BHS creditors vote to support rent cut plan

- Published

Emma Simpson examines the problems facing BHS

Almost all creditors of the troubled store chain BHS have voted to allow a cut in rents for some of its UK stores.

The loss-making retailer had put forward the plan as part of an attempt to turn its fortunes around.

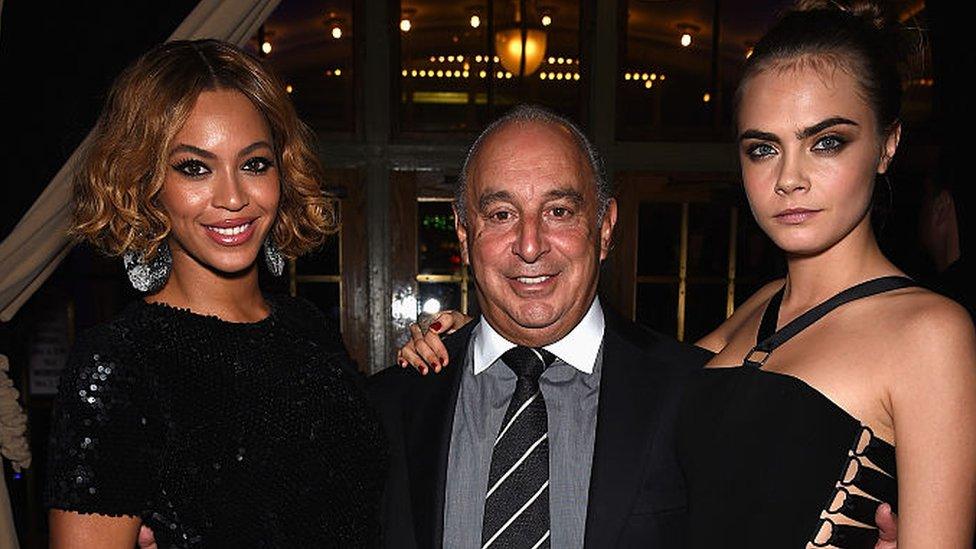

BHS was bought by billionaire Sir Philip Green for £200m in 2000, but he sold it last year for just £1.

It is now owned by Retail Acquisitions, a consortium of financiers, lawyers and accountants.

The company currently has debts of more than £1.3bn, including a pensions deficit of £571m.

Under the agreement, a number of BHS's stores - 47 - will see a hefty rent cut of either 75% or 50%.

The best-performing stores, which covers 77 outlets, will continue to pay rent as normal, although rents will be paid monthly rather than quarterly.

The remaining 40 stores will continue to trade for a minimum of 10 months while negotiations with landlords are held on reducing rents by 25%.

A separate meeting later on Wednesday saw creditors vote to approve a plan involving 23 other BHS stores grouped as BHS Properties Limited.

'Credible plan'

Darren Topp, BHS's chief executive, thanked the creditors and said: "This gives BHS the opportunity to move forward.

"It is a tough time for retailers across the UK with huge structural challenges faced by all, however, we have a very credible plan to return BHS to growth and profitability and a revitalised British Home Stores will emerge as we accelerate our turnaround plans."

The latest agreement also includes a plan to sell the long lease on its flagship Oxford Street store for around £30m.

BHS - which has been loss-making for seven years - needed a Company Voluntary Arrangement (CVA), external, otherwise it would have ended up in administration, placing the jobs of its 10,000 workers at risk.

Will Wright, restructuring partner at KPMG, who oversaw the CVAs, said: "Today's 'yes' votes enable BHS to tackle the issue of an unsustainable lease burden which was weighing heavily on the business.

"While together, the two CVAs comprise only one element of BHS's plan to turn around its fortunes, they are a critical cog in the mechanism that will put the business in a stronger operational position. The proposal process has given both the company and its creditors the opportunity to agree a compromise that is mutually acceptable."

BHS was bought by billionaire Sir Philip Green for £200m in 2000, but he sold it last year for just £1

Pension hole

But even with the landlords' support, BHS has warned that it needs extra funding to trade beyond 25 March and it is trying to raise £100m.

A further major problem for the company is its pension deficit.

BHS is in talks to address this with the Pension Protection Fund, as well as the Pensions Regulator and the BHS pension trustees.

BHS insists that it continues to meet its pension payment obligations.

But in BHS's CVA submission, the retailer's directors were clearly hoping that the two pension schemes would be transferred into the PPF and that the company would have no further liability to fund it.

Malcolm Weir, head of restructuring and insolvency, at the PPF warned: "The CVA for BHS has been agreed, however this does not mean the pension schemes' deficits have been resolved.

"The Pension Protection Fund (PPF) will be working with the company over the coming months to find a solution. However failure to reach a compromise may still result in insolvency. Members of the pension schemes continue to be protected."

BHS: A history of a High Street stalwart

British Homes Stores first opened for business in Brixton, south London in 1928

1928: A group of American entrepreneurs set up British Home Stores. The first store is in Brixton and nothing in the store costs more than a shilling (5p) - double that of rival Woolworth's maximum price of sixpence

1929: BHS raises its maximum price to five shillings (25p) allowing it to sell home furnishings, including drapery

1970: The firm expands steadily in the postwar era - by the beginning of the year it employs some 12,000 workers in 94 stores across the UK

1985: BHS begins to franchise its brand to stores around the world, to which it supplies products and support

1986: The store merges with designer Sir Terence Conran's Habitat and Mothercare to form Storehouse Plc, and the "British Home Stores" name is replaced with "BhS", then "Bhs" and eventually "BHS"

2000: Retail billionaire Sir Philip Green buys BHS from Storehouse Plc for £200m

2002: BHS becomes part of the Arcadia empire, controlled by Sir Philip, when he buys the clothing group and its Topshop, Dorothy Perkins and Burton brands

2005: The store resurrects its "British Home Stores" branding, but it is losing ground to cheaper rivals like Primark

2015: Sir Philip sells the loss-making BHS for £1 to Retail Acquisitions led by Dominic Chappell, writing off £215m of debts in the process

2016: BHS begins an insolvency procedure to reduce its rents and transfer its pensions liabilities into the Pension Protection Fund, the government-supported rescue agency

- Published23 March 2016

- Published23 March 2016