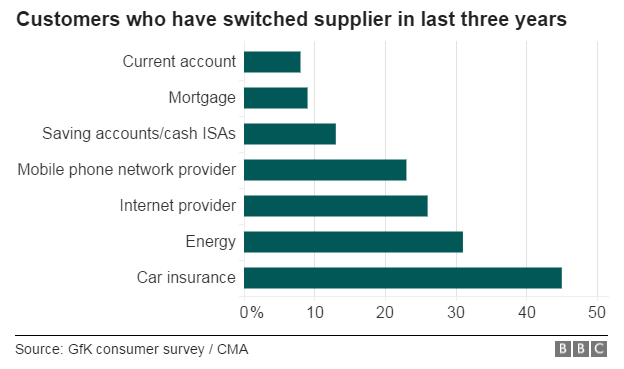

Customers, for the most part, remain unmoved despite the simplicity of the system.

Last year, 1.03 million current accounts were switched last year, compared with 1.15 million the previous year. That is a fraction of the 68 million active current accounts in the UK.

Red warnings

Commentators suggest, despite a big advertising campaign, customers do not swap owing to a lack of trust in banks to ensure direct debits are automatically switched to the new account.

They also say that the complexity of these accounts and the lack of a clear "price" make it enormously difficult to decide between the options.

There are 269 different current account options to choose from for UK consumers, according to financial information service Moneyfacts.

One of the High Street giants - Barclays - has 69 different options on its own, although they are not all available to everyone.

Customers who do attempt to find a better deal are met by a blizzard of numbers when comparing the charges levied by each account.

For overdrafts, there may be authorised overdraft fees, overdraft arrangement fees, overdraft review fees, as well as the same again for going into the red without prior authorisation from the bank.

To add an extra layer of complexity, the cost of an overdraft is not always clear from the interest charged.

For example, two banks charge 15.9% interest on overdrafts but borrowing £500 for two weeks costs £17 with one bank, but £27 with another. Why? One of the banks does not charge for the first £250 that is borrowed.

Frustrated customers, by sticking with the account they had got and paying the fees regardless, ultimately faced extra expense, the competition authority suggested.

"Banks have an incentive to set high overdraft charges, due to the lack of customer engagement," the CMA concluded.

There is also a range of costs for more specialist services. Different fees are charged, for example, for banker's drafts, same-day transfers of large amounts of money, and transactions in foreign currencies.

Growth of rewards

That is the complexity of costs, so what about judging the benefits offered with accounts?

Since Prof Ashton's work was published in 2013, banks have become more likely to offer a cash incentive to customers to switch to one of their accounts, and rewards for regular use of the account.

Packaged accounts, which have been around for some time, charge a fee but include add-ons such as insurance products.

Reward accounts may also charge a fee but may also offer cash upfront, as well as cashback or savings if the account is used in certain transactions - such as paying household bills or shopping at certain stores. The sting may be charges elsewhere, such as going overdrawn.

"Customers should choose a current account based on its overall package to ensure it covers all their financial requirements. This is particularly important if they want a reasonable overdraft to cover any unexpected outgoings, otherwise they could end up being stung with excessive fees," said Rachel Springall, of Moneyfacts.

Sir Donald Cruickshank conducted a well-received review into the UK banking industry for the government nearly 16 years ago in which he highlighted the stranglehold of the biggest banks on the market.

He is more upbeat about the market now, and said bank accounts with a subscription fee were a sign of progress. Monthly fees for current accounts, which changed over time, were good for the market, even if they were not always good for the consumer, he said.

"There are more banks [than in 2000], it is easier to get banking licences, and it is easier to compete," he told BBC News.

"The average customer of the big banks does not particularly want to switch. They want to know that they are getting as good a deal as they could get elsewhere.

"There has been a response from the established players [because] they know that the new ones can take their business away."

Also on the BBC:

Computer says 'this one'

Consumers are still faced with such complexity when choosing an account, but one source of relief for consumers, according to the CMA, is a new system that automates the choice using information on bank statements about previous spending.

The idea of the government-backed "Midata" project is that customers download data of previous transactions into a price comparison website and it crunches the numbers to suggest where they might get a better deal.

But the CMA says the scheme still has lots of shortcomings, not least that it does not work if customers are using one of the most popular smartphones in the UK - the iPhone.

Two other major difficulties are still to be resolved with this project.

Firstly, consumer research suggests the majority of people would be unlikely to use the service owing to fears about giving their personal data to a price comparison website.

The second, as MPs pointed out, was that an estimated 11 million people are not "functionally literate" on the internet.

Andrew Tyrie, chairman of the Treasury Committee, told the BBC News website that the CMA seemed to be "passing the buck".

"The CMA seemed to be saying that consumers need to take more responsibility. But most do not have the tools to do it. Many lack the computer skills. In any case, many are also wary of sharing their data," he told BBC News.

The issue is on the list of possible "remedies" produced by the CMA. Its final view on those is expected to be published in the coming weeks.

Tomorrow: The only truly free current account