Singapore Airshow sees plane deals shrink to $12.7bn

- Published

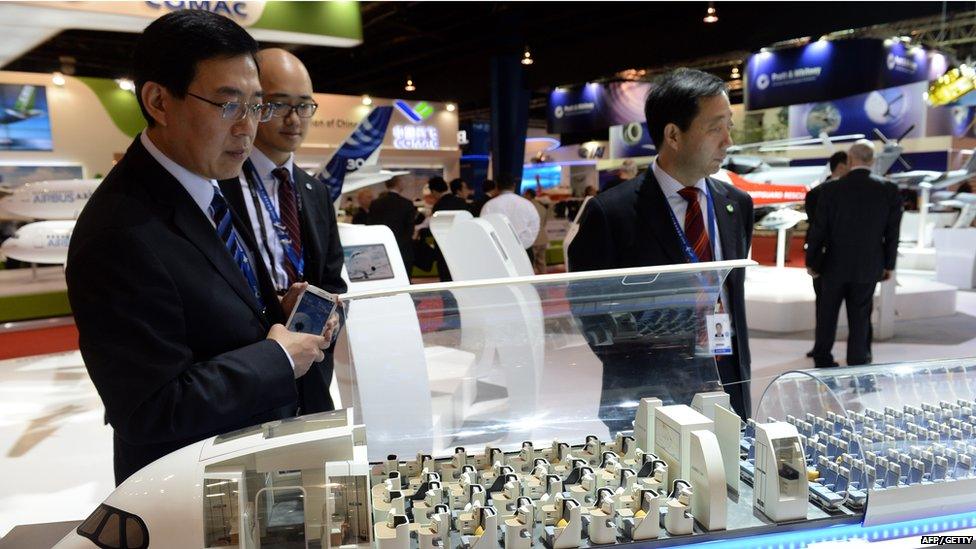

The Singapore Airshow has been facing an increasing number of rival exhibitions in the region

The biannual Singapore Airshow, external, Asia's biggest aerospace and defence exhibition, saw trade deals fall to $12.7bn (£8.9bn) this year compared with public takings of $32bn in 2014.

Organisers said the smaller amount was because more transactions are being made privately due to the "changing nature of business deals".

There were 11 announced deals, with another 40 made at undisclosed values.

The airshow launched on Wednesday and opens to the public this weekend.

"As the industry becomes more sophisticated and competitive, a growing proportion of the announcements and deals included undisclosed values," organiser Experia Events said in a statement.

Experia's managing director Leck Chet Lam told the BBC earlier this week that they hoped to either exceed of achieve the same deal amount as 2014.

In a statement today, he said "we are committed to creating carefully curated programme elements and are looking forward to delivering a 2018 edition that will further contribute to growing industry capabilities."

Business deals

The largest order was made by Philippines Airlines for 12 Airbus A350s worth $3.7bn, followed by a purchase by China's Okay Airways for a dozen Boeing 737s worth $1.3bn.

Papua New Guinea's Air Niugini signing their order for four Boeing 737 MAX

Earlier today, Papua New Guinea's Air Niugini announced an order for four Boeing 737 MAX planes worth $440m.

Japan's Mitsubishi Aircraft Corporation also won a $940m order for 20 of its planes from US leasing company Aerolease.

The biggest orders in recent years have been by low cost carriers, which have rapidly expanded their fleet sizes.

In 2012, Indonesia's Lion Air ordered 380 Boeing planes in a deal worth more than $22bn while in 2014 Vietnam's VietJetAir ordered 100 Airbus aircrafts.

'Buoyant mood'

The modest orders made during the three-day trade period partly reflect a drop in demand for new planes due to the weak global economy.

Manufacturers Boeing and Airbus released positive long-term forecasts for aircraft demand in the Asia Pacific

But Rajiv Biswas, Asia Pacific Chief Economist at IHS Global Insight said the commercial aviation industry is actually "in a buoyant mood."

"Many Asian airlines placed large orders between 2011 and 2014, and now have a long pipeline of aircraft deliveries to absorb over the next four years," he said.

"Due to the existing capital expenditure commitments already made by many Asian airlines over the medium-term outlook, future new orders are expected to come in smaller sizes."

Rising wealth in the regional is expected to continue to fuel growth in Asia Pacific air travel demand. Last year, the total number of domestic air passengers rose by 10.5%.

Mr Biswas expects the aviation industry's profits to rise by about 9% each year because of the sharp fall in oil prices and strong regional growth in Asia Pacific passenger traffic.

The next airshow will be held in February 2018. Organisers said about 70% of exhibitors have already made reservations to participate.

- Published19 February 2016