Softbank reveals record $4.4bn share buyback

- Published

Softbank's founder, Masayoshi Son, announced a 120bn yen buyback of shares in August last year in an attempt to shore up investor confidence

Japan's telecoms giant Softbank Group has announced its biggest share buyback to-date, sending its shares up almost 16% on Tuesday.

In a surprise move designed to boost investor confidence, the company said it would buy back up to 14.2% , externalof its shares worth some 500bn yen ($4.4bn, £3bn).

The announcement follows a sharp fall in the firm's latest quarterly profits.

It also comes amid a slide in the company's share price.

Last week, Softbank posted an 88% fall in net profit for the three months to December to 2.3bn yen. The telecoms giant has been trying to turn around the flagging US wireless firm Sprint - in which it has a controlling stake.

"The proposed share repurchase will be funded through proceeds from sale of assets and cash on hand, but not through any debt procurement," the firm said, external.

The company said that over the past 12 months it had received about 300bn yen from the sale of investment securities, among other measures.

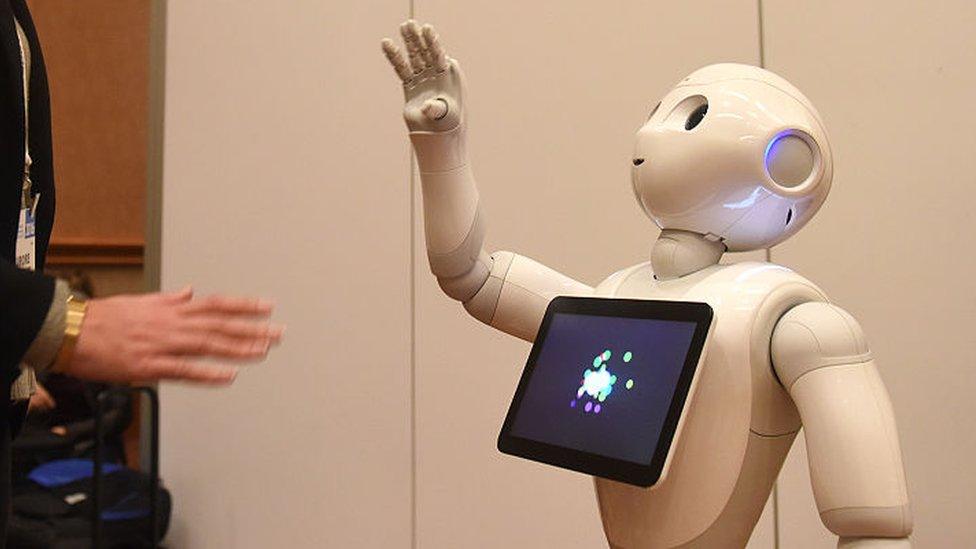

Softbank's Pepper sells out every time a new batch goes on sale in Japan

The group's businesses include the sale of internet services, computer software, mobile communications and handset sales, among others.

It has a stake in Alibaba and its companies include Yahoo Japan.

In June, the company's robotics and mobile arms announced that the world's first personal robot that can read emotions, external - Pepper - would go on sale in Japan.

Softbank hopes to see the friendly looking robot used in stores as a personal shopper and schools as a teaching assistant, among other roles.

The firm was established in 1981 and was listed in Japan in 1998.

Prior to Monday's share buyback announcement, Softbank's shares had fallen more than 28% in the year-to-date.

- Published20 January 2016

- Published23 June 2015