Apple warns iPhone sales set to fall for first time

- Published

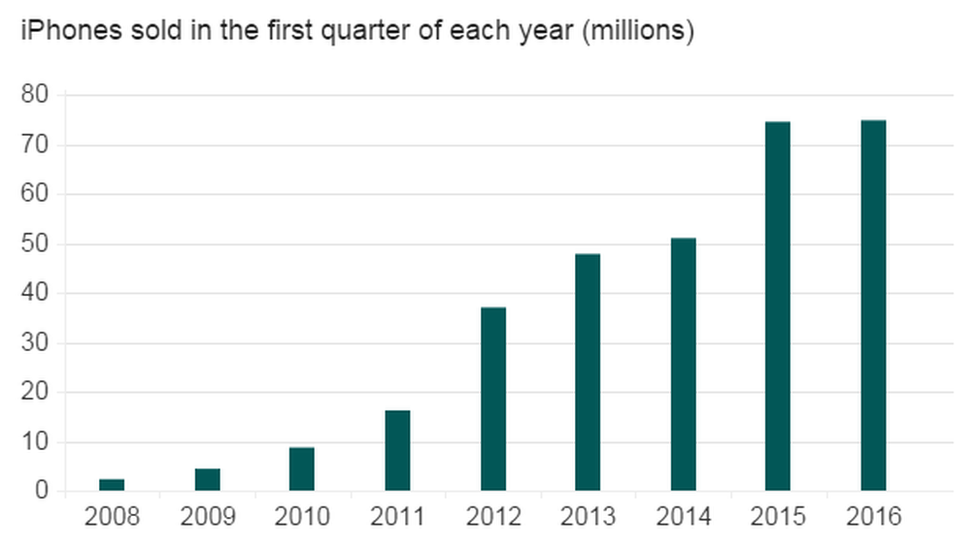

Apple has reported the slowest growth in iPhone sales since the product's 2007 launch and warned sales will fall for the first time later this year.

The US tech giant sold 74.8 million iPhones in its fiscal first quarter, compared with 74.5 million a year ago.

Apple said revenue for the next quarter would be between $50bn (£34bn; €46bn) and $53bn, below the $58bn it reported for the same period a year ago.

This would mark Apple's first fall in revenues since it launched the iPhone.

Despite first-quarter iPhone sales being below the 75 million expected by analysts, it was still a record quarter for the company.

Apple revenue in the three months to 26 December was $75.9bn and net profit was $18.4bn, both of which are the highest ever recorded by the company.

Sales of iPhones accounted for 68% of the company's revenue in the period.

Analysis

By Rory Cellan-Jones, BBC technology correspondent

Any other company announcing record profits and revenues might expect a warm welcome from investors. But now that Apple has scaled so many peaks the worry is that the only way is down - and there's evidence in these figures to back up those concerns.

Sales of the iPhone, surely the single most profitable product any company has produced, were basically flat. What's more, the revenue outlook for the next three months indicates we can expect the first fall in sales since the iPhone's 2007 launch.

Then there's China - still growing but far more slowly. The iPhone is still an object of desire there, but at a time when Apple says it's seeing softness in the economy, the attractions of cheaper rivals from local firms like Xiaomi may grow.

Of course, the worries about "peak iPhone" have surfaced before and evaporated with the hugely successful iPhone 6. Last year's upgrade to the 6S was a minor one, and we can expect something more radical in September.

But the pressure is now mounting on Apple to deliver another blockbuster product to keep the profit engine running.

The Apple watch will not fill that role - we've still not even heard any sales figures for the product.

Perhaps the 1,000 engineers rumoured to be working on an Apple Car will come up with the exciting innovation which Apple's fans and investors await with growing impatience.

Chinese 'softness not seen before'

Apple boss Tim Cook credited "all-time record sales of iPhone, Apple Watch and Apple TV" for the performance.

But the firm's chief financial officer, Luca Maestri, said the company was operating in "a very difficult macroeconomic environment".

He added that "iPhone units will decline in the quarter" and that the company was not projecting beyond those three months.

Mr Maestri partly blamed the strong US dollar for Apple's flat sales, estimating it had knocked $5bn off the company's revenues.

Apple's sales in Greater China - defined by the company as China, Hong Kong and Taiwan - rose 14%, but that was much slower than the 70% increase a year ago.

Mr Maestri said the softness in China was "something that we have not seen before", Reuters reported.

'Mother of all balance sheets'

China accounts for almost a quarter of Apple's sales, more than all of Europe combined.

The profitability of Apple's business improved, with gross margin - or how much the company makes per product - increasing to 40.1%.

Geoff Blaber, an analyst at CCS Insight, said Apple was "generating industry defying margins" and had cash of almost $216bn.

Speaking to analysts, Mr Cook said the company had "the mother of all balance sheets" and that its financial position had never been stronger.

Apple's shares were down 2.7% in after hours trading at $97.28.

Daniel Ives, an analyst at Capital Markets who owns shares in Apple, said given the "white knuckles fears" ahead of the results, he would "characterise the overall headline performance as better than feared".

- Published26 January 2016

- Published28 October 2015