Steel: Liberty submits bid for Tata's UK assets

- Published

Port Talbot is Tata Steel's biggest UK plant with about 4,000 workers

Liberty House has confirmed it has formally submitted a letter of intent to buy Tata Steel's UK assets, which include the Port Talbot works.

The head of Liberty, Sanjeev Gupta, was the first to express an interest when the assets were put up for sale.

Earlier on Tuesday, a management buyout team also confirmed it submitted a bid.

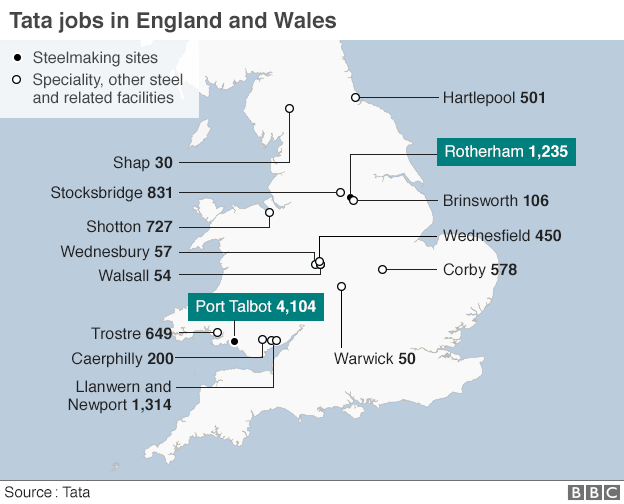

In addition to the Port Talbot factory - the UK's largest steelworks - Tata's remaining assets include sites at Newport and Rotherham.

About 4,000 people work at Port Talbot, some 1,300 at Newport, and about 1,200 at Rotherham. Tata also has operations at Corby, Shotton and Teesside.

Tata's Long Products division is in the process of being sold separately.

In a statement Liberty said: "Liberty believes the UK steel industry can achieve long-term viability if based on an agile, sustainable, non-cyclical model."

The company repeated its plans to move away from steelmaking in blast furnaces to recycling steel in electric arc furnaces.

Liberty said it had appointed a panel of financial advisers led by international investment bankers Macquarie Capital (Europe) Limited, with the State Bank of India as co-financial advisers.

Business Secretary Sajid Javid said the government was "doing everything we can" to secure a future for Tata's UK steel works.

He has postponed a major trade visit to Iran to focus on the future of the steel industry.

Asked by MPs if Tata would rush through a sale by the end of June, Mr Javid said he hoped the company would remain flexible about timing.

"They don't have an unlimited amount of time, but they do understand that it does take time," he said.

What is Liberty House?

Liberty House started life in the university room of Indian-born founder Sanjeev Gupta.

While a student at Cambridge University in 1992, the budding entrepreneur started a trading company that has since become a global steel and commodities business with annual sales of more than £2bn.

With operations in 30 countries, and headquarters in London, Dubai, and Singapore, Mr Gupta's Liberty has also emerged as a possible saviour of Britain's steel industry.

Liberty's focus is on recycling the mountains of scrap metal generated in the UK, rather than the historical method of producing steel in blast furnaces.

Last month, it acquired Tata Steel's plants in Lanarkshire. In recent years, it has reached similar deals with other companies for steel plants in Newport and the Black Country.

A management buyout team, under the name of Excalibur Steel UK, has also confirmed it has registered a letter of intent with Tata expressing its formal interest in its UK steel assets.

It has appointed investment banker Mark Rhydderch-Roberts as a non-executive director. He joins Stuart Wilkie, the previous head of Tata's UK strip steel business, and former Alcan senior executive and venture capitalist Roger Maggs on the board.

£1m-a-day losses

Mr Wilkie, chief executive of Excalibur, said in a statement: "It was only two weeks ago we made the decision to pursue a buy-out that enables the management and staff to take a stake in the ownership and operation of a strategic British industry.

"We believe we have a large number of the pieces in place required to make this a success, including a management team with vast experience of steelmaking and processing."

The government has promised to support any buyer of the business by taking up to a 25% stake in a new business and making hundreds of millions of pounds of finance available.

Tata has not publicly set a deadline for any deal, but has made it clear it cannot sustain its £1m-a-day losses indefinitely and does not want to prolong the uncertainty for workers and customers.

Tata's Scunthorpe operation, which employs more than 3,000 people, has been sold to investment firm Greybull Capital for a nominal £1.

- Published3 May 2016

- Published28 April 2016

- Published26 April 2016

- Published25 April 2016

- Published21 April 2016