BHS: Where has all the money gone?

- Published

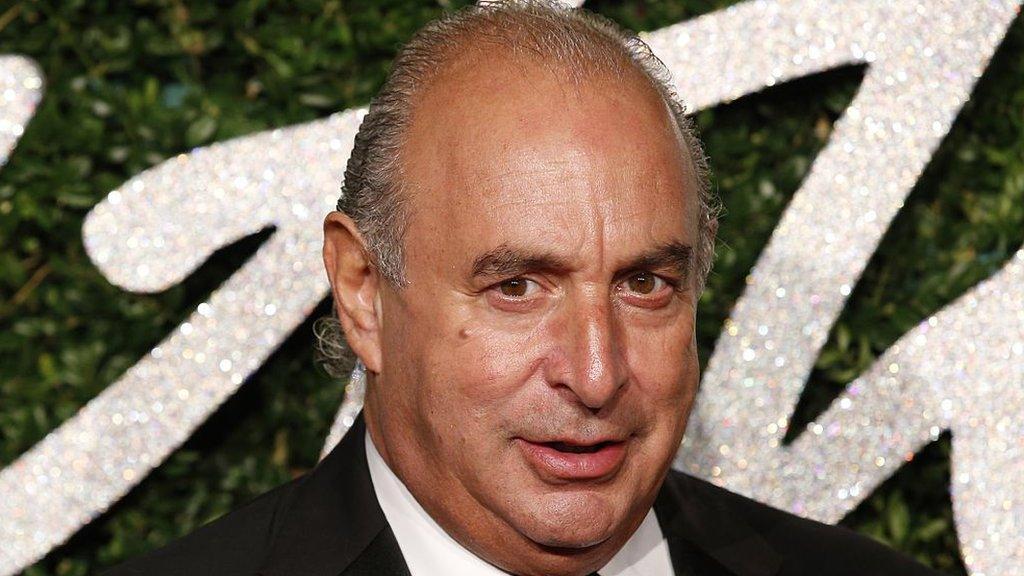

One year after it was sold by retail billionaire Sir Philip Green for £1 to a consortium of investors, BHS has gone into administration.

A big concern for employees - past and present - is the state of the pension fund.

The Pension Protection Fund (PPF) is expected to rescue the BHS scheme, which has around 20,000 members.

The PPF is a statutory lifeboat fund set up to ensure pensions are paid when a company goes bust.

But there are questions over why BHS had such a large hole in its pension pot in the first place.

Sir Philip bought BHS in 2000 for £200m. As a company it was not performing well but its two defined benefit pension schemes were in surplus.

Today they have a combined deficit - that's the difference between what they need to pay out over the coming years and how much they have - of £571m. That's what is called the "buy-out cost", a conservative estimate made by insurance companies looking to plug the hole.

Some have accused Sir Philip of taking too much money out of BHS - money that could have been invested in the company to modernise it and boost the pension fund.

Sir Philip says he sold the business in a good state with a chance at a sustainable future. He suggests that it is mismanagement by the new owners that have led to its current problems.

Sir Philip Green and his wife Lady Christina who is the owner of Arcadia

The money trail

Sir Philip's takeover of BHS saw a dramatic boost in its performance: pre-tax profits increased from £18.5m to £94.8m in a single year.

At this point the pension scheme had a surplus of £17.4m.

Profits remained around £100m a year until 2004. Over the same period, BHS paid out £414m in dividends to shareholders.

Most of this money went to Sir Philip Green and his immediate family, the owners of BHS.

In 2005 his wife, Lady Christina Green, became the ultimate controlling party.

BHS has not paid a dividend since then.

Financial crisis

But the pension scheme was struggling. In 2004 the shortfall had hit £80.8m.

It started to improve until 2008 when it returned to a surplus of £3.4m.

That was when the financial crisis hit. Any pension fund relies on its income from investing in the financial markets and as those investment returns lessened the surplus disappeared and the fund has been in deficit ever since.

Worse was to come. BHS was struggling to compete with online rivals and cheaper High Street competitors.

Chris Martin has been chairman of the BHS pension fund's board of trustees since January 2014. He said: "It was apparent that trading was poor and getting worse and as the trading gets worse you get a more conservative funding target."

In other words the trustees began to worry about how much BHS would be able to put aside for pensions.

Things were so bad that they wrote to members last December to tell them the deficit had hit £225.6m. Since then it has risen again, although it may not be quite as bad as the "buy-out cost" of £571m which is calculated using a different accounting method.

The wider group

BHS has been part of a wider group of retailers - Arcadia - since 2009, and there are questions over whether money that could have helped BHS - and its pension fund - was drained out of the company into the group.

Sir Philip bought Arcadia in 2002 including other High Street shops like Topman, Topshop, Burton Menswear and Dorothy Perkins.

His retail empire certainly invested in BHS every year since the 2000 takeover until at least 2014.

But since 2000, BHS paid £141m of rent to companies owned by Sir Philip and his family.

It has also paid out £252m of management charges over five years to 2014.

Taken together the dividends, management charges and rent paid between 2000 and 2014 come to £807m, according to calculations by Nick Hood, a former chairman of insolvency specialists Begbies Traynor and now business risk adviser at Opus Restructuring.

In defence, Sir Philip has said rent and management charges would have to be paid regardless. In fact, he has claimed that far from taking money out of BHS, the sale of the company last year amounted to a £430m loss to Arcadia.

Arcadia also agreed to write off a £200m charge over BHS assets, and left £65m of cash in the business along with £100m freehold and long leasehold for the new owners Retail Acquisitions.

And it is thought Sir Philip has offered to pay £40m of cash and write off a further £40m as a dowry.

Even so regulators may want a bigger contribution from the billionaire.

- Published26 April 2016

- Published27 November 2020

- Published26 April 2016