Oil price: are the numbers stacked against oil producers?

- Published

oil price pipeline

Saudi Arabia and Russia may have agreed to freeze oil output at January levels but their agreement is dependent on other producers following suit.

The dramatic fall in the price of oil from over $100 a barrel in the middle of 2014 to around $30 a barrel at the beginning of this year has preoccupied the world's economic community.

While this output freeze should help - indeed Bank of America Merrill Lynch said oil could be up to $47 a barrel by June - there is no doubt that oil producing countries are still under pressure from global oversupply and falling demand.

We've been looking at some of the figures to see what they tell us about the outlook for producers:

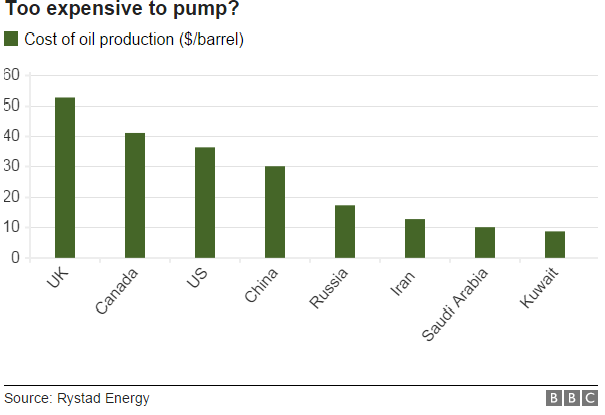

Cost of production

The cost of drilling new wells has been falling globally, but not by as much as the price of oil.

Half of oil production from future developments is uneconomic at $60 per barrel, and the sustainable price of oil is above $70 per barrel in the longer term, according to energy consultancy Wood Mackenzie.

In many parts of the world the cost of getting it out of the ground now far exceeds the price you'll be paid for it.

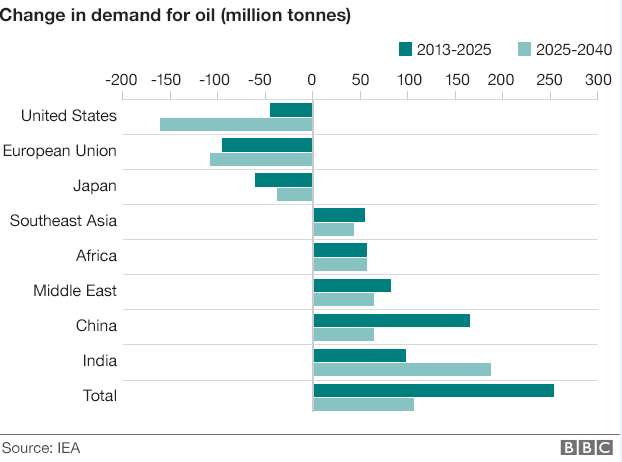

Slower demand growth

Even producers that are economically viable face a market that is oversupplied with oil.

India is the only economy that will see a consistent growth in oil demand for at least another 25 years.

The world's largest oil consumer, the US, will experience one of the world's largest reductions in oil demand, according to the International Energy Agency (IEA).

BP's 2016 Energy Outlook, external, which makes predictions for the next 20 years, also suggests that as demand for oil declines in western economies, India and China will account for half the increase in demand.

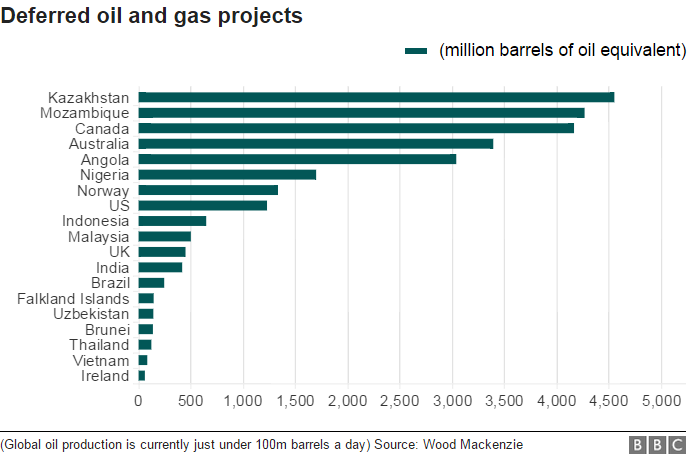

Postponing production

Wood Mackenzie says that development of some 68 major projects has been pushed back, external in the past six months.

Kazakhstan, Central Asia's richest nation, saw the biggest amount of deferred capital spending. It is estimated to have delayed 4.5bn barrels of oil production due to the collapse in prices.

And the growing fears of a "lower for longer" price environment will continue to put projects at risk.

British operators are seeing rig rates and labour costs - down more than 15% since the start of last year according to the industry body Oil & Gas UK, external - and this ranges from those employed directly by oil and gas companies, to Aberdeen taxi drivers and hotel staff whose livelihood depends on a thriving oil industry.

Royal Dutch Shell confirmed at the beginning of February that it would cut 10,000 jobs amid a sharp fall in annual profits and BP announced a further 3,000 job cuts after laying off 4,000 employees last year.

In 2015, investment in the upstream oil and gas sector globally fell for the first time in seven years by about 20%, as producers faced an oil price which has plummeted eventually to around $30 a barrel, says the IEA, external.

Continuing production

"Since the drop in oil prices from late 2014, there have been relatively few production shut-ins with less than 0.1% of global production halted so far - around 100,000 b/d [barrels per day] globally", says Stewart Williams, vice president at energy consultancy Wood Mackenzie, external, referring to occasions when oil fields put a cap on production.

But that is only less than 0.1% of global production. So why aren't more producers turning off the taps?

"Given the cost of restarting production, many producers will continue to take the loss in the hope of a rebound in prices", says Wood Mackenzie's Robert Plummer.