Why a story about bulk shipping matters

- Published

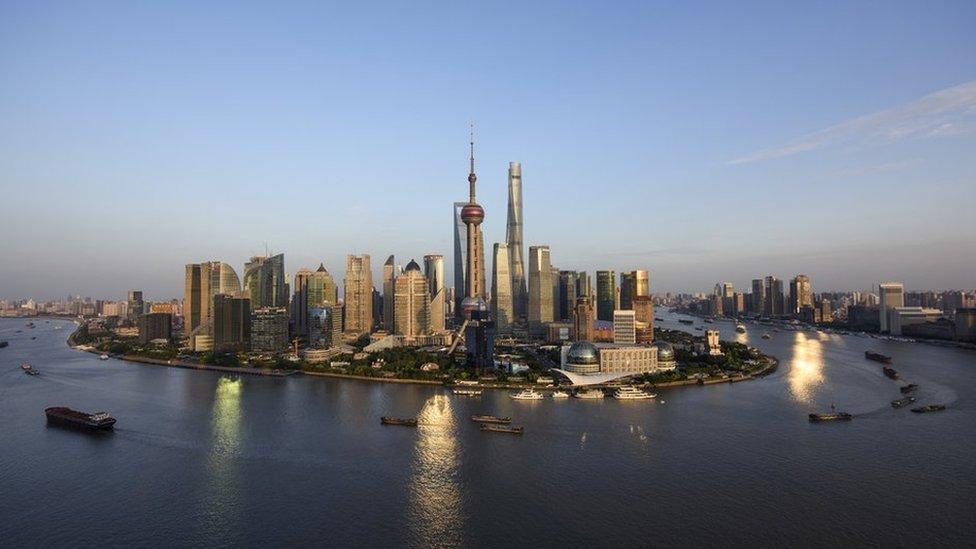

China is buying less from the world and that's having a knock on effect on everyone - from Australia to Indonesia.

When China's economy was growing at double digits, businesses ranging from coal-mines to shipbuilding decided it was the only game in town, and that this was the only strategy worth pursuing.

'The China story', or the 'Look East' policy. All part of the same narrative.

Sometimes when I read reports that forecast doom and gloom for a particular industry based on falling Chinese demand, I feel like shaking my head.

China has been broadcasting for some years now that its economy is transitioning and rebalancing, moving away from fixed asset investment to an economy that depends on services and consumption.

One wonders why the supermen of the shipping industry thought that China's economic boom was going to last forever, or that the super-cycle in commodities would go on and on and on…

The latest report from IHS on the dry bulk shipping industry tells a similar story.

What is dry bulk, you ask?

Bulk carriers are designed especially to move bulk cargo like coal, ore and grains

Dry bulk is all that stuff that China needed as its economy grew at 9% to 10% - coal, iron ore, grain, steel - it's the transportation of that stuff across the world on massive ships, that's called the dry bulk trade.

No surprises here, IHS projects one of the worst years on record for the industry, on the back of falling Chinese demand.

The most recent Chinese import data confirms the doom and gloom.

China is buying less from the world, and that's having a knock on effect on everyone - from Australia to Indonesia.

IHS says that in 2015 China bought a third less coal, and Indonesia - one of its key suppliers - saw the amount of coal it sold drop by 40%.

Not great for all of those investors in Indonesian coal mines.

So, why should you care about the dry bulk shipping industry?

Video explainer on Baltic Dry Bulk Index

It is a key gauge of global trade and tells you how much it costs to move stuff around the world.

And here's the thing - the dry bulk index - also called the Baltic Dry Bulk Index - saw a peak of 11,000 points in May of 2008, just before the global financial crisis.

This year it has hit fresh record lows and skirted around the 300 points mark.

What this tells you is that global trade is nowhere near the levels it was pre-2008.

So the 'green shoots of recovery' you hear policy-makers and economists talking about, that's not being seen on the global shipping routes or lanes.

Countries are trading with each other far less than they used to because demand is down, and much of the growth we have seen since 2008 has been fuelled by government stimulus, investment and debt - and expectation that this growth would last forever.

And perhaps nowhere are the ghosts of those expectations seen more starkly than in the global shipping industry.

"It would be safe to presume that the market's failed expectations were the main problem for dry bulk shipping," says IHS.

"There were a large number of orders in 2012 and 2013, booked on the premise that there would be a continuation of China's commodities super-cycle driven by China's economic boom. This is simply no longer the case."

Greed. It's almost always blind.

- Published8 March 2016

- Published2 March 2016

- Published3 March 2016

- Published1 March 2016

- Published23 October 2015

- Published19 December 2012