Anbang unexpectedly scraps $14bn bid for Starwood Hotels

- Published

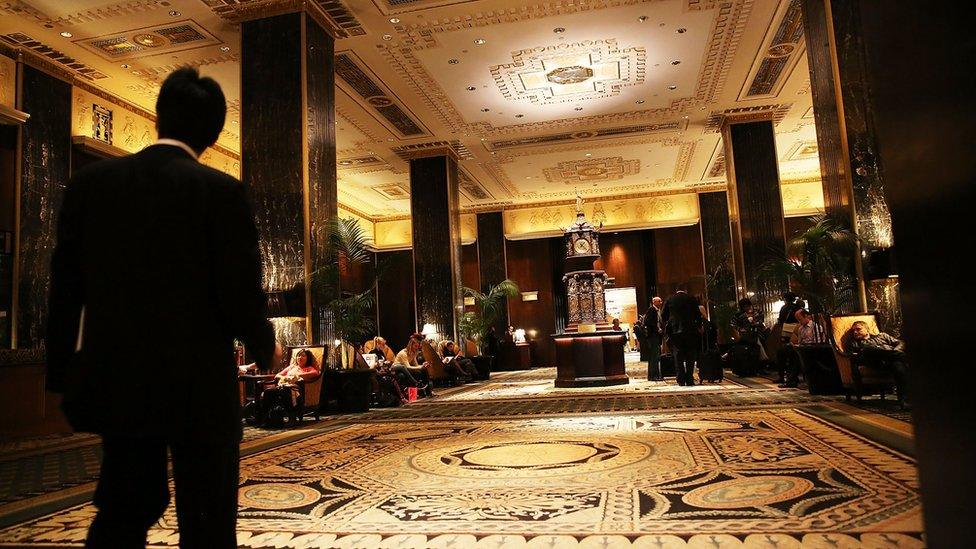

Starwood owns several hotel brands, including Sheraton

Chinese insurance firm Anbang has unexpectedly abandoned its takeover offer for Starwood Hotels, ending a three-week bidding war with Marriott.

Anbang had raised its all-cash offer for Starwood to $14bn (£9.75bn) it sought to challenge the merger between the hotel groups.

However, the bid is being scrapped because of "market considerations" a statement released on Thursday said, external.

According to reports, there were questions over its financing sources.

Anbang has been making an aggressive push into the US property market over the last few years but little is known about the company.

The exit of Anbang from the bidding process means that Marriott is one step closer to becoming the world's largest hospitality group.

However, the whole saga has highlighted the growing role of Chinese companies in global mergers and acquisitions.

There have been $92bn worth of foreign takeovers by Chinese companies this year, according to data provider Dealogic.

Starwood - which owns several hotel brands, including the Sheraton, Westin and St Regis - saw its shares fall 4.5% in after hours trade in New York.

Marriott shares lost 5%, showing some investors may be concerned the firm now has to pay an additional $1bn to purchase Starwood because of the bidding war.

- Published30 March 2016

- Published18 March 2016

- Published21 March 2016