Carl Icahn dumps Apple shares over China fears

- Published

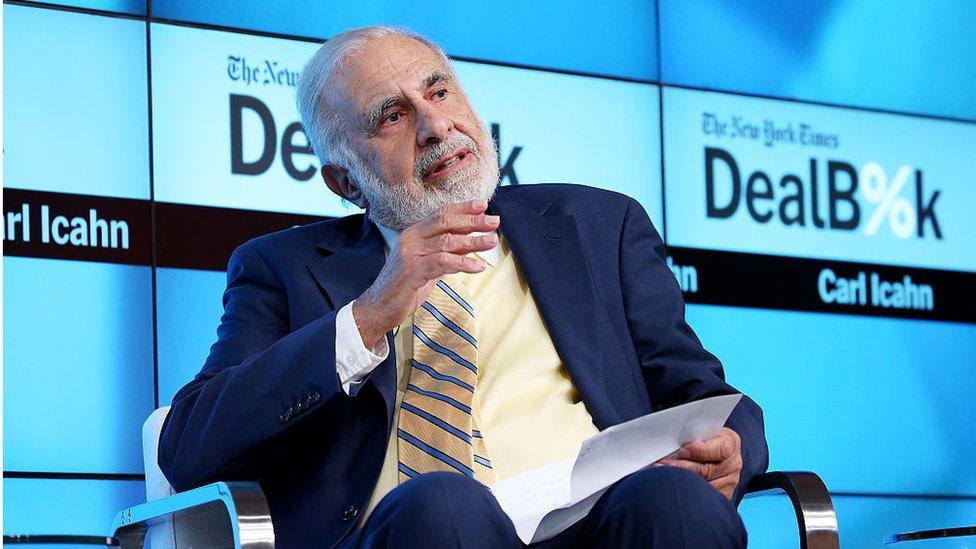

Billionaire activist investor Carl Icahn has sold all his shares in Apple over concerns about the technology firm's prospects in China.

"We no longer have a position with Apple," he told CNBC.

Reports say Mr Icahn made $2bn (£1.4bn) from selling his stake in Apple. At one point last year, he owned 53 million shares worth $6.5bn.

He blamed China's economic slowdown and worries over government interference for selling out of Apple.

In March China passed a law that required all content shown in China to be stored on servers based on the Chinese mainland.

As a result Apple's iBooks and iTunes movies service were shut down in the country. Apple said it hoped access to the services would be restored soon.

Earlier this week, Apple reported in a 13% drop in its second quarter revenue as sales of iPhones slipped.

Carl Icahn

Mr Icahn started buying Apple shares, external in the third quarter of 2013 when they were trading at about $68 a share.

Shares closed down 3% to $94.83 on Thursday and have shed 27% in the past 12 months.

Cook 'sorry'

Mr Icahn said he spoke to Apple chief executive Tim Cook to tell him about the share sale.

"I called him this morning to tell him that, and he was a little sorry, obviously. But I told him it's a great company," he said.

The stock sale has not been disclosed in a filing to the stock regulator.

Mr Icahn is the majority shareholder in Icahn Enterprises - a holding company with a range of investments, with interests ranging from mining to automotive to real estate and food packaging.

- Published27 April 2016

- Published22 April 2016