China's HNA Group to buy airline caterer Gategroup

- Published

China's HNA Group has made an offer to buy Gategroup, a Swiss-based airline catering firm for 1.4bn Swiss francs ($1.5bn; £1bn).

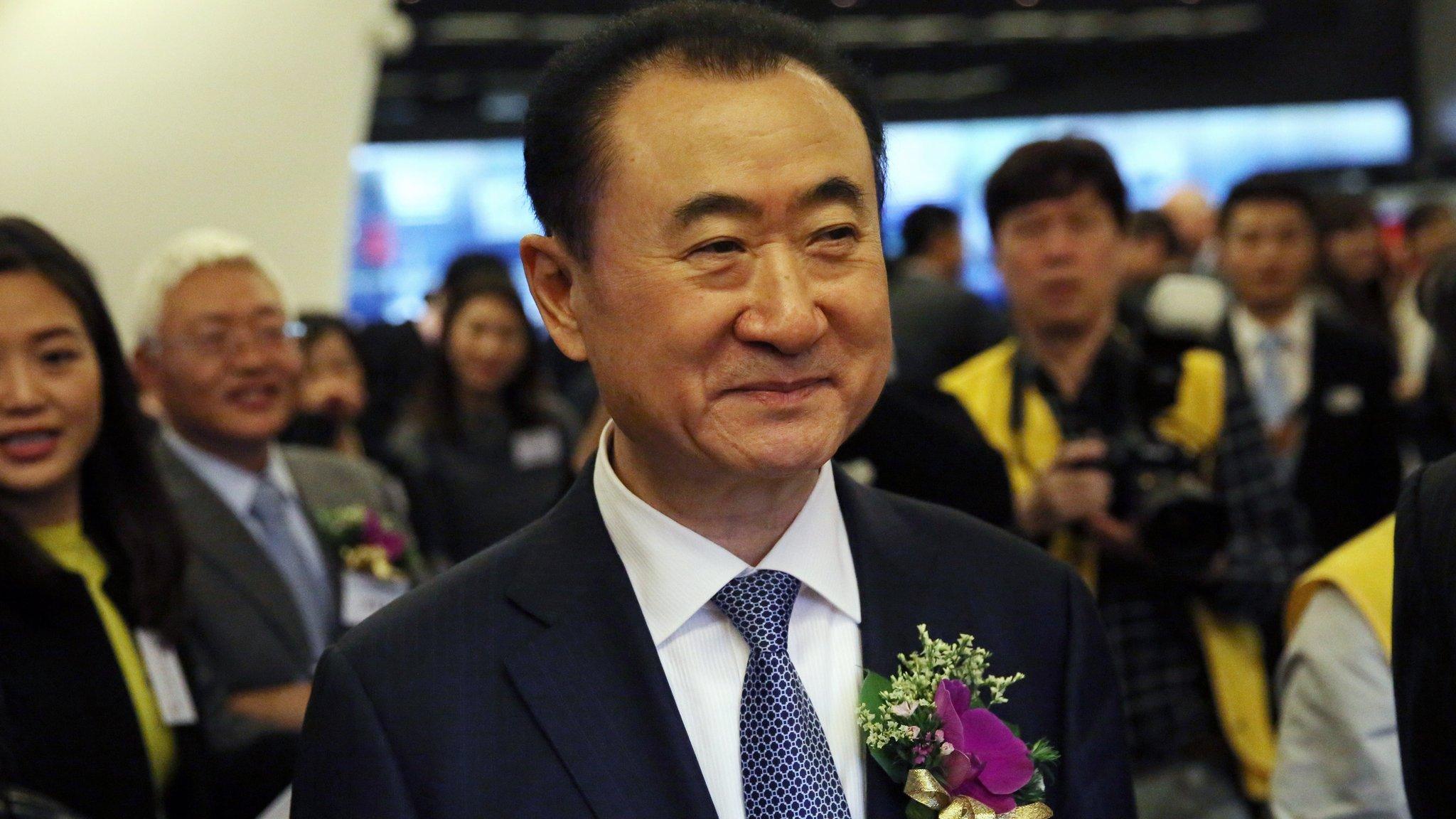

Conglomerate HNA Group owns Hainan Airlines and is led by billionaire Chen Feng.

HNA has offered 53 Swiss francs a share for the Swiss firm, an offer which has been backed by Gategroup's board.

The transaction is expected to be completed in July if the deal is approved by regulators.

In a statement,, external Gategroup chairman Andreas Schmind said: "The offer reflects the fair and adequate value and quality built by Gategroup.

"It makes strategic sense that our company will become part of HNA, one of the leading providers of airport and aviation services worldwide."

HNA family

HNA Group is the parent company of Chinese carrier Hainan Airlines, the fourth biggest operator in China. The big three - Air China, China Eastern and China Southern - are all state-owned airline groups.

HNA also owns a number of subsidiary airlines including Hong Kong Airlines, Lucky Air and China West Air. In addition, the conglomerate's portfolio includes business interests in real estate and it also owns several retail brands in China.

Between this year and last year, HNA has spent more than $6bn buying companies in the aviation industry.

The company's chairman is attempting to cash in on continued interest in air travel in the Asian region.

In September last year, a unit of HNA purchased an Irish aircraft leasing firm Avolon Holdings for $2.5bn.

In November, HNA spent $2.8bn to acquire airport luggage handler Swissport Group, external from PAI Partners SAS.

According to industry research, external, China is forecast to become the world's biggest passenger market by 2034, surpassing the US.

Analysis: Karishma Vaswani, BBC Asia business correspondent

As China's economy slows down, big corporate honchos are looking to hedge their bets by placing their funds outside of China. The Chinese currency, the yuan, has been on a weakening trend recently, partly as a result of what many see as a deliberate move by China to allow its currency to weaken so as to boost exports.

That means if the yuan continues to weaken, it will become more expensive for Chinese firms to buy assets overseas - which may be one reason why you're seeing such a flurry of activity in such a short period of time.

Expect more acquisitions by Chinese firms in the year ahead, but also expect more bumps ahead too.

It's a trend that's set to continue, but will almost certainly run into political trouble ahead of the US elections as a bigger spotlight is shone on China's attempts to snap up overseas assets.

- Published12 January 2016

- Published10 February 2015

- Published4 September 2015

- Published2 November 2015