Tax transparency: Could the UK take a leaf out of Norway's book?

- Published

People's earnings and taxes have been made public in Norway for 200 years

Last July at The Times CEO Summit, David Cameron announced plans to make the top 250 companies in the UK publish the gap, external between average male and female earnings, in order to try to tackle the gender pay gap.

For the UK, where revealing someone else's tax affairs is a criminal offence, this is a pretty radical step. But for some countries this is nothing new.

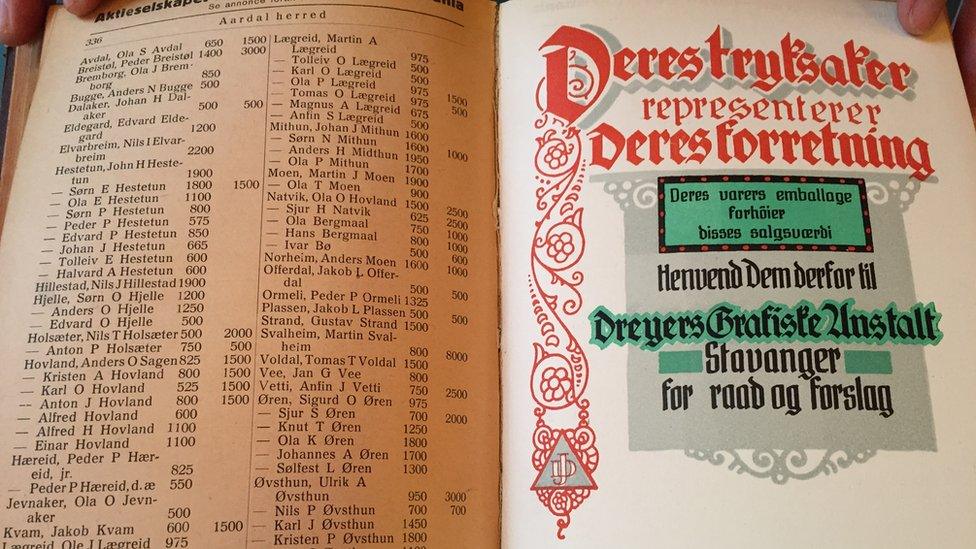

In Norway, for instance, everyone has been able to see how much you earn and how much tax you pay since 1814. Until recently the data was only available at the town hall or in expensive printed books, rather like the Yellow Pages, but these days it is all available online.

For newspapers like Dagbladet, one of the top tabloids in Norway, this is a windfall. It can and does report on the lives and loves of the rich and famous just like many newspapers do in other parts of the world.

Dagbladet is one of Norway's top tabloids

But in Norway they can spice up each and every report at the click of a mouse - the earnings, tax and wealth of everyone from the prime minister down is available online for anyone to see.

Dagbladet's editor-in-chief John Arne Markussen admits that this did go too far at one point, with stories on the richest and poorest streets in Norway and apps that let you find out who lived in a house you were passing and how much they earned.

Now if you look up someone's tax details they at least know who is doing it, but that doesn't stop journalists like Bjorn Bore. So I asked him to look up the editor's tax returns from last year. It was only mildly embarrassing for John Arne Markussen.

"You did good boss, congratulations," was his reporter's rather surprised sounding comment when he found his boss's salary and bonus from 2014. "He made 2.8m kroner but he paid 1.3m kroner in tax." That's more than £230,000 in wages and £108,000 in tax - it had been a good year for the newspaper apparently.

John Arne Markussen admits that at one point things did go too far in Norway

Village affairs

But this tax transparency is not just a matter of celebrity gossip or embarrassing the boss. It has had radical consequences for Norway.

It started when Norway won its independence and needed to set up a central bank. Taxes were raised and to make sure everyone was paying their fair share, all the details were published.

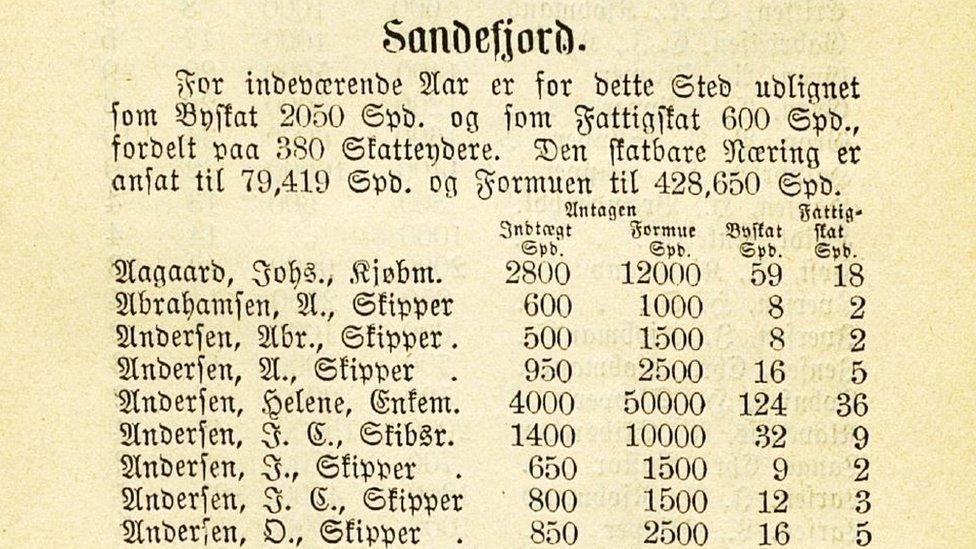

The above extract is from the booklet, Tax assessment 1871 for cities in Norway, and shows a table for the city of Sandefjord. The columns show:

Name and profession

Income (in speciedaler, the currency that preceded the krone)

Assets

City tax

Poor tax

As an attempt to increase openness and stop corruption, the news was also available to the illiterate - town criers stood on village greens and announced the whole village's taxes.

As a result Norway is one of the least corrupt countries in the world.

It has also reduced gender inequality and it is easy to see why at Opera, an internet company in Oslo. It has attracted top talent from around the world, including Ruth Alflat from Yorkshire.

In England, she told me, it was a bit of a taboo to discuss how much you earned. "Here you don't have to do that, it is available knowledge and that is very important for fresh graduates. You know what to expect, what people should be paying... in England you take what you are given."

Cultural differences

It is so ingrained that I was amazed to hear one of Ruth's bosses complain that the system is no longer as open as it was. She sets people's wages but wants them to be able to see the rates she is offering are fair. She also helps friends in their wage negotiations and trade unions publish detailed lists of what everyone should be earning.

Internet company Opera attracts staff from around the world

Even top bosses like the system. Ones I spoke to said they believe that paying taxes is a civic duty and huge wage differences between the best and worst paid are obscene.

But could it work in the UK? Is it just what David Cameron ordered?

Thomas Eriksen is a professor of anthropology at Oslo University. He doesn't think the system is easily transferable. "There are religious sects, Lutherans, here in Norway that forbade members from even having curtains because nothing should be concealed from the public eye," he says.

That openness and public scrutiny of private lives is part of a particularly Norwegian culture, as is not standing out or getting above yourself. Prof Eriksen says that also limits entrepreneurship and initiative in Norway and is the downside to all that openness.

In many ways Norway is like the UK, a wealthy open Western society with wide international links. But a country where a man's home is his castle and tax affairs are secret is far removed from one where curtains were banned just in case you were committing a sin in your own sauna.

Total tax transparency here in the UK? Dream on.

For more on this story, listen to BBC Radio 4's In Business: Why don't we talk about our pay?

- Published21 January 2016