Panama Papers: Australia investigates tax evasion

- Published

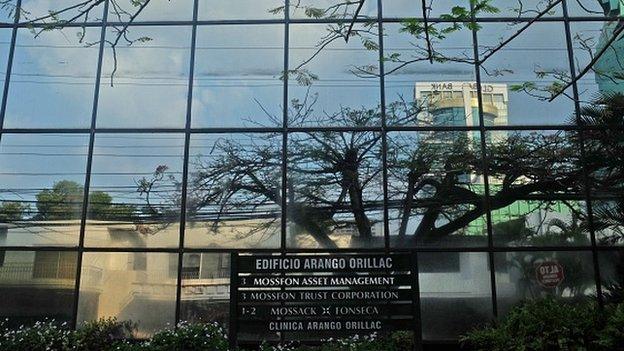

The investigation follows a leak of documents from law firm Mossack Fonseca

The Australian Tax Office (ATO) is investigating more than 800 individual taxpayers, all residents of Australia.

They have been identified as high net wealth clients of a law firm in Panama.

The investigation follows a leak of 11m documents from the database of law firm Mossack Fonseca, revealing how wealthy and powerful people hide their wealth.

The ATO says in a statement it has managed to link more than 120 of the individuals to an "associate offshore service provider" located in Hong Kong.

The tax body did not disclose the name of the company in Hong Kong.

The ATO is working closely with the Australian Federal Police, Australian Crime Commission and other agencies, and said some cases may be referred to the Serious Financial Crime Taskforce.

"The message is clear - taxpayers can't rely on these secret arrangements being kept secret and we will act on any information that is provided to us," said ATO Deputy Commissioner Michael Cranston.

Panama Papers - tax havens of the rich and powerful exposed

Eleven million documents held by the Panama-based law firm Mossack Fonseca have been passed to German newspaper Sueddeutsche Zeitung, which then shared them with the International Consortium of Investigative Journalists, external. BBC Panorama is among 107 media organisations - including UK newspaper the Guardian, external - in 76 countries which have been analysing the documents. The BBC doesn't know the identity of the source

They show how the company has helped clients launder money, dodge sanctions and evade tax

Mossack Fonseca says it has operated beyond reproach for 40 years and never been accused or charged with criminal wrong-doing

Tricks of the trade: How assets are hidden and taxes evaded

Panama Papers: Full coverage; follow reaction on Twitter using #PanamaPapers; in the BBC News app, follow the tag "Panama Papers"

Watch Panorama on the BBC iPlayer (UK viewers only)

- Published4 April 2016

- Published28 January 2016