Crash test: The tech driving down car insurance fraud

- Published

- comments

Telematics tech could reduce 'crash for cash' fraud and false personal injury claims

Fraudsters beware: the days of dodgy car insurance claims are numbered. Technology has you in its sights.

Like everything from watches to refrigerators, cars are fast becoming internet-connected and laden with sensors monitoring their every move.

A "black box" can be found in millions of cars globally, now that more and more drivers are choosing so-called telematics insurance policies.

And these devices, that monitor speed, acceleration, braking, cornering - all aspects of our driving - are helping insurance companies weed out fraudulent "crash for cash" and personal injury claims, potentially saving the industry billions in losses every year.

There are about 12 million of these policies globally now, with the biggest markets being the US, the UK - which now has more than 450,000, a 40% increase on last year - and Italy.

Knowing where, when and how fast a car was going can help insurance assessors

That still only represents about 1.5% of the global market for insurance policies, however.

Fraudulent claims

Jonathan Hewett of Octo Telematics, which supplies the data and analysis that comes from black boxes , says it gives insurers a complete understanding of a crash - even if only one vehicle involved has the technology: "Telematics provides a much deeper set of data… that allows insurers to do that much better."

As claims account for about 80% of insurers' costs, being able to examine them forensically to determine liability - and whether drivers are making fraudulent claims - is crucial to the bottom line.

"You can understand the force of the impact, and thus the likelihood of things like whiplash and soft tissue injury," Mr Hewett explains.

Telematics boxes could help reduce false whiplash claims

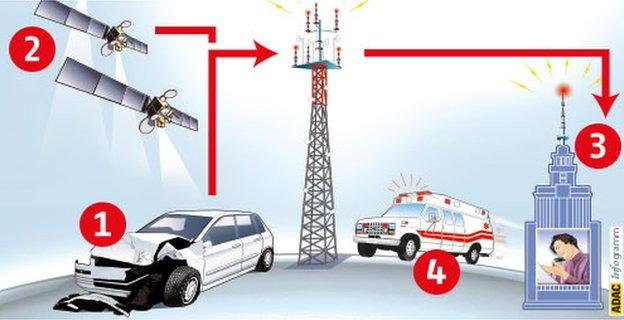

Another, perhaps unexpected, benefit of telematics is allowing insurers to become aware of a crash as soon as it happens. The boxes are usually connected to a vehicle's diagnostics port under the bonnet or plugged into the 12-volt power socket in the cabin.

If the device detects a G-force above a certain level it automatically triggers a call to check if the driver and any passengers are unharmed, or alerts emergency services if needed, explains Scott Goodliffe of insurance broker Adrian Flux.

Technology that can automatically notify emergency services in the event of an accident will be compulsory on all new vehicles sold in Europe from April 2018 under the European Union's eCall initiative, external.

An eCall will only be made automatically in the case of severe accident

The EU says this will significantly reduce the response times to crashes and could save hundreds of lives a year.

Allowing insurers to contact drivers faster following accidents will help stop "ambulance-chasing lawyers" getting involved, according to Octo's Mr Hewett.

That gives them more control over the claims process, provides a better service to customers - and minimises costs.

"It's as much about process efficiency as it is about financial efficiency" for an insurer, he says.

Smartphone nanny

Cost is the primary reason why telematics policies have made inroads into the car insurance market given that they offer savings of up to a third - often a four-figure sum - for young drivers.

However, now that telematics is increasingly being linked to smartphones, the technology is also encouraging those with less experience behind the wheel to drive more responsibly by giving them feedback about their performance.

Michael Lee, managing director of insurance services for UK insurer Hastings Direct, says: "We use the data generated by our telematics products and proactively contact young drivers with poor driving scores" - under 50 on a scale where 100 is the highest.

Although it is a labour-intensive process, "drivers then see a 60% increase in their scores", Mr Lee says, meaning they are less reckless on the roads.

Smartphone apps and self-fit 'black boxes' are becoming more popular

Adrian Flux offers a self-fit black box linked to a smartphone app updated daily that details driving performance - and the potential effect this could have on the annual premium.

It has proved very popular with both young drivers and their parents who often foot the bill, the company says.

'Pay-per-trip'

The car insurance market for young drivers is very quickly reaching a tipping point, according to Ofir Eyal of Boston Consulting Group, because telematics allows them to prove that they are safe drivers and thus pay significantly lower premiums.

Such policies have so far not had wide appeal to older drivers in most developed countries because the potential savings have been much lower, although the rise of policies that only use smartphone apps, along with cheaper, self-fitted black boxes, is beginning to alter that equation.

Octo Telematics also provides 'pas-as-you-drive' insurance products for motorcyclists

Mr Eyal believes that telematics penetration will continue to increase in the next few years and help insurers deal with rising demand for "pay-per-trip" policies and as more journeys are made in vehicles we don't own.

"It's about getting the right technology to the right customers; it's not one size fits all," he says.

"The challenge for the car industry is adjusting to changing consumer demand - insurers will need to adjust their business models to adapt and provide services for the different type of journeys we will be making in the future."

Data conundrum

But question marks remain over all the data that cars are starting to generate: how accessible it will be to consumers?

Mr Lee doubts that car manufacturers will create a standard set of metrics, so insurers will be forced to learn how to process each manufacturer's data.

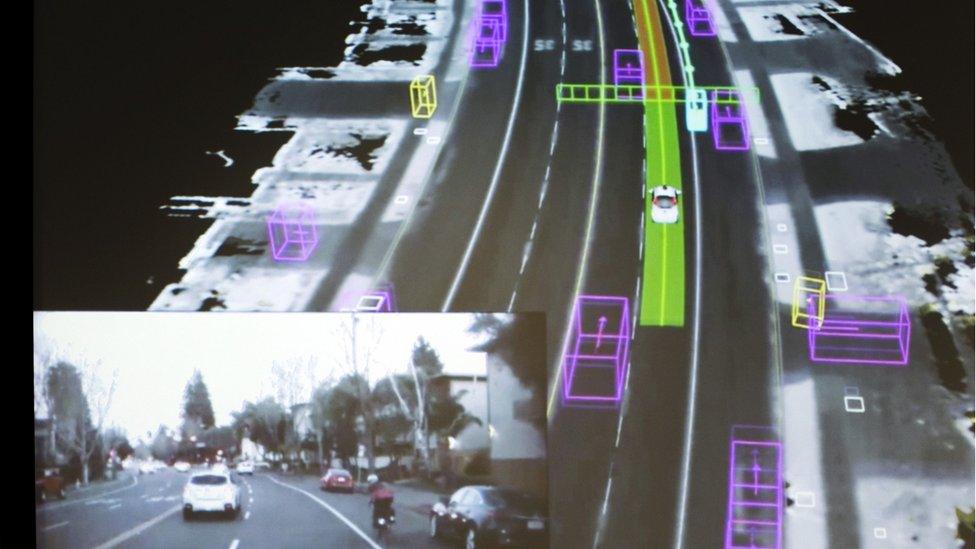

Telematics data will be crucial for insuring driverless cars

But as telematics goes mainstream, regulators are likely to impose standards to allow data to be transferred between insurers in the same way as a no-claims bonus can be today, he believes.

The advent of autonomous vehicles presents another challenge.

Octo's Mr Hewett says data analytics will be critical to understanding what happened - and determining liability - if, say, a driverless car collides with a pedestrian.

Given that a mix of conventional, semi-autonomous and fully driverless vehicles could be on the world's roads for anything up to the next five decades, the need for data standards will become all the more acute.

Follow Technology of Business editor @matthew_wall on Twitter, external.