Online self-assessment tax return deadline passes

- Published

Anyone filing online tax returns from now is likely to receive a penalty but some hit by flooding may have been given an extension.

Self-assessment forms must have been completed by the end of Sunday, with fines starting at £100.

There are also penalties for those who fail to pay outstanding tax, through a 3% interest charge.

Those affected by the flooding in late December and early January were allowed to apply for a later deadline.

This option was open to those who have been forced out of their homes and businesses, or have seen paperwork and computers damaged.

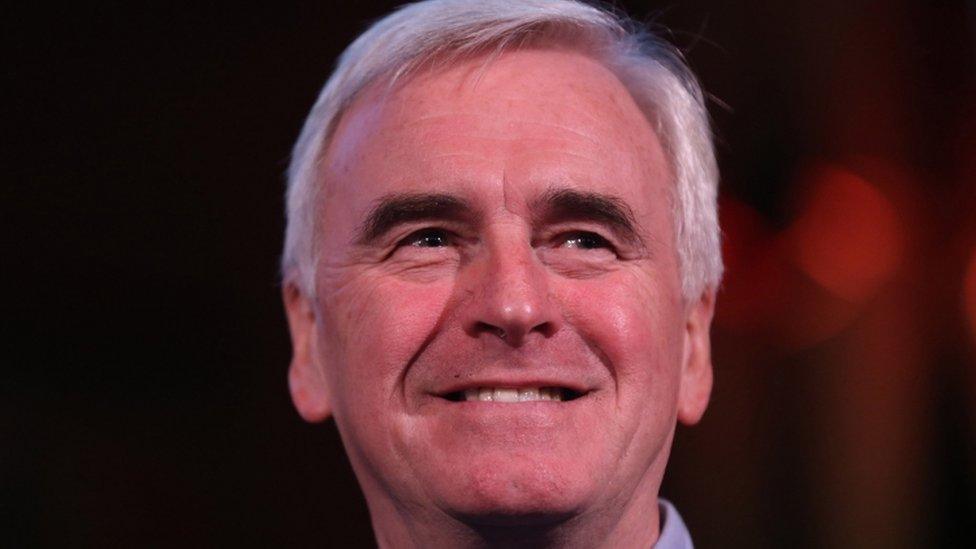

Labour's John McDonnell publishes tax return

However, the tax authority was far less likely to grant an extension to HSBC customers who were hit by online banking problems on Friday.

Tax returns are generally required from the self-employed and those with more than one source of income.

- Published31 January 2016

- Published25 January 2016